Yours. Mine.

Once you get married and have kids, can you really keep all your money separate from your spouse's?

This series is now available as an eBook for your Kindle. Download it today.

For young, childless marrieds like my husband, Mike, and me, the path of least resistance is to do what we did for years before our wedding: keep all our money separate. Post nuptials, we live in the same apartment, we have the same jobs, we're still earning similar salaries, and we buy the same overpriced vegetables at the local frou-frou market.

At the same time, we are beginning to think of the future. I can see the stroller that will block the narrow hallway outside our one-bedroom rental. Someday, after we have kids, we want to leave the apartment behind for a house—to follow that deeply rutted trail of American adulthood in a sensible, four-wheel-drive car. Combining finances in some way is part of this journey for most people, at least the ones who took my survey on how long-term partners manage their finances.

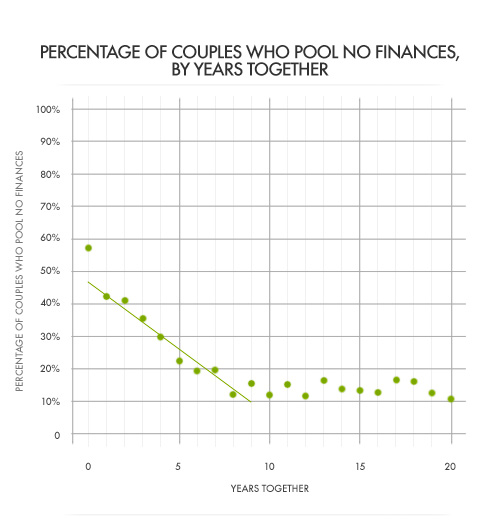

The longer couples stay together, the less likely they are to be Independent Operators, my term for pairs who keep their accounts entirely separate. In my survey, 57 percent of couples who were in a relationship for less than a year kept their money apart. The proportion decreased to 42 percent once they'd stayed together for more than one year but less than two. After that, each year of togetherness reduced the share of Independent Operators by about 4 percentage points, until the couples hit the eight-year mark. At that point, the percentage of couples who kept their money separate dropped to 20 percent and stayed that low or lower. For the survey population as a whole, the Independent Operator method was less popular than the other two choices (the Common Pot, for couples who pool all funds, and the Sometime Sharer system, for those who have some joint and some individual accounts).

Independent Operators I spoke to reinforced these statistics: Many of them saw their financial method as transitional. Some, like Kate, 28, looked forward to a turning point at marriage. She sees a Common Pot—or at least a Sometime Sharer system—as one of the few clear markers she'll have for the change of status. Kate's live-in boyfriend wants to combine accounts now, but Kate wrote in her survey response, "I guess I want there to be some difference between dating and marriage." Mike and I didn't even consider the possibility of combining money until the ink dried on our marriage license.

For other couples, having kids is the big existential change that will prompt them to combine funds. With particular interest, I quizzed my Independent Operator survey responders about how they maintain separate accounts with children, because that seemed fairly impossible to me. Do you really want to spar over who is paying for tiny jars of mashed carrots?

Most of the time, the answer is simply no. Even the couples I talked to who were deeply devoted to keeping their money separate gave up and became Sometime Sharers when the babies came along. Max, 49, and his wife use the joint checking account they opened when their daughter was born to pay for all of her expenses, though they still pay for their own costs from separate accounts. Max wrote that this method is both practical and flexible, giving him and his wife the "opportunity to buy things for ourselves without having to obtain spousal approval or justification."

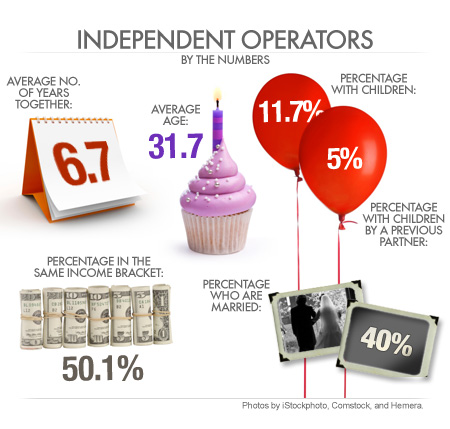

The most stalwart Independent Operators, I found, are not like Kate and Max or Mike and me: They are mostly unmarried and they don't have kids. Or if they do, the kids are more likely to be from a previous relationship.

Carol, 59, and Richard, 62, represent this kind of arrangement. (I've changed their names at their request.) They have lived together in Portland, Ore., for nearly 17 years and have no plans to marry. This is how '90s their courtship was: Richard wooed Carol by mix tape. Neither has children, and neither has been married before. Carol is a Young Adult novelist and freelance writer, and Richard's an accountant. "My money is my money, and I don't want anyone else to have a legal claim on it, even the person I love," Carol explains.

Typically for Independent Operators, according to my survey, Carol and Richard are in the same income bracket. This makes sense: If you're keeping money completely separate, you probably want to earn and spend at comparable levels, or else things could get uncomfortable. Think about a vacation for which one half of a couple wants to fly first class and stay at a five-star resort in St. Bart's, and the other can only afford to drive to Jones Beach for a day trip. "I'm a little more spendy, but it involves very minor negotiations over whether we should buy a $400 piece of furniture or a $250 piece of furniture," Carol says. "We're in the same range about how we want to live our lives."

Carol knows this is key from experience. Because she's a freelance writer, she's endured a few years when her income was quite out of step with Richard's. At her earnings nadir, she made only $15,000 a year. Richard loaned her a couple thousand dollars that year, and she scrupulously paid back every cent. Anya, 28, has a boyfriend who was laid off in January of 2009 and has been looking for a permanent position ever since. She says she realized recently she might "just have to bite the bullet and pay for him if I want us to do something fun," she wrote to me. The lesson for I.O.s: In the event of a large earning disparity, you have to either combine resources for a time or commit to the lifestyle of the poorer partner.

Research suggests that when low-income couples have kids, their relationships tend to suffer when they keep all their money separate. A recent study of couples with children in the journal Family Relations shows that couples who earn less than $50,000 and have independent money management systems "reported lower levels of relationship satisfaction and less agreeable methods of resolving conflicts than when couples share a joint account." This goes for both married and cohabitating parents. Another study of mothers with young children (PDF) and their partners showed that married couples who kept money separate were more likely to split. This makes sense: If you can pay to feed your kids only by pooling resources, it will lead to strife when you don't.

Even Carol, who describes herself as a "hard-liner" Independent Operator, concedes that she and Richard don't make enough to do it this way forever. "What will happen years from now if neither of us is earning income, we're living off our retirement savings, and one of us has some kind of horrendous medical or nursing home expenses?" she wondered. After thinking about it for a second, she said, "Towards the end of our lives there will be the impulse for more sharing without rigorous payback rules." When Carol says this, I fast-forward 50 years and see my wizened hand writing a rent check to Mike over the kitchen table at our assisted-living facility, his wavy white hair covering the tops of his ears (yes, he still has hair). This seems even more absurd. I don't think I want to wait for some kind of health catastrophe for Mike and me to support each other financially.

The How-To Part: Managing Independent Operator Accounts

For now, Carol makes sure she and Richard are truly splitting everything down the middle. They manage their household budget by putting into an accordion folder they call "the bin" a receipt with their initials on it for each bill paid toward shared expenses. This includes groceries, stuff for the house, vet bills for the cat, and travel tickets. Every few months, Richard pulls up a blank spreadsheet, and Carol reads every receipt aloud, saying who paid for what.

Another Independent Operator approach, from Clarissa, 39, who works in publishing, and her husband, Alex, also 39 and a lawyer, involves going roughly halfsies by dividing up expense categories. (Their names have been changed.) Alex pays "the mortgage, cable, and car insurance, which leaves him in roughly the same position as I am after paying for groceries, utilities, and expenses for the kids," Clarissa says. This accounting method is not as precise as Carol and Richard's—Alex pays for takeout, for example, without insisting that Clarissa pay him back. Clarissa glances at the balance on Alex's bank statements when they come in to make sure they're coming out more or less on par. "If the accounts get too unbalanced because of a change in expenses, "I adjust who is responsible for what payments," Clarissa says. For example, Alex pays the mortgage, which more than doubled when the couple moved recently. So Clarissa has taken on more of the other bills, so that they both have nearly the same amount left over at the end of the month.

Unlike Clarissa and Alex, Carol and Richard think of their income and investments as private information, so they know the gist of each other's assets but not the nitty-gritty details. In case of emergency, Carol says, "We each maintain a list of accounts, investments, and assets that the other should know about when one of us dies." Carol acknowledges that her method of choice is "a little schizo or compartmentalized." It's worth noting that of all the I.O. couples I spoke to, they were the only long-term pair that was so obsessive about financial privacy.

To me, there's something sort of perverse about wanting your partner to know about your investments only after you're dead. While I might not want Mike to know about every coffee I buy or dress I nab, I do want him to know about my investments. I also want his input on any major purchase I might make. I would never feel comfortable shelling out for private school for our kids, for example, unless Mike supported my decision. In the big ways, I want us to behave as a unit.

Also, after talking to the couples who are committed to the Independent Operator system, I realize that our "choice" to keep money separate is sort of an illusion: Choice implies that this is an active decision, rather than the left-over status quo. Now that we've actually thought through how getting married affects how we feel about money, it makes sense to truly choose one of the methods I've written about. Tomorrow, I'll tell you what Mike and I decided.

Like Slate on Facebook. Follow us on Twitter.