The Congressional Budget Office’s grim report on the government’s long-term budget outlook released yesterday paints a rosier picture of the approaching “Taxmageddon” than the name would imply.

Congressional aides coined “Taxmageddon” in February to describe December 31, 2012, the date when both the Bush tax cuts are set to expire and the automatic spending cuts agreed upon during last year’s calamitous debt ceiling fight are scheduled to go into effect. Earlier this year, the predicted result of such a doomsday was an immediate and catastrophic double-dip recession; Ben Bernanke described the looming deadline to take action as “a massive fiscal cliff.”

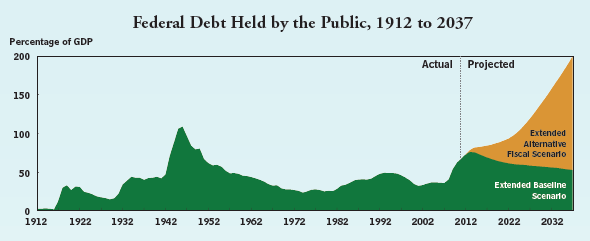

The new CBO report shows, however, the so-called fiscal cliff (or fiscal slope) may be preferable in the long-term to extending current policies. If the current tax cuts and spending were to continue, a scenario which the CBO calls “much bleaker” than the Taxmageddon one, federal debt would exceed 90 percent of GDP by 2022 and 109 percent by 2026. If America’s federal debt approaches or exceeds 100 percent of GDP, economists have warned it could set off a domino effect of fiscal consequences leading to a crisis similar to those now faced by some European countries.

On the other hand, if Taxmageddon were to occur, debt would decline from 73 percent of GDP this year to 61 percent by 2022 and 53 percent by 2037. If following the election Congress does agree on a debt-reduction package before December 31, the CBO advises that the package must be similar in size to the combined deficit cuts and tax hikes of Taxmageddon in order to avoid an “explosive” fiscal crisis in the future.