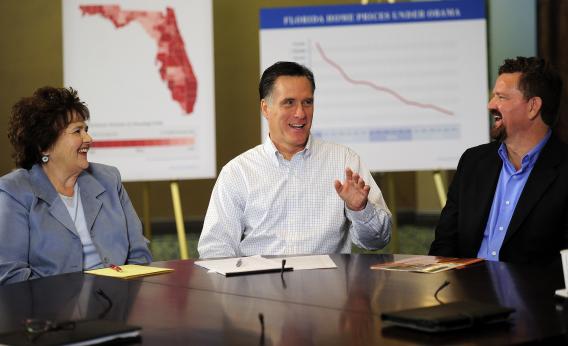

TAMPA, Fla. – Mitt Romney was underdressed. Nine struggling Tampa residents were meeting him at 8 a.m., in a circular Sheraton conference room overlooking a pool. They dressed for a meeting. He dressed in jeans. The last time I watched Romney in such a set-up, he uncorked a joke about forgetting his blazer; he left that in the bottle this time. He took a seat in front of a foreclosure map, grabbed a pen and a piece of paper, and started note-taking on individual stories of pain.

“I saw this morning that the number of homes in foreclose represents about around one quarter of all homes in the country,” he said. “Some 460,000 homes – absolutely extraordinary numbers.”

The Real People started sharing. One of them had bought two condos at the height of the market. “They’re both rental properties now?” asked Romney. They were. “I don’t want to get too personal here, but the rental rate, compared to your carrying cost…”

“I’m breaking even,” said the Real Person.

“You’re breaking even,” said the candidate, relieved.

Most of the stories focused on bad banks, not bad personal decisions. Romney was adamant: People who owned homes weren’t to blame for the problem.

“If you look home prices over time, in America – 100 years of home values – and you take out inflation, home values have grown about 1 percent per year,” he said. “Starting about a decade ago, it started going dramatically up. That coincided with the efforts of Congress and Freddie and Fannie, saying: ‘We’re going to insure these homes.’” The maniacs, they blew it up. “The truth is the bad news is there, we realize it, we need to go back and start over again. We need to recognize these loans don’t have value, because the underlying property was massively overvalued.”

Ah: Fannie and Freddie. It was the first oblique reference to the GSEs, one of which employed Newt Gingrich as, in his word, a “historian.” But this was as partisan as Romney got. He preferred to nod sadly at the stories and speak generically about what needed to be done; not necessarily what government should do.

“Too many institutions aren’t willing to write it off and say, we made a mistake, we over-leveraged, we loaned too much,” he said.

After the meeting (and after a Fox interview), Romney stood with his back to the water and took questions. (The new setting was missing something that the old setting had in abundance – sunbathers walking around in bikinis.) How did Romney square his foreclosure pain-feeling with his previous statements that foreclosures should be allowed to happen?

“Where there has been fraud, where people who entered into a mortgage arrangement were mislead by institutions or by individuals – why, there should be an effort to go after those institutions and prosecute them,” he said. “That’s something that Pam Bondi is doing here – the attorney general of Florida – and is hopefully being done in other states as well. Secondly, the banks ought to show greater flexibility in being able to renegotiate with those people who have circumstances that would justify that renegotiation. The banks seem to be paralyzed – I talk to bankers, community bankers and ask why are you not able to work through some of these problems? They say, in part, they’re frightened about what’s happening with Dodd-Frank, and taking actions that may put them in peril.”

Another reporter asked whether Romney had trouble connecting to voters. “I don’t feel that I have any challege connecting to people on an emotional level,” he said. Mary Pinon, a mortgage lender who asked Romney some of the most pointed questions, agreed with that. “He’s very genuine,” she said. “Why don’t they bail out the people who own these homes, instead of bailing out the banks?”

He didn’t say he’d bail out the people.

“He didn’t say he wouldn’t.”