Will Bitcoins Make Me Rich?

A dispatch from inside the digital currency bubble.

Courtesy of Casascius/Wikimedia Commons

Update, 3:13 p.m.: The bitcoin market is extremely volatile today, with the price ranging from a low of $120 to a high of $266. You can see the latest prices at the top of the page here.

Let me begin this column with a lengthy disclosure. One morning last week, I stopped at my bank, filled out a withdrawal slip for $1,027.51, and walked away with an envelope full of cash. The odd amount was deliberate; I had been instructed by LocalTill to be exact in everything I did. What’s LocalTill? Don’t bother Googling it—its shady-looking website offers only murky details, explaining that the firm is a way for “merchants to accept secure transactions when selling goods online.” It’s something like PayPal, except LocalTill isn’t tied to your bank account or credit card, and instead deals only in cash. This makes its transactions less traceable, less regulated, and, as I would soon experience, more final.

Next, per LocalTill’s instructions, I drove to a local Bank of America branch and asked for an out-of-state wire transfer slip. I scrawled out LocalTill’s New York bank account number and handed my wad of cash to the teller. This was a dizzying moment: I’ve been on the Internet forever and have been well-schooled in frauds that begin with the instruction, “First, wire your money to an out-of-state account …” Yet here I was doing exactly that. If LocalTill was a scam, I’d have no recourse. So why was I willing to take such a risk?

Bitcoin, of course. Bitcoin is a “digital currency” invented in 2009 by a cryptographic expert who went by the pseudonym Satoshi Nakamoto, but whose true identity remains unknown. It exists only in computers, minted at a regular rate by a network of machines around the world, and its value isn’t regulated by any government. The currency, like its creator, clings to the shadows. Bitcoins are like cash in that they aren’t tied to your identity, and transactions made with bitcoins are irreversible and untraceable. But they’re like credit cards in that they aren’t physical. In the past, if I wanted to pay you for certain unmentionable services rendered, I’d have to get a fancy briefcase, fill it with bills, then take a long, dangerous trip with my stash. Bitcoin allows me to transfer money to you online, instantly, for free. As a result, it’s perfect for the black market—a couple of years ago, it became a media sensation when Gawker reported on its use as the central currency on Silk Road, a site that sold virtually any drug in the world. Lately bitcoin has also been hailed as an emerging global safe haven, a place for nervous Europeans and panicky gold-bug types to store their wealth away from the prying reach of financial regulators.

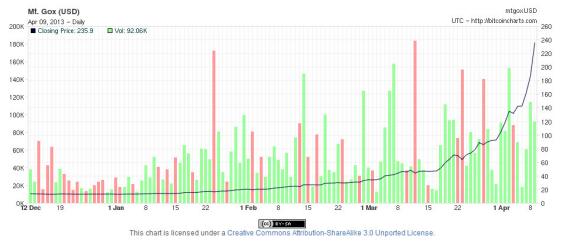

I’m not very panicky about the world’s currencies, nor am I looking to buy drugs online. Indeed, I don’t care at all for bitcoin as a currency. Instead, I wanted to buy bitcoins as pure, shameless speculation. I wanted a chance to ride a rocket ship. Partly due to its growing legitimacy as a currency but mainly because of speculators like me, the value of bitcoin is entering a bubble phase—its exchange rate with real-world currencies is hiking up at an incredible, likely unsustainable pace. In 2011, back when Gawker reported on Silk Road, you could buy a bitcoin for about $9. Since then the price has seen terrific fluctuations, but it has generally gone up. At the start of this year, each bitcoin was worth about $20. From there the chart turns into a hockey stick—by March, bitcoins hit $40, and within a month they’d doubled again.

Courtesy Bitcoincharts.com.

Three weeks ago, I began hearing about bitcoin everywhere I turned. One afternoon I had lunch with a partner at Andreessen Horowitz, the large Silicon Valley venture firm, who told me that he’d been fielding pitch after pitch for start-ups that offered bitcoin-related services. After lunch, I got an email from David Barrett, the CEO of the fantastic expense-reporting start-up Expensify. Barrett wanted to let me know that his firm would soon let people submit expenses and get paid by their employers in bitcoins. He explained that the feature wasn’t a gimmick. Bitcoin would be helpful for people who regularly submitted expenses internationally; other services—like PayPal—charge hefty fees for moving money overseas, but with bitcoin people could send money for free.

I made a mental note to start looking into a story about bitcoin’s apparent rise to legitimacy. But before I could get started, bitcoin took over the media. Henry Blodget was calling bitcoin "the perfect asset bubble." Felix Salmon published a lengthy treatise on why the bubble was sure to burst. The New Yorker spoke to some of bitcoins' leading boosters about the future of the currency. Meanwhile the price just kept going up: Early last week the value of bitcoins soared past $100 each. This week, it went past $200. If you want a bitcoin today, it will cost you about $235, and if you wait till tomorrow, it will be more.

Hence, my disclosure. No one is quite sure why the price of bitcoins has spiked so quickly, but one of the leading theories is that it’s been hit by what Quartz’s Zach Seward calls a “demand crisis.” The world’s supply of bitcoins is essentially fixed, but because people in the media keep talking about it, demand keeps rising. This leads to higher prices—and as prices go up, people who currently hold bitcoins develop greater and greater expectations for the currency. This causes bitcoin holders to hoard their stash, which further reduces supply, which in turn boosts the price and sparks yet more media attention—and the cycle continues until the bubble pops.

Thus, by writing about bitcoin, I’m serving, in some small way, to raise its price. And as of last week, that benefits me directly. Thankfully, my wire transfer to LocalTill went through; after taking its $21.51 processing fee, the firm transferred my $1,000 to Bitfloor, one of the many online bitcoin exchanges where people trade bitcoins for cash. I immediately put in a purchase order, and within seconds the deal was done. I was the proud owner of 7.23883 bitcoins, which I’d purchased for about $138 each. If I sold my coins now, my original $1,000 investment would be worth $1,700—not a bad return in less than a week’s time.

But I’m not selling just yet. I agree with Blodget and Salmon that the bitcoin market is a bubble; at some point, as in all bubbles, prices will stop rising and they’ll likely plummet, and a lot of people will lose a lot of real and imagined money. But that’s pretty much all anyone can say about the market with any certainty. When the bubble will burst, at what price and for what reason, is completely unpredictable. And until then, while prices are going up, you could make a lot of real money from this digital funny money.

My own guess is that the bubble’s popping isn’t imminent, and I think that when prices do fall, they’ll land somewhere higher than the $138 I paid for my bitcoins. I’m certain that I’ll be able to double my investment, and I might even hold out to triple it. (After that I’ll get shakier about keeping bitcoins.) Why do I think prices will get that high? Because at the moment, it’s a logistical nightmare to turn dollars into coins. You’ve got to take several leaps of faith, trusting sites that look like they were put together by teenagers. I initially tried to buy coins using MtGox, the largest trader, but the cash-processing service it uses refused to accept deposits greater than $500. What’s more, last week, shortly after bitcoins hit $142, MtGox was hit by a denial-of-service attack that took it offline for several hours. The site I used, Bitfloor, is hardly any safer. Last fall it was hit by an epic hack that resulted in the theft of 24,000 coins, at the time worth $250,000—and worth, amazingly, $5.6 million today.* (Bitfloor now claims to store most of its customers’ coins in machines that aren’t connected to the Internet, and it uses two-factor authentication to protect its users’ accounts.)

At the moment, the shadiness of the bitcoin market dissuades mainstream investors. And—as we saw in the housing and dot-com bubbles—it’s when the masses get involved that bubbles really take off. Over the next few months, I expect that we’ll see better, more secure services for transferring dollars into bitcoin exchange systems. You’ll be able to send money to sites like MtGox instantly from your bank account. At that point—when ordinary people can order up bitcoins as easily as they bought shares of Pets.com back in 1999—the real money will pour into the bitcoin economy, and that’s when prices will begin to get really crazy.

That’s just a theory. It could be a stupid one; bitcoin could collapse tomorrow. And remember, I’ve got a conflict of interest here—if this piece gets you interested in bitcoin, I get richer. Still, though, one week into my bitcoin trade, I’m very, very pleased with myself.

Correction, April 10, 2013: This piece originally misstated the value of 24,000 bitcoins. At press time, they would’ve been worth approximately $5.6 million. (Return.)