Donald Trump’s already bad start to the week just got a little bit worse. New York Attorney General Eric Schneiderman announced on Monday that his office has informed the Trump Foundation that it violated state law earlier this year, and ordered the nonprofit to cease its fundraising in New York immediately.

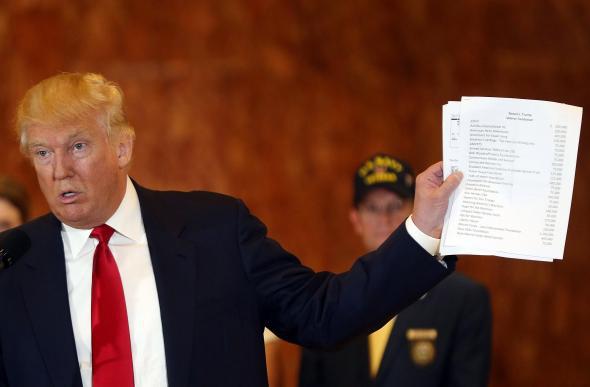

As the Washington Post’s first reported last week, the foundation appears to have been operating without the necessary paperwork to raise large sums of money in New York. Under state law, a New York–based charity that solicits more than $25,000 a year from the public must obtain a special kind of certification to do so. The AG’s office claims that “based on the information” the state has received, the New York–based Trump Foundation never filled out the necessary paperwork despite crossing that threshold. The state hasn’t cited specific examples of when and how Trump’s charity specifically violated the law, but the most obvious candidate is the roughly $1.7 million it claims it raised online earlier this year in conjunction with a veterans fundraiser Trump staged as counterprogramming to the GOP primary debate he skipped in January.

The AG’s office informed the Trump Foundation this past Friday that it has 15 days to file the missing paperwork. Failure to cease fundraising and submit the necessary paperwork “shall be deemed to be a continuing fraud upon the people of the state of New York,” according to the official letter the state sent to the nonprofit.

The Trump campaign responded to the news by simultaneously saying it would “cooperate fully” with authorities while also casting aspersions on the motivations of Schneiderman:

As I explained last week, this isn’t some inconsequential paperwork mistake. A charity that solicits more than $25,000 a year may undergo annual audits from independent accountants in New York. By not registering with the state charities bureau, Trump’s foundation was able to operate with far less oversight than it otherwise would have. As charity-tax experts told the Post, if the Trump Foundation would have filed the paperwork it was supposed to, outside accountants would have had a chance to check its books, as well as to examine explicitly whether the foundation had spent any money that benefited Trump or his businesses in violation of other statutes. In short, they’d have likely spotted any number of the red flags that the Post’s David Fahrenthold has uncovered through his dogged reporting into a foundation that Trump has apparently used to play the role of benevolent billionaire without actually being one.