The Fed Knew LIBOR Was Corrupt in 2008. So Why Didn’t It Act?

KAREN BLEIER/AFP/GettyImages.

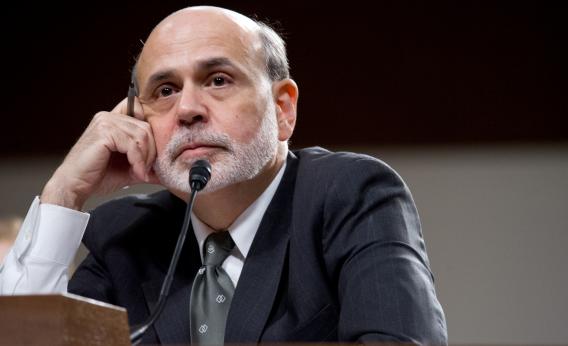

To hear Ben Bernanke tell it, the Federal Reserve did everything it should have about the suspicious activity surrounding the LIBOR scandal. Chairman Bernanke informed a Senate committee today that the Fed told everyone it was supposed to when it first suspected the London Interbank Offered Rate was being manipulated by the major banks.

Told is the critical word here. What exactly did the Fed say—and what did they do thereafter—when they began suspecting a problem?

Bernanke testified: "Importantly, it informed all the relevant authorities in both the U.K. and the United States ... and the New York Fed also communicated with the FSA and the Bank of England in the United Kingdom."

But there is dispute about whether the Fed did inform all the relevant parties that the rate was being rigged. Mervyn A. King, governor of the Bank of England, said he did not receive a warning in 2008 that the rate was being gamed. Instead, King says, the Bank of England just got an email from Tim Geithner, who was president of the N.Y. Fed at the time, suggesting reforms to the LIBOR system. Yet it is uncontroverted that, at the time, the Fed had evidence of LIBOR’s integrity problems.

So, issue one: What did the Fed tell other parties, and when?

Issue two: Even if the fed passed along its concerns, there's no evidence of follow up designed to stop the illegal behavior and determine why and how the most important international rate was being manipulated.

There is no question it's the Fed's responsibility to help ensure the integrity of that rate. All of which brings us back to where we've been for several days. The Fed's performance as a regulator is highly suspect, and it has to be investigated by someone who is at arm's length from it. The Fed's own governing structure is too warped by conflict—with a board dominated by banks that are at the center of the controversy.

No one believes the Fed can properly analyze or dissect its own role in this. We need an investigator we can trust—to bring trust back into the system.