How Big of a Bite Is Apple's Tax Burden?

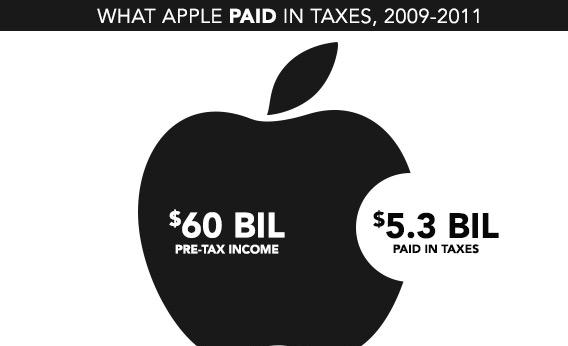

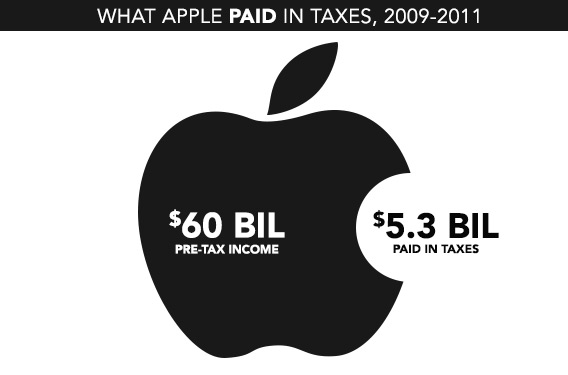

How much money does Apple save with its various tax avoidance methods? It's difficult to say precisely. Any company—just like any household—normally does what it can within the bounds of the law to reduce its tax burden, but if you roll over the graphic below you'll see that viewed broadly it's an awfully big deal.

According to the Senate Permanent Subcommittee on Investigations, between 2009 and 2011, Apple actually paid only $5.3 billion in taxes. Had it paid the full 35 percent U.S. statutory corporate income tax rate, its tax bill would have soared to $21 billion. Barely any company does pay that full rate, which is exactly what makes the issue so vexed. Thirty-five percent is a lot, so the incentive to shelter income is enormous. And as we're learning, companies full of smart people who are good at making new kinds of products are also really good at finding ways to reduce their tax bill.