After their original plan was trashed for being an obvious giveaway to corporations and the rich, congressional Republicans are reportedly thinking twice about how much their upcoming tax bill should slash rates for millionaires.

The framework party leaders floated last month would cut the top income tax rate to 35 percent, down from 39.6 percent today. But according to Axios, key Republicans are now “exploring” whether to leave the top rate as is for those making $1 million or more per year. While anti-tax jihadi Grover Norquist is already upset over the idea, sources tell the site that, despite sounding a bit ambivalent about it in public, President Donald Trump doesn’t really object to keeping the higher rate for the highest earners.

“He basically thinks they [rich people] are fine and he believes they don’t care that much about the individual rate so long as they get all the other goodies, like the corporate rate and expensing,” the official told Axios.

Trump, for once in his presidency, is probably correct here. Given the other “goodies” Republicans are planning to deliver them, Americans lucky enough to be pulling down seven figures probably won’t care much if the top marginal income tax rate stays put. The president, of all people, should know.

The key thing to realize is that America’s millionaires and billionaires make a great deal of their money off of things other than their salaries. The richer households get, the more of their income tends to come from ownership stakes in businesses, as well as investments in securities like stocks and bonds. Within the rarefied world of the top .1 percent—households that make $2 million a year or more, approximately—this sort of capital income often dominates tax returns.

These families will benefit handsomely from the GOP’s proposed corporate tax cuts, which should keep stock prices high and leave companies with more profits left over for dividends. But perhaps even more importantly, they stand to reap a big windfall from the GOP’s plan to create a special low rate for pass-through businesses, whose owners currently pay taxes on their profits as personal income, with the top rate at 39.6 percent. The vast majority of businesses in the country are organized as pass-throughs—including big law firms, hedge funds, some manufacturers, and the president’s very own Trump Organization. The GOP wants to cut the top tax rate for these businesses all the way down to 25 percent.

Republicans have tried to frame this proposal as a way to help small businesses stay competitive—Trump himself gave a whole speech about how the cut would benefit truck drivers. But mom-and-pop stores and guys who haul freight for a living likely won’t benefit much; those sorts of business generally pay far below the top rate today, since their profits aren’t all that big.

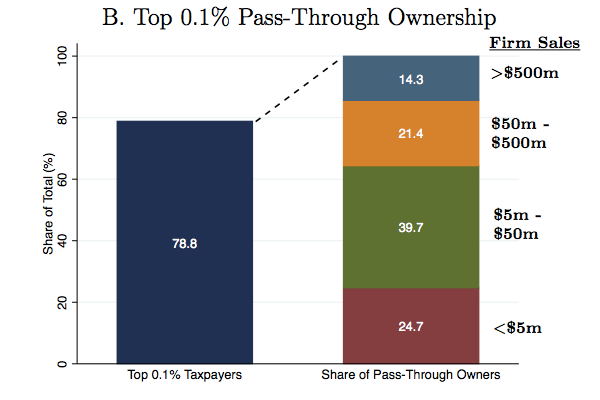

The move will, however, be an enormous boon to America’s millionaires. Among the top 0.1 percent of taxpayers, for instance, nearly 80 percent report income from a pass-through, according to a recent working paper by researchers at the University of Chicago; University of California, Berkeley; and the Treasury Department. More than 75 percent of those businesses have at least $5 million in sales; more than one-third have more than $50 million in sales.

It is unclear exactly how broad the tax cut for pass-throughs will be. It may only apply to some kinds of businesses, or may limit how much income a business owner can report as profit as opposed to salary. But unless it’s structured only to benefit truly small businesses, which at this point seems unlikely, the change will almost certainly make members of the GOP donor class (and rich Democrats) wealthier.

What Republicans are struggling with, then, isn’t really whether to lower taxes on millionaires and billionaires. It’s whether to give them a jumbo, new mansion-in-the-Hamptons-sized tax cut, or something slightly more modest, but much harder for the public to spot.