Claimed

When Castro took power, Americans fled Cuba and left a lot of property behind. Now the claims on these contested holdings—land, buildings, cars and more—are exciting speculators and could stand in the way of reconciliation.

Back in April, at the Nasdaq marketplace in Times Square, a few hundred interested parties gathered for a daylong conference. It was labeled the “Cuba Opportunity Summit: High-Velocity Growth.” Wharton faculty organized the event. CNBC financial reporter Michelle Caruso-Cabrera hosted it. The scent of predatory capitalism wafted through the air.

There were cruise-line executives eager to anchor in Havana Harbor. Pharma folks thirsty to hire Cuban scientists at fractions of the salaries of American lab workers. Hoteliers, telecoms guys, retail bankers, and agriculture experts. A handful of international lawyers to grease the wheels. A sprinkling of Cuban diplomats in the back of the room, taking notes.

The spectacle of American companies scrambling to storm Cuba’s shores would have seemed far-fetched—even laughable—just a few months prior. But a startling December 2014 announcement from President Obama set the greed machine whirring. Obama’s intent was clear: We will seek some sort of détente with Cuba. We will move to normalize. And down the line, maybe sooner than later, there will be commerce.

Thomas Herzfeld was among the panelists at the Cuba Opportunity Summit. Back in 1970, 25 years old and not long out of the military, Herzfeld had been the youngest managing partner at a New York Stock Exchange firm. He got an ulcer, so he moved to Miami to relax. Surrounded down there by Cuban exiles, managing their money, he began to develop an understanding of the opaque Cuban economy. He eventually formed the Herzfeld Caribbean Basin Fund, which is listed on Nasdaq (ticker symbol: CUBA). Under American law, he wasn’t allowed to invest directly in Cuban entities, but he found ways to stick his nose into nearby operations that offered exposure to the island.

Now 70, tall, handsome, and elegantly dressed, Herzfeld was every bit the wise old Cuba hand at the Wharton event. From up onstage, he warned attendees that a “carpetbagger” approach would not sit well in Havana. He enthused about entering “one of the last true emerging markets” and building a new Cuban middle class. He delightedly noted that Cuba’s railroads are built with the same gauge as ours.

And then, shifting tone, he brought up something that sounded like a stumbling block. “There is the issue around prior claims,” he said gravely. He talked about how to vet and value these claims. He spoke of “vulture investors trafficking in claims” and the difference between “real claimants versus claims speculators.” He mentioned, in an offhand manner, perhaps designed to pique the crowd’s interest, that he’d devised an airtight plan to solve this claims problem.

My ears perked up. This was near the end of the day, and no one else—amid all the gushing about a brand new Cuba—had mentioned anything about “prior claims.” Were they a potential monkey wrench in the greed machine?

When I set out to understand these difficult-to-value assets and the speculators they’d attracted, I discovered that the Cuba claims are much more than a roadblock. They offer a stark snapshot of the past: old grievances, ramshackle farms, decaying factories, Cold War geopolitics. Yet they have the power to shape the future. Handled badly, they might derail the Obama administration’s efforts to reconcile with Havana; handled shrewdly, they might help pave the way to a 21st-century Cuba.

Meanwhile, all around the claims, sharks circle and nip, smelling opportunity.

* * *

After Fidel Castro took power in 1959 he nationalized the Cuban economy. He seized the sugar mills. The power plants. Oil refineries, department stores, hotels. Some of these belonged to Cubans. But others belonged to American citizens doing business on the island. Within a couple of years, all the Americans in Cuba fled, leaving this property in Castro’s hands.

Governments expropriate stuff all the time. Even capitalist governments. In America, we call this eminent domain, and the state compensates the people it takes the stuff from. Castro, too, acknowledged the principle that he owed these people something in return. But he never paid up. Eisenhower tried to force him. So did Kennedy. No dice. And so, in retaliation, we slammed Cuba with a trade embargo—one that’s now lasted more than 50 years.

Starting in 1964, the U.S. Foreign Claims Settlement Commission created a registry to record the assets yoinked from Americans who’d been in Cuba. (The FCSC calls itself “a quasi-judicial, independent agency within the Department of Justice which adjudicates claims of U.S. nationals against foreign governments.” Since its establishment in 1954, it has completed claims resolutions against countries including Libya, Panama, the Soviet Union, and Vietnam.) After Castro took power, 5,913 individual Cuba claims were certified. They were assessed at a total value of $1.9 billion at the time they were seized.

The largest of these so-called “U.S.-certified” claims were corporate. The Cuban Electric Company, an American-run entity that Castro nationalized, had its claim valued at about $268 million. Exxon had a claim for $72 million. Coca-Cola for $28 million. Woolworth for $9 million. If you look through the Walt Disney Productions claim, you’ll see line items like $12,300 worth of color 35 mm feature film prints.

There were family claims, too. Estates had been taken. Modest sugar plantations. Even items along the lines of, as claims experts will put it, “great-grandma’s 1953 Chevrolet.” The dollar value of the tiniest claims wouldn’t buy you a decent lunch in Miami these days. You can explore the claims in our interactive chart.

All these claims, great and small, have lain around for decades—gathering dust and (as stipulated by the FCSC) 6-percent annual, noncompounding interest. They’ve grown to a collective worth of just about $8 billion. In theory, the U.S. State Department is authorized to broker a deal with Cuba that will settle all the claims at once. The claimants can also, experts seem to agree, attempt on their own to reach individual agreements with the Cuban government. But to date, as far as anyone can tell, not a single claim has been settled.

The claims have faded out of view over the years. I, for instance, have long been aware that I can’t legally buy Cuban cigars in New York, yet I’d never quite realized that the trade embargo’s origins were specifically tied to these claims. Or that, under the Helms-Burton Act, the trade embargo can’t be lifted until the claims are resolved. I’d never heard of the claims. Nor, when I asked, had any of my generally well-informed friends.

Even some of the claimants have stopped paying attention. Some companies long ago wrote the claims off as losses, to take the tax benefit. The Cuban Electric claim, through various corporate shufflings, has fallen onto the balance sheet of Office Depot—which has zero emotional link to the decades-old injustice. The Woolworth claim now belongs to Foot Locker.

Family claims have been handed down through four generations, diluted by the branching of heirs, coming to rest in the hands of descendants who’ve never been to Cuba and can’t be bothered to hate communism. Their old family mansion might have been divided into 16 apartments by now, sheltering Cuban families who’ve lived there for 40 years in multiple generations of their own. It’s messy. Some claimants have given up hope of seeing any return.

Photo by Chip Somodevilla/Getty Images

It’s tough to feel deep sympathy for the long-ago losses of a giant corporation—especially since American companies have a less-than-stellar record of operations in Latin America. Likewise, it’s tough to muster tears for heirs to Anglo families that were rich and powerful enough to own holdings in Cuba 50 years ago. (The claims of native Cubans who fled the revolution dwarf, in dollar terms, the claims of people who were U.S. nationals. These exile claims comprise a separate, in some ways broader, fight. But they’re not covered by the FCSC, and they don’t stand between Obama and restored relations.)

There’s an almost funny disconnect embedded in the fact that these claims were carefully recorded by the FCSC down to the last nickel, engraving into the ledger the sacred notion of individual property rights. The entire project on the Cuban side—the very basis of the move to nationalize farms and businesses—was to sweep away the principle of property. For Cuba to admit that the claims are important and just is tantamount to acknowledging the foundations of capitalism.

* * *

If, as everyone assumes it will, Cuba does eventually wish to transition to some form of capitalism—craving an economic recovery that features U.S. investment—it actually bolsters the claimants’ leverage. Because if the claims aren’t settled there will always be encumbrances on the disputed properties. They will be, in a practical sense, haunted. A risk-averse hotelier might be scared to develop a new resort with an inchoate claim on it when, somewhere down the line, an heir could show up, point to a certification, and demand her great-great-grandparents’ land. You’d have a quagmire of lawsuits and attorney fees and treble damages and delays.

Knowing this, from time to time, a few enterprising hustlers have eyed the claims while licking their chops. They sniff around the claim holders. They make enquiries to open-minded Cuban officials over backroom mojitos. They conjure up schemes to sidestep the U.S. government and cut their own deals.

For a long while, the prospect of settling the claims through official state channels seemed a remote fantasy. Cuba and the U.S. had hunkered into a stalemate. There was no hint of perestroika on the horizon. Which made each individual claim, considered as a financial asset, a strange sort of duck.

Imagine your grandparents, who were U.S. citizens, owned a farm in Cuba that got seized by Castro. They fled with nothing and, understandably, they were pretty raw about it. So they got their claim certified by the FCSC for $1 million. That was back in the 1960s. A few years ago, you inherited the claim.

What good did it do you? What you had was a piece of paper from Uncle Sam certifying that you were owed a certain amount by Cuba. Maybe, sometime in the future, if our pals in Havana decide to play nice, you might see some fraction of that amount as compensation for your grandparents’ troubles. But the piece of paper was worth nil to you in the here and now. You might have reasonably concluded, after research and reflection, that the claim would never get paid, given that it had lain dormant since 1967. And here is where the hustlers step in.

One day, out of the blue, I knock on your door. “Hello there,” I say, “I’m an international lawyer well-connected to the Cuban government. I’d like to represent you in your efforts to resolve your claim. I guarantee you I’ll get 100 cents on the dollar. Don’t settle for anyone who promises less! You’ll just need to pay me a small contingency fee—say, 30 percent of whatever we do end up recovering.” If I talk a good game, especially with a Cuban accent, you might believe I’m your white knight who’s going to close a favorable, backdoor deal.

Or maybe: “Hello there,” I say, “I represent a group of wealthy investors. We’d like to outright buy your $1 million claim. We’ll give you $250,000 for it.” If you’ve abandoned all hope of getting back your million (never mind the years of interest on top), my offer might sound like a decent exit strategy. Suddenly, your worthless piece of paper is a liquid asset. And, after all, it wasn’t your sweat that went into that farm. Cold hard cash would feel like a windfall. Benjamins from heaven.

Timothy Ashby was one of the people knocking on doors. In a previous life, Ashby had been a political appointee under President Reagan, as a deputy assistant secretary of commerce in the International Trade Administration. Around 2006, having re-entered private life, he devised an ingenious scheme that centered on the Cuba claims. He planned to buy them up, one by one, until he amassed a big chunk of them. Maybe he’d corner the market. Then, having puffed himself into a major player, he’d go straight to the Castros. Let’s forget about the U.S. State Department, was his idea. Let’s hash this out between us, negotiate a swap. You give me something good, and we can put these nagging claims in your rearview mirror.

Ashby is based in London these days, but when I met him it was in Lower Manhattan. He’d come to speak on a panel about future opportunities in Cuban tech. (“There’s huge potential,” he said, giving me a snippet of his elevator pitch. “I’ve been formally advising the Cuban government about the development of its IT sector. There are Cuban software engineers there with Ph.D.s who get paid $300 a month.”) After he slid two different business cards across the table to me—one for a London law firm at which he is not officially on staff, another for a company called Pembury Capital that lists him as CEO but doesn’t have a website—I asked him to recount his claims saga.

He explained that, along with investment partners, he established a claims holding company called Siboney that was registered in the Isle of Man. He began to locate claimants and make offers. A few of the claims Siboney bought were hotels. A few were prime agricultural acreage. In all, he managed to purchase nine claims for a total of $4.5 million. “We paid an average of 28 cents on the dollar,” he tells me—a huge discount to the original value FCSC had assigned to the claims. Ashby reckoned their actual worth, if he could somehow negotiate a deal with Cuba that put the properties back in play, was more like $55–60 million. When Siboney asked BNP Paribas to value the claims, says Ashby, they agreed the value was in the tens of millions.

“For example, one of the claims we bought was the Hotel Kawama claim,” Ashby tells me, “on a huge beach right near the marina. It had belonged to a family in California. The father died, and we bought the claim from the son for $1 million. It’s a run-down hotel now, operated by Cuban state tourism. We were talking to the Cubans about razing it, replacing it, bringing in new foreign investment.”

But then the Bush administration shut him down. Anti-communist, Castro-hating conservatives didn’t like the idea of an American wheeling and dealing in Havana. Ashby was told he’d need a license from the Office of Foreign Assets Control if he wanted to buy more claims, or swap the ones he owned, since a foreign country—namely, Cuba—had an interest in the underlying properties. Ashby asserts that Cuban American former Rep. Lincoln Díaz-Balart (whose aunt, weirdly, was the first wife of Fidel Castro) “personally intervened and persuaded the Bush White House to deny me the OFAC license. He didn’t want the claims settled. He wanted to keep the gun at the head of the Cubans.” Díaz-Balart did not respond to multiple inquiries left with his law office.

* * *

Under the Helms-Burton Act of 1996, the trade embargo can’t be lifted until the claims are resolved. (Lots of other things need to happen as well, but the claims are a clear sticking point.) Many Cuba experts I spoke to theorized that Obama desperately wants to make normalization part of his legacy. Which suggests that the claims issue, long on the back burner, might soon come to a boil.

The administration’s loosening of Cuba strictures is already moving at, as one expert put it, “breathtaking speed.” First, there was the December 2014 statement that got the ball rolling. Then the opening of embassies and the removal of Cuba from the list of state sponsors of terrorism. Traveling to Cuba has gotten far easier for U.S. citizens. Companies like Airbnb are already earning revenue from Cuban operations. New commerce regulations were announced in September and were expansive. For the first time ever, there is explicit authorization for U.S. companies to establish physical office space in Cuba and to hire local Cuban agents.

The fact that this has happened with no movement on the claims must be, for some claimants, galling. It seems clear the administration will do all it can to ease commerce with Cuba short of openly violating Helms-Burton. It’s fair for claimants to wonder if their claims will be brushed aside—an afterthought in the rush to open up the island.

Under U.S. law, the State Department has the power to “espouse” the certified claims, which means it can broker a blanket deal with Cuba to resolve all the claims simultaneously. There’s clear motivation for State to sweep the claims away, given the administration’s broader goals. Yet none of the experts I spoke to knew for sure how espousal would work.

Would there be a tribunal to hear each claim individually? Would corporate claims be split from family claims? Big claims separated from small claims? Would there be one lump settlement for everyone? One hundred cents on the dollar, or more like 2 cents? Could payment be in cash, or in Cuban sovereign bonds, or something more complex? Could a claimant opt out of the deal if she didn’t like it?

The State Department has said very little on the matter. I asked for answers to the above questions and others. A State Department representative, after a week’s deliberation, emailed the following comment: “The resolution of outstanding U.S. claims remains a priority for the U.S. government. We raised claims during re-establishment talks and discussed property claims in the bilateral commission meeting on September 11 in Havana. We are not in a position to address specific time frames at this point.”

I’ve talked to several lawyers who represent certified claimants, and almost none of those claimants were willing to speak with me. I was told that claimants are wary of tipping their hands before a final negotiation—be that negotiation with the State Department or with Cuba or with a speculator. After so many years of inactivity, the last thing claimants want now is to say something impolitic that might scotch the deal.

I did manage to speak to one certified claim holder. Tim Claflin is a 72-year-old investment manager in Boston. His great-great-grandparents were in the shipping business, ferrying cargo between Boston and Cuba. During a financial downturn they foreclosed on a mortgage, which was how they came to own a 30,000-acre sugar plantation, replete with a refinery, on the Cuban coast. Claflin visited it once, on his spring school vacation, when he was 8 years old. Castro confiscated the property 10 years later.

“We filed a 30-page claim,” says Claflin. “The acreage, the cattle, everything.” (You can read the adjudicated claim here. It includes an itemized list of lost items, including $54,000 worth of molasses.) The Claflin family claim was one of the largest noncorporate claims certified by the FCSC. It was valued at $11.7 million at the time it was seized. With simple 6-percent interest, it’s now worth more than $40 million.

“We used to check in every five years or so with the government,” says Claflin, “when somebody died or something, to make sure they had all the right names and addresses for us. But last time they said we shouldn’t bother. They said they’d find us when a settlement happens.”

Over the years, Claflin has gotten many knocks at his door. “Some people want to represent me on a contingency basis and take 20 percent of the settlement,” he says. “I was also approached seven years ago by a group represented by Tim Ashby. They made me an offer of about $1.2 million, but I didn’t think it was enough, so I turned it down.”

The Claflin claim illustrates some of the complexities that can gum up the issue. For instance, Tim Claflin is only one of 25 heirs to this claim, so any agreement will need to be coordinated with other stakeholders. What’s more, the Swiss cement company Holcim made a deal with Castro years ago to build a factory on the Claflin land—it’s unclear what legal entailments might come into play if the property were ever returned to the Claflins. There are also, almost certainly, Cuban families who’ve been living on other parts of the plantation for multiple generations. Claflin has no urge to kick them off their plots.

“I think Obama wants to finish this before he’s out of office,” Claflin says, “so he’s not going to spend time to fight for the best deal. I’ve been told I can expect 4 percent of the original claim.” That would be $468,000. Claflin doesn’t sound thrilled, but he doesn’t seem to think there’s much he can do at this point. If a settlement comes down, he’ll assess his options then.

* * *

No one seems to think Cuba has enough hard currency to pay off $8 billion in claims. That’s more than 10 percent of the current Cuban gross domestic product. But for every pessimistic claimant glum at the thought of settling for pennies on the dollar, there’s an optimist who sees the claims as a golden opportunity—not just a means of satisfying claimants but as a way to jumpstart the Cuban economy. Tom Herzfeld is one of these dreamers. After I watched him speak at the Wharton Nasdaq conference, where he coyly mentioned his plan to resolve the claims and boost Cuba in one fell swoop, I got in touch with him to ask him how he’d do it.

The headquarters of Thomas J. Herzfeld Advisors are in a stylish building in South Beach, Miami, just down the hall from Elite Model Management. Herzfeld’s conference room is plastered with framed press clippings about himself. (He claims to have been quoted in more than 2,000 articles.) To scan the photos that accompany these stories, dating back to the 1970s, is to watch an evolution in the tie and lapel widths native to Florida executive fashion.

Herzfeld is so old-school that he still keeps paper charts. When I visited his office, he jovially displayed the ledger in which he tracks, in pen ink, the Herzfeld Caribbean Basin Fund, which he started in 1993 as a way to bet on the opening of Cuba. There’s a page in the ledger where he needed to Scotch-tape an extra sheet of graph paper at the top, flopping beyond the margin, to contain a skyward-shooting line. That’s where the fund spiked on news of restored U.S.-Cuba diplomatic relations.

Herzfeld can’t invest directly in Cuba for now. He tries to find things like cruise lines, regional airlines, shipping companies, and other businesses that will surge when the walls come down. He sallies out on his yacht sometimes to count containers on Miami cargo ships in the harbor, keeping tabs on the comings and goings of freight. One of his more esoteric holdings—almost a curiosity at this point—is stock in the long-dead Cuban Electric Company. This means he has a piece of the Office Depot claim.

Herzfeld hopes to convince claim holders to swap their claims for shares in a new fund he’ll launch—a fund that doesn’t exist yet. In return for owning half the equity in the fund, and for making those pesky claims go away, the Cuban government would offer an array of developable properties for the fund to invest in. Herzfeld says he’s identified all the properties he needs. None have prior claims attached to them. The fund would partner with investors to build hotels on these properties or to mine nickel from them or to grow vegetables in their soil. This way the claims will evaporate, the claimants will receive liquid shares in the fund that they can either hold or sell, and the Cuban economy will crawl out of the past and into the future.

He says he’s circulated the plan to officials at the State Department and within the Cuban government, and he’s brought it up with claimants. “Everyone loves the idea,” he assures me. When asked why he in particular should be the one to run the fund, he cites his experience, his knowledge of the Cuban economy, and the simple fact that it’s his idea. He also notes his noble intentions. “It would be the least profitable thing we do here,” he says. He promises he’ll forego any monetary benefit beyond a 1-percent management fee.

“That would still be nice for Tom,” a skeptical Cuba expert chuckled when I described the plan. Even if all the other steps miraculously fell into place—claimants exchanging their claims, the Securities and Exchange Commission approving the fund, OFAC licensing it, the State Department stepping aside, and Cuba offering up land on a silver platter—it seems possible that running such a fund could be farmed out to a bigger player like Goldman Sachs or Morgan Stanley.

Herzfeld’s plan is not the only one of its kind. The 1898 Company, a Spanish outfit, has similar thoughts about bringing investors together with claimants to develop desirable properties. Raúl Valdés-Fauli, a Miami lawyer whose family owned a bank in Cuba, once tried to organize claimants into a cohesive bargaining group that would have pushed for a similar claims-for-equity swap. Tim Ashby foresees an approach in which Guantánamo gets tossed into the mix—in exchange for settling the claims and closing the prison, maybe the bay gets transformed into a free enterprise zone for U.S. businesses, with high-speed Internet cables snaking undersea from Florida.

“There’s room for creativity here,” says Richard Feinberg, an international political economist who’s working on a Brookings Institution research paper about the claims. “Let’s see the claims not as a problem but as a solution. That’s the beauty of economics—it’s not a zero-sum game like geopolitics or military security affairs. We can put together solutions in which everyone is better off.”

In all these proposals, even the ones that might serve to enrich their proponents, the driving impulse to lift up Cuba seems heartfelt. Tom Herzfeld envisions his plan as a way for Cuba to save face, to escape the claims without hemorrhaging money, to give the claim holders more value than they could expect from a straight cash settlement, and to create jobs for a new Cuban middle class that he’s certain will thrive. “There’s a lot more at this stage of my life than another dollar,” says Herzfeld. “I’d like to be remembered for something more than just making a lot of money.”

Still, there’s irony in the fact that all these guys are pitching market economics as the solution to the claims issue. It’s like Cuba merely took a timeout from capitalism—a hiccup in history. And now that timeout is ticking to an end, and everybody knows it. Fidel Castro is 89 years old. Younger Cubans want the Internet and premium cable and, like, a living wage. Meanwhile, many assume that Cuba’s savior will be … complex, rapacious capitalism. Those young Cubans—well-educated and healthy, thanks to the communist system—comprise a highly attractive workforce that will perform skilled labor for absolute peanuts. Every part of the U.S. financial apparatus is poised to pounce.

The beautiful dream of the revolution has ended poorly, and the claims have come to seem like strange bookends on either side of it: At first they were a tally of the merchantry and profiteering Castro squashed; now they’re an opportunity to let a thousand Starbuckses bloom.

* * *

In September, Akerman LLP—a law firm with perhaps the premier Cuba practice in the U.S.—held a conference call to advise American companies on the latest rules of engagement. Everybody is panting to launch enterprises in Cuba, but no one is clear on what exactly is legal. A leisure-group executive asked a question about risk adjustment. An exec from Western Union asked if regulations had changed with regard to cash remittances. Representatives from Visa and Carnival Cruise Lines hopped on the call to pose queries.

One of the Akerman lawyers hosting the call and fielding questions was Pedro Freyre. Freyre’s family owned properties in Cuba. (“My grandfather’s house is beautiful—every time I’m in Cuba I drive by it. The house I was born in is occupied by a Cuban official agency.”) Freyre now works in Akerman’s Cuba practice in Miami. He mostly counsels businesses and investors on how to legally get involved with Cuban development. But he also advises a handful of claimants.

“I certainly don’t convey to my clients that they’re going to get 100 cents on the dollar,” he says. “I manage their expectations. But in order to build a solid foundation for a new relationship with Cuba, you have to clear out the bad stuff. You need to address it. You can’t let it fester.”

Freyre favors a simple, win-win solution. Claimants would drop their claims in exchange for tax credits from Cuba. If the claim holder wants to go back and invest in the island, he or she could do so with a major tax break. But the credits would also function as liquid assets, with a busy secondary market—if a hotelier decides to build a resort, he could buy up a bunch of tax credits from claimants at a discount. The claimants get an easy exit and cold hard cash; the developer reduces his costs. “I think Cuba will want something simple,” says Freyre, “and I think they’ll want to settle this all at once.”

Cuba’s taken a tough stance on the claims. It cheekily argues that the trade embargo has cost it more than $100 billion over the decades so, really, the U.S. should be making restitutions to Havana. “They’re really good negotiators,” says Freyre. “They’ve acknowledged that they owe some compensation. They’re willing to discuss it. But they don’t give up a lot. They don’t see themselves as over a barrel. They think this is a respectful conversation between equals.”

I asked Freyre why Americans harbor such excitement about Cuba. Even if things were running smoothly, this is a country of less than 12 million people with a GDP equivalent to a midsize U.S. city. Its infrastructure is in disrepair. It’s small potatoes, in the grand scheme.

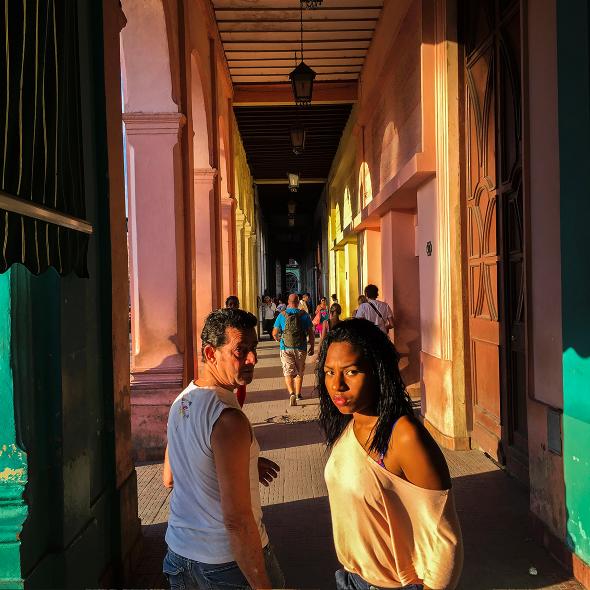

Freyre lit up. “It’s the forbidden fruit!” he said with a big smile. “You’re right, this isn’t China or Mexico or Brazil, in terms of scale. But it’s a stunningly beautiful place, with hundreds of miles of untouched, pristine beaches. It’s fertile—it could be the provider of winter vegetables to the U.S. East Coast tomorrow. The people are funny and good-looking and smart, and I’m not just saying that because I’m Cuban. It has 99-percent literacy—Florida is 80 percent. The life expectancy is one year less than in the United States—in Haiti, expectancy is 63. These are things that don’t happen in other parts of Latin America. If you’re Hyatt, or Google, or Apple, or Chiquita, you look at Cuba, and you say, ‘Oh my god, this is a fantastic place.’ ”

Freyre’s office is papered with photos and drawings of Havana. He jumped to suggest Cuban restaurants for me to try while I was in Miami. He twinkled as he described his travels back to the island where he was born. He implored me to make a visit.

“I’m a lawyer, I’m a rational guy,” he says, “but I’m a believer in mythology. There’s a mythical Cuba. There’s a Cuban magic. You’ve got to go. When you go, it will grab you. The moment you land at the airport and drive into the city, you’re gonna see row upon row of abandoned factories that were privately owned. You’ll see the faded old signs of restaurants that used to be there. You drive the bumpy road that takes you around the port, and you’ll see the abandoned oil refinery, the old dockyards. In the city, you’ll see the icon, the Habana Libre hotel—that used to be the Hilton, OK? And it’s frozen in time since 1959, with burst pipes and water splashing in the lobby. These are the claims. And you’ll see the potential.”