“Perhaps no statistic better illustrates the enduring legacy of our country’s shameful history of treating black people as sub-citizens, sub-Americans, and sub-humans than the wealth gap,” the Atlantic’s Ta-Nehisi Coates wrote in his masterful essay, “The Case for Reparations.” That gap, enormous and awful as it already was, has been growing since the recession. Last week, the Pew Research Center reported that the median white household was worth $141,900, 12.9 times more than the typical black household, which was worth just $11,000. In 2007, the ratio was 10 to one. The divide between white families and Hispanics was similar.

Depressing as those numbers sound, they may actually be a bit too upbeat. Pew is arguably overstating black wealth.

This part gets the tiniest bit technical, but here’s the overarching question to consider: Do you consider your car an asset? Or is it a consumer good?* Because if you don’t count it as an asset, the median black household has virtually no “wealth”—which is what a family owns minus all of its debts—to speak of. Pew’s analysis is based on the Federal Reserve’s 2013 Survey of Consumer Finances. And when the central bank tallies up America’s net worth, it adds vehicles, along with some other durable goods, to the asset column, right along with things like houses, stocks, bonds, and savings. According to the Fed, the median vehicle is worth about $15,800.

In some respects, it makes sense for the government to count cars and trucks toward wealth. After all, if you’re really pressed, you can sell your pickup. Insurance companies consider these things assets that can be insured. They’re worth something in a pinch. But there are also good reasons why we shouldn’t count consumer durables as wealth (for those wondering, Thomas Piketty doesn’t). For starters, families often need them. Most Americans probably can’t survive without a car. Second, they lose value over time. Home prices (often) go up, plus owners save on rent. Stocks appreciate. Bonds pay interest. But every extra mile you drive your car takes a bit off its resale price. It’s a depreciating asset.

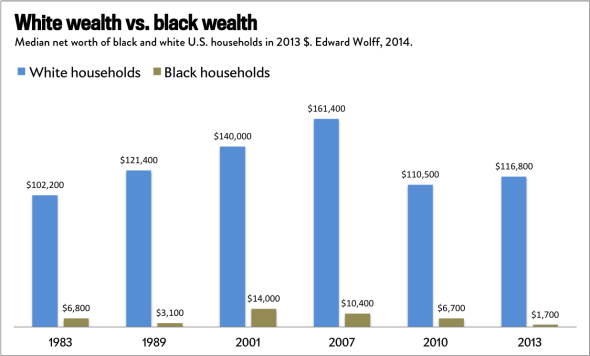

What happens when you remove vehicles and other durables from the picture? For minority families, it gets much, much bleaker. According to New York University economist Edward Wolff (whom I cited in a recent post) the median black family, minus cars and the like, is worth just $1,700 (40 percent have zero or negative wealth). The median white family is worth, roughly, 69 times more.

Chart by Jordan Weissmann

This doesn’t fundamentally change the story Pew is telling about the racial wealth divide. It just shows that the median black household lives even closer to the edge than the official numbers might suggest. The reasons why have to do with far more than relative poverty (as Matt Bruenig has written at Demos, white households are worth far more than black households even when they have similar incomes). Because of racist policies like redlining, midcentury black families were regularly cut off from the housing market, forced into predatory lending arrangements when they did buy, and settled in neighborhoods that were eventually decimated by white flight and urban decay. For the American middle class, homeownership is wealth, and without it, blacks weren’t able to save and build assets to pass on to the next generation. In more recent years, subprime lenders specifically targeted minority communities with the risky loans that later led to the foreclosure crisis.

The story is complicated. But the upshot is simple: When it comes to finances, the U.S. has left the typical black household with just about nothing.

*Correction, Dec. 15, 2014: Based on an interview with Pew, this article incorrectly stated that the Survey of Consumer Finances counts common household furniture and appliances as assets. It does not.