The version of the Republican tax plan unveiled last week went out of its way to make adoption more expensive. The proposal, debated this week by the House Ways and Means Committee, eliminated the tax credit for adoptive families. On Tuesday, Republicans on the committee doubled down, killing an amendment proposed by Democrats that would have restored the credit to the bill. But on Thursday, after an outcry from religious conservatives, Republicans reversed course and said they would retain the tax credit in both the House and Senate versions of the tax bill.

In attempting to quietly slash the credit, Republicans seem to have missed how important adoption has become to one of their most important constituencies. An evangelical pollster found in 2013 that 5 percent of practicing Christians had adopted a child, compared to 2 percent of Americans overall. Many churches in the have designated this Sunday, November 12, as “Orphan Sunday,” with a special focus on international adoption. Many social conservatives see adoption as a way to not just care for needy children, but to discourage women from getting abortions.

“There will be, in effect, an economic incentive to abort those babies,” the president of the Southern Baptist Theological Seminary, Albert Mohler, told listeners of his popular daily podcast on Thursday, before the reversal was announced. The Republican Party “puts its moral character at risk by putting forward of tax reform proposal that would disincentivize the adoption of children.” The Susan B. Anthony list, an anti-abortion PAC, issued a statement critical of the provision; Focus on the Family said it has “reached out to every channel available to us” to save the credit. A blogger for the conservative site Hot Air summed up the social-conservative response to the proposal: “What the hell are they thinking?”

“The GOP claims to be the pro-family, pro-life party, but they are funding Planned Parenthood and killing an adoption tax credit that literally helps families adopt children,” wrote Erick Erickson, urging his readers to “shut down Congress’s phone lines” with calls to keep the credit in place. Russell Moore, the influential policy head of the Southern Baptist Convention, echoed that argument and called the credit’s loss “insane”:

The current adoption tax credit allows families to claim up to $13,570 to offset the tremendous costs of adopting a child. Agency fees, legal expenses, and travel costs can add up to tens of thousands of dollars, aside from the basic expense of caring for a child. A Google engineer and adoptive father who tweeted at length about the tax credit last week said his first son cost his family about $50,000 to adopt.

The adoption credit, meanwhile, is a relative bargain for taxpayers. Canceling the credit is estimated to save just $3.8 billion over the course of 10 years. As the Weekly Standard pointed out in a piece defending the adoption credit, cutting the estate tax—a core element of the Republican plan—would have cost taxpayers 50 times more than preserving the adoption credit. The adoption credit currently makes up less than .01 percent of the federal budget.

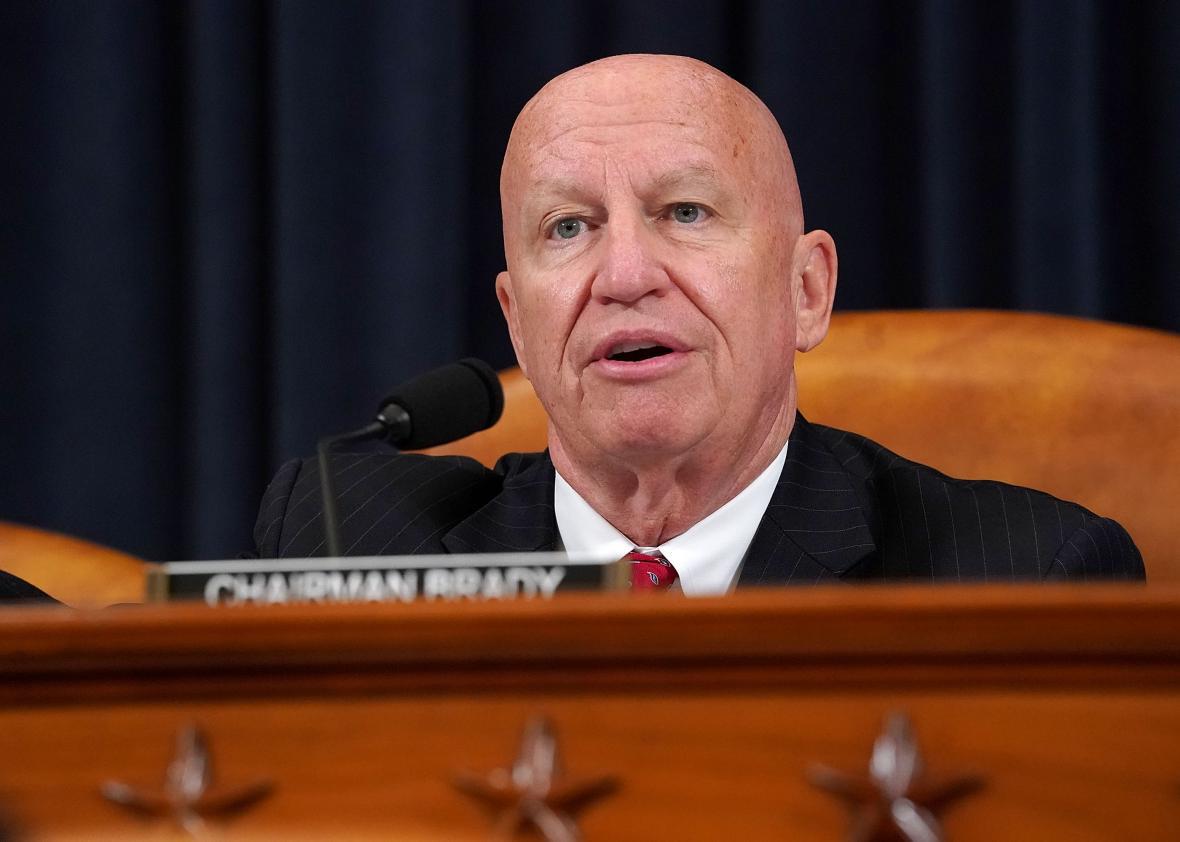

On Thursday afternoon, the Ways and Means committee acquiesced to the outcry from their conservative critics, and voted 24-16 to add the credit back to the bill. Preserving the credit “will ensure that parents can continue to receive additional tax relief as they open their hearts and their homes to an adopted child,” committee chair Kevin Brady said. Brady happens to be the father of two adopted children, and knows from experience how expensive and exhausting the adoption process can be. But earlier this week, he attributed his potential change of heart to something else: “For me as a pro-life dad and my wife as a pro-life mom, we understand.”