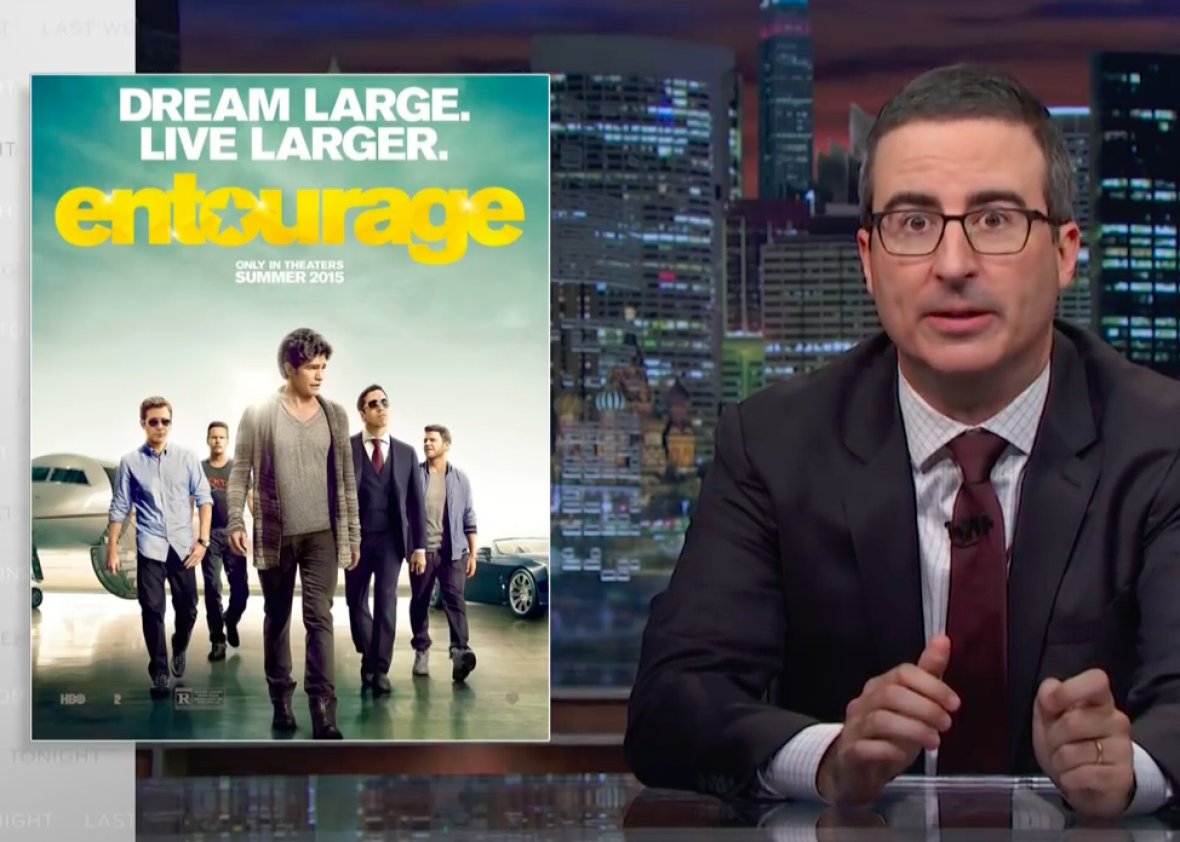

John Oliver Explains the Problem With Tax Incentives, and It’s Not Just Because They Helped Fund the Entourage Movie

Still taken from the video

Last Week Tonight has never shied away from covering topics that might otherwise seem boring, and the show returned to form by dedicating Sunday night’s main segment to the nitty-gritty of corporate tax breaks. Sure, an entire segment about tax incentives and economic development sounds dull, but John Oliver managed to liven it up, and, as he points out, there are worse things you could be watching. Like the Entourage movie. Ick.

Anyway, here’s how the system works: State and local governments offer tax breaks to corporations in the hopes that those corporations will move to that state or town, creating new jobs. For example, New York has a a program called Start-Up NY that lets businesses get away with not paying property, corporate, business, or income tax for the first 10 years. “I believe that sound you just heard is Donald Trump getting an erection,” joked Oliver.

The problem with these tax incentives is that there is little evidence to show that they’re effective at spurring job creation—and they cost the government a ton of money. New Jersey has reportedly offered Amazon $7 billion in tax breaks to attract the company to Newark, even though Amazon already has more money than it knows what to do with (“How else can you explain the existence of Goliath, a show that, and this is true, nobody has ever seen?”) while New Jersey could really, really use that money for, just off the top of my head, fixing its terrible mass transit system.

In Kansas City, tax incentives have definitely benefited corporations, which have taken full advantage of competitive tax break programs in Kansas and Missouri simply by moving their offices a few blocks across state lines. “That isn’t ‘creating jobs’ any more than moving your couch from the bedroom to the living room is ‘creating fucking furniture,’” said Oliver. Add in the fact that these tax incentives are responsible for some weird, unnecessary stuff—like the Noah’s ark replica museum in Kentucky and, ugh, the Entourage movie—and you’ve got a pretty good case for why governments should start looking into other options to incentivize businesses instead.