“It’s Miller time!”

So said one of the several dozen Republican senators who stayed on the floor to watch Vice President Mike Pence call the vote around 1:50 a.m. late Friday night. The Tax Cuts and Jobs Act, Republicans’ signature tax bill, passed the Senate 51-49, picking up all Republican votes except for Tennessee Sen. Bob Corker’s. There were hugs on the floor, awkward ones. There were cheers from several of the men huddled around Maine Sen. Susan Collins when she voted for it. Democrats, meanwhile, had all left the floor immediately after voting.

It had been a long day.

Republicans had the votes hours before they had the bill. The Senate floor was mostly quiet Friday afternoon and into the night as debate time went on and on, in order to buy Republicans time to finish writing the final product. That included a slew of major last-minute changes, including a nearly $150 billion provision to preserve a $10,000 property tax deduction to win over Collins. In order to cover that and other adjustments, the bill preserves much of the alternative minimum tax, which it had previously repealed.

Other changes fell into the less-than-statutory realm of handshake agreements. Collins presented a signed letter from Senate Majority Leader Mitch McConnell that he would never, ever allow automatic spending cuts triggered by pay-as-you-go law to go into effect. (Perhaps Collins could use the letter as tinder to get her fireplace going when she returns to the Maine winter?) And Arizona’s Jeff Flake claimed he got a “firm commitment” from leaders and the White House to secure a “permanent” deal protecting DACA recipients. Marc Short, the White House’s legislative director, subsequently described that “firm commitment” as a pledge to “include him in our talks.” Given the high regard in which President Trump holds Flake, the retiring senator is sure to be a decisive figure in those talks.

Around 6:30, when Democratic offices began receiving updated versions of the 479-page text, tweets emerged of pages in the text with hasty, handwritten adjustments. Democrats were quick to make a thing of it. Illinois Sen. Dick Durbin, the minority whip, hammed up his struggles to divine the handwritten text in the margins of page 257. He asked for it to be entered into the congressional record, but then noted that doing so would require “translators and interpreters.” Similar gimmicky treatments magically appeared simultaneously on the social media feeds of nearly every Democratic senator. Democrats also devoted a lot of attention throughout the debate to a specific carve-out Pennsylvania Sen. Pat Toomey had included to help the conservative Hillsdale College in Michigan. In the final amendment vote later in the night, a Democratic amendment to strip the carve-out succeeded.

Once the vote-a-rama—a lightning round series of votes on amendments before final passage—began, the major question mark was an amendment offered by Florida Sen. Marco Rubio and Utah Sen. Mike Lee. It would have expanded the refundability of the child tax credit, to help the working poor and middle class, by slightly raising the corporate tax rate from the bill’s original level. The decision for Democrats was: Move the policy in a direction to their liking, or instead keep Democratic fingerprints off of the bill? Though some centrist Democrats voted for it, most voted against it. Senate Minority Leader Chuck Schumer was closely watching the vote, nudging members to vote “no.” The amendment fell, 29–71. Democrats chose to let Republicans own the bill in its entirety.

Elsewhere, a Ted Cruz amendment to expand the use of 529 education savings accounts got stuck at a 50–50 vote. It was held open until Vice President Mike Pence arrived to break the tie in the amendment’s favor. The wealthy and upper-middle class can now more easily use tax-preferenced vehicles for sending their children to private K-12 schools.

The bill now theoretically will head to a conference committee to mesh it with the House bill. Or the House will just try to save time by passing the Senate bill.

Neither bill is popular.

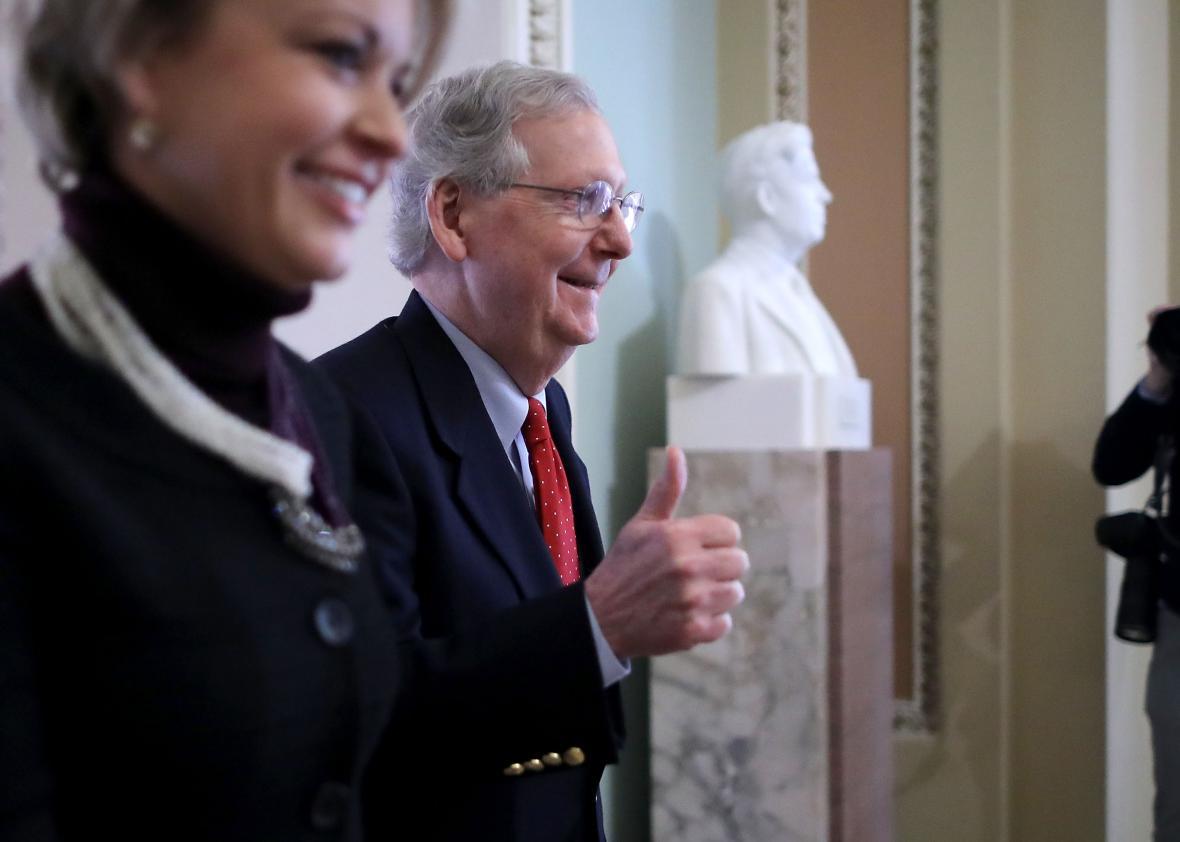

They don’t care.