One wintry Thursday morning, I drank my coffee black. I prefer my morning joe with a lot of milk in it, but I didn’t want to mess with my glucose reading. Arriving at work, I headed to a conference room where I met a nurse from my company’s wellness vendor. She weighed me, took my height and blood pressure, and calculated my body-mass index. She pricked one of my fingers and inserted my blood sample into a small machine that measured my blood sugar, LDL cholesterol (the bad one), and HDL cholesterol (the good one). She wrote down each, and I breathed a sigh of relief. I had passed. I wouldn’t have to take a multi-week online health-improvement course to avoid paying an extra $600 on my health insurance next year.

If you work for an American corporation, there’s a good chance you’ve undergone a similar routine. According to a 2015 Kaiser Family Foundation survey, 50 percent of large firms (defined as having 200 or more workers) annually offer or require employees to complete what’s known as a biometric screening, and more than half of those companies offer a financial incentive to employees who participate. Some even make participation mandatory for employees who enroll in company-sponsored health insurance. Half of large employers surveyed offer health risk assessments (HRAs), which are questionnaires intended to identify high-risk behaviors. Biometric screenings and HRAs are just two types of workplace wellness programs, a broad category that can also include smoking cessation courses, lifestyle coaching, and weight-loss competitions.

Wellness is good. (Who doesn’t want to be well?) And wellness vendors—the companies that your employer pays to administer those HRAs and biometric screenings—assert that their programs save money by making employees healthier, thereby preventing expensive claims. Employers are “spending hundreds of millions of dollars on health care, in fact an average of $12,000 per employee,” said Eric Zimmerman, the chief marketing officer of Redbrick Health. “So it doesn’t seem imprudent to spend a small percentage of that on keeping people healthy.” (Disclosure: Redbrick is the wellness vendor formerly used by Slate’s parent company.)

“If you invest and focus on the health of your population,” says David Nill, chief medical officer of wellness vendor Cerner Health, “you will be happier, healthier, more productive, and actually the result of them being healthier is they’ll have less utilization and spend less money on care resources.”

The notion that wellness programs save companies money by making their employees healthier is appealing. In fact, the federal government encourages companies to implement wellness programs. But wellness programs promote medical tests of dubious value, encourage unnecessary doctor visits, and collect sensitive health information despite often extremely lax privacy policies, with little to no evidence that they improve health outcomes. There’s not even much sign that wellness programs help a company’s bottom line—not directly, anyway. So how did we get to a point where employers consider wellness programs a “need to have,” in the words of Redbrick?

* * *

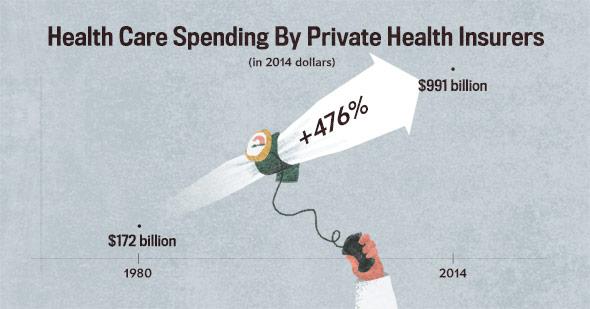

The history of wellness programs is inextricable from the history of rising health care costs in America. According to data from the federal government’s National Health Expenditure Account, overall American health care spending almost quintupled between 1980 and 2014, from $634 billion to $3.03 trillion (all in 2014 dollars). The increase was even more dramatic for health care spending by private health insurers, rising from $172 billion to $991 billion, adjusted for inflation—a 476 percent increase.

Illustration by Natalie Matthews-Ramo.

Since companies are always looking for ways to slow rising health costs, the idea behind wellness programs sounds like a win-win: Educate employees about their health and identify any health problems before they get expensive, and you’ll end up with a healthier, cheaper-to-insure workforce. Both the Americans with Disabilities Act of 1990 and the Health Insurance Portability and Accountability Act of 1997 (HIPAA), which aimed respectively to prevent discrimination on the basis of health status and to protect employee health information, contained exceptions that explicitly permitted corporate wellness programs.

Throughout the 1990s, federal regulations kept workplace wellness programs in check. Companies were allowed to offer modest financial incentives, but the rewards could be tied only to participation, not to outcomes. In other words, companies could offer workers cash or a discount on their insurance premiums for completing an HRA or a biometric screening, but they had to give all participants the same reward regardless of their health status.

That changed during the George W. Bush administration. In December 2006, Bush’s regulators in the departments of Labor, Treasury, and Health and Human Services—the three agencies that regulate group health plans and enforce HIPAA—finalized a new rule establishing that companies could tie financial rewards to health outcomes. Not only that, they could increase the size of the financial rewards up to 20 percent of the total cost of the health plan.

Put another way, this meant that companies could shift up to 20 percent of the total cost of premiums onto unhealthy employees. Business leaders had told administrators that they’d have “a greater opportunity to encourage healthy behaviors through programs of health promotion and disease prevention if they are allowed flexibility in designing such programs,” as Bush’s staff wrote in the rule.

In 2009, Safeway CEO Steven A. Burd launched a public relations and political campaign claiming that his company had seen a stunning drop in health care costs after implementing a wellness program. In an opinion piece for the Wall Street Journal, Burd said that Safeway had begun testing employees’ tobacco usage, weight, blood pressure, and cholesterol levels in 2005 and tying financial incentives to their results. Burd called this program “completely voluntary” in the same paragraph that he explained individuals who didn’t pass these tests had to pay $780 more in annual premiums, or $1,560 more for family plans. This kind of doublespeak is par for the course in the world of corporate wellness, where avoiding a financial penalty is often framed as getting a discount.

Simply by instituting wellness programs, Burd wrote, “we have kept our per capita health-care costs flat (that includes both the employee and the employer portion), while most American companies’ costs have increased 38% over the same four years.”

As it turns out, almost none of Burd’s story was true. As the Washington Post’s David Hilzenrath discovered, Safeway implemented its wellness program in 2009, not 2005, and only about 14 percent of its workforce was even eligible to participate in it. Safeway did manage to keep its health care costs down—by raising deductibles in 2006, shifting more of the cost of health care onto employees.

But Congress—and the Obama administration—bought Burd’s story hook, line, and sinker. “The Safeway program has proven so successful that the company wants to increase its incentives for rewarding healthy behavior,” Republican Sen. Mitch McConnell said in June 2009. “Unfortunately, current laws restrict it from doing so.” In a radio interview broadcast from the White House in August 2009, President Obama said Safeway “is a company that has done a great job in helping encourage its employees to get fit, and they actually give them an incentive. They say, ‘Look, you’re going to save X amount on your insurance premiums—you’ll see that in your paycheck—if you are taking steps to take care of yourself.’ ”

Not everyone was on board with raising the limits on penalties charged to employees who didn’t meet wellness standards. A group of health advocacy organizations, including the American Diabetes Association and the American Lung Association, wrote a letter to Congress pleading “that individuals not be penalized—either financially or by exclusion from coverage or services—if they are sick or if they presently engage in specific behaviors or have certain health conditions, such as smoking or obesity.”

Still, the so-called “Safeway Amendment” became law as part of the Affordable Care Act. Since 2010, companies have been able to shift up to 30 percent of the cost of employee-only health care premiums onto employees who fail wellness tests unrelated to tobacco, and up to 50 percent for failures related to tobacco.

Illustration by Natalie Matthews-Ramo.

The ACA is grimly specific about the financial component of wellness programs, but it is much less specific about what those programs are allowed to consist of. Wellness programs are defined as “a program offered by an employer that is designed to promote health or prevent disease.” The law offers no standards for participatory programs; as for outcome-based programs, the ACA says a program is kosher if it:

has a reasonable chance of improving the health of, or preventing disease in, participating individuals and it is not overly burdensome, is not a subterfuge for discriminating based on a health status factor, and is not highly suspect in the method chosen to promote health or prevent disease.

Just this May, the Equal Employment Opportunity Commission confirmed that these ACA standards were in compliance with the Genetic Information Discrimination Act and the Americans with Disabilities Act.

The “Safeway Amendment” is a remarkable exception to the Affordable Care Act’s ban on discriminating against pre-existing conditions. Thanks to “Obamacare,” people with high blood pressure, cholesterol, blood sugar, or body-mass index—or any other factor that a wellness vendor screens for—can be legally charged thousands of dollars more in premiums than people without those conditions. Technically, wellness programs must provide a “reasonable alternative standard” for people who don’t pass a screening. But the ACA “doesn’t say what the alternative standard is. It’s totally open-ended,” says Karen Pollitz, a senior fellow at the Kaiser Family Foundation.

* * *

You might think of Al Lewis, Vik Khanna, and Tom Emerick as the Three Musketeers in the fight against wellness programs. Lewis is a health care consultant. Khanna worked as a consumer health advocate for the Maryland State Attorney General before running wellness programs for various companies. Emerick managed health benefits for Walmart for 15 years. Individually, they all came to realize that wellness programs alienated employees and wasted money. After Khanna accepted a job running a wellness program for a nonprofit health system, he says, “I had a lightbulb moment when I realized that these people who want these wellness programs and are running them really, literally have no idea what they’re doing.”

Lewis has published three books on wellness programs: Why Nobody Believes the Numbers, Cracking Health Costs (co-authored with Emerick), and Surviving Workplace Wellness (co-authored with Khanna). Lewis and Khanna call out wellness practices on a blog called They Said What? (Recent posts include “Weight Loss ‘Challenges’ Produce a Culture of Deceit, Not a Culture of Health” and “Wellness Meets 1984.”) After I first talked to him for this piece, Lewis started sending me emails every week or so with subject lines like “more wellness news … another doozy” and “Laura, how is wellness like Seinfeld?” (Answer: It’s about nothing.)

Lewis et al’s criticisms of the industry start with two of the most common tools in the wellness program’s toolbox: the health risk assessment and the biometric screening. HRAs typically offer advice that any moderately educated adult has already heard hundreds of times: Eat lots of fruits and vegetables. Exercise. Don’t smoke. Get enough sleep. It seems highly unlikely that an employee with unhealthy habits would suddenly decide to adopt healthy ones after completing an HRA.

HRAs can contain misinformation, too. The HRA I completed last year grouped full-fat dairy and eggs in the same category as cold cuts, fried foods, and cake, even though the evidence against saturated fat is nowhere near as conclusive as the evidence against processed meats and sweets. In an HRA he completed to save money on his wife’s health care plan last year, Khanna reports, “They tell me that I’m slightly overweight with a BMI of over 25, and that’s because I’m very muscular. I’m short, but as one of my workout mates says, I’m built like a fire hydrant.” Khanna, now 58, took up bodybuilding at the age of 17 and describes himself as “a fitness and wellness fanatic.”

As Khanna’s experience shows, BMI is a crude tool—it can’t necessarily tell the difference between someone who’s ripped and someone who’s chubby; it also can’t tell the difference between someone who’s chubby and someone who’s pregnant. What’s more, a 2013 meta-analysis of data from nearly 3 million people found that a BMI in the overweight category was associated with lower mortality than a BMI in the “normal” range; only morbid obesity was associated with higher mortality.* In short, wellness programs are using a rough measurement without much predictive value as a means of distinguishing healthy employees from unhealthy employees.

The other measurements taken in a typical biometric screening are a little better. Blood pressure tests are very useful for detecting hypertension, but blood pressure isn’t consistent from one moment to the next. As for cholesterol tests, the United States Preventive Services Task Force (USPSTF) recommends that otherwise healthy adults get screened for lipid disorders every five years unless they have other factors that put them at risk for heart disease, and recommends glucose screenings only for people over the age of 40 who are overweight or obese.

The upshot is that wellness programs often recommend screenings for otherwise healthy people far more often than their doctors would. As Gilbert Welch, a professor at Dartmouth College’s Geisel School of Medicine, has argued in books such as Overdiagnosed and Less Medicine, More Health, screening generally healthy people for diseases isn’t just wasteful; it can be harmful. Sometimes screenings generate false alarms. Sometimes they detect abnormalities that would never have developed into a disease, but trigger a treatment regimen just to be safe—exposing a patient to the side effects of a medication or the risks of unnecessary surgery. Biometric data collection can lead “people to feel more vulnerable, to be terrorized by false alarms, and to be overdiagnosed and overtreated,” Welch writes in Less Medicine, More Health.

Moreover, most health conditions simply aren’t wellness-sensitive—i.e., they can’t be prevented via lifestyle interventions. Think about multiple sclerosis, or asthma, or schizophrenia, or Crohn’s disease. These conditions require ongoing treatment, sometimes in the form of expensive medications. No amount of lowering your blood pressure or losing weight is going to make them less expensive to cover.

And conditions that are wellness-sensitive are quite uncommon in the working-age population. Cancer, heart attacks, stroke, and diabetes usually don’t hit until retirement, even among people who have had bad habits all along. “Most of the diseases they say they are going to prevent are diseases of aging,” Khanna says. A heart attack or cancer diagnosis can be quite expensive to treat, but it’s more likely that Medicare will be on the hook for covering it than your employer-provided insurance. Lewis and Emerick’s Cracking Health Costs estimates that “only about 7 percent of your total spending—at the very most—pays for medical events like heart attacks that are preventable through wellness.”

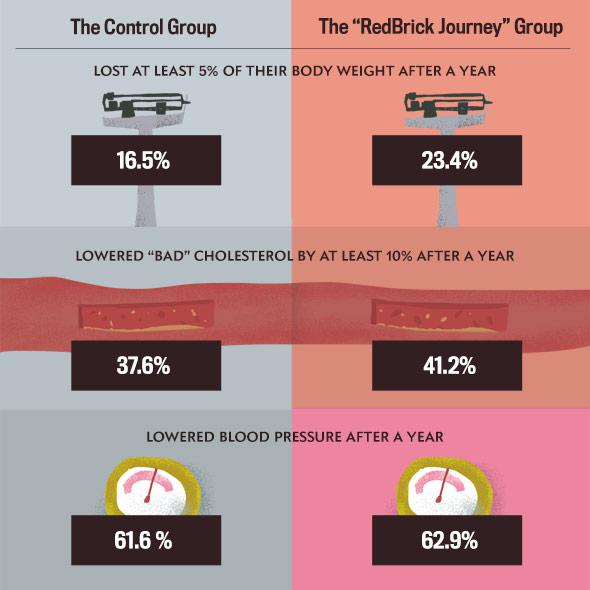

If you take a close look at Redbrick’s numbers, for example, it’s hard to see how or where companies are saving money via wellness programs. Redbrick tracked the biometric measurements of 84,400 high-risk individuals from multiple companies over about a year, some of whom completed a Redbrick online program—known as a “Journey”—and some of whom didn’t. In that time period, 23.4 percent of obese individuals who completed a Redbrick Journey lost at least 5 percent of their body weight, compared to 16.5 percent in the control group. Among those with elevated “bad” cholesterol, 41.2 percent who completed a Journey lowered it by at least 10 percent, compared to 37.6 percent of non-Journey-takers. And 62.9 percent of individuals with high blood pressure who completed a Journey saw a categorical improvement, compared to 61.6 percent of those who did not complete the wellness program—a non-statistically significant difference, unlike the other results.*

Illustrations by Natalie Matthews-Ramo.

Despite the fact that Redbrick participants improved their overall health at only a slightly higher rate than nonparticipants, Redbrick claims that companies that use its programs will save $3.80 for every dollar they invest, with an average savings of $612 per person per year. This return on investment (ROI), which doesn’t include the cost of incentives, is allegedly the result of lower medical claim costs and reduced absenteeism. When I asked Zimmerman how Redbrick accounted for those savings, he said, “I wouldn’t say the reason to invest in this category is for a 3.8 to 1 ROI. I don’t know that it’s logical to invest in well-being and expect a near-term financial return.”

A government-sponsored 2013 analysis of large employers’ medical and wellness data by the nonprofit RAND Corporation was unable to detect a statistically significant reduction in health care costs as a result of wellness program implementation. RAND also challenged the notion that financial incentives produce thinner employees: according to their analysis, $10 in incentives is associated with 0.03 pounds of weight loss. At that rate, a company would need to spend $10,000 to get an overweight employee to lose 30 pounds.

* * *

So what are employers actually after when they implement wellness programs tied to large financial incentives? Cost-shifting. Under the ACA, wellness programs are a legal way to shift a significant portion of the cost of premiums onto employees deemed unhealthy. Wellness programs don’t save money by preventing expensive medical claims—and in fact, they might even increase claims costs due to encouraging unnecessary doctors’ visits. But wellness programs can save money if enough employees fail them or opt out.

To make their employees healthier, it’s clear, employers need to totally redefine what a wellness program is. A wellness program that’s actually about wellness would be entirely voluntary, not financially coercive. It wouldn’t collect any personal health information from employees. It wouldn’t weigh people or take their blood samples. It would be truly a benefit, not a cost-saving measure. It might reimburse employees for their gym or yoga studio memberships. It might subsidize a community-supported agriculture membership.

But if employers start adopting any of these benefits en masse, they might have to call them something else. The term wellness program might be beyond redemption by this point.

*Update, Sept. 2, 2016: This article has been updated to clarify that only Redbrick’s blood pressure improvements were not statistically significant; Redbrick’s other results were statistically significant. (Return.)

*Correction, Sept. 1, 2016: This article originally misstated the scale of a 2013 meta-analysis. Although the researchers started with a pool of more than 7,000 studies, they analyzed only 97 studies with a combined sample size of approximately 2.88 million individuals. (Return.)