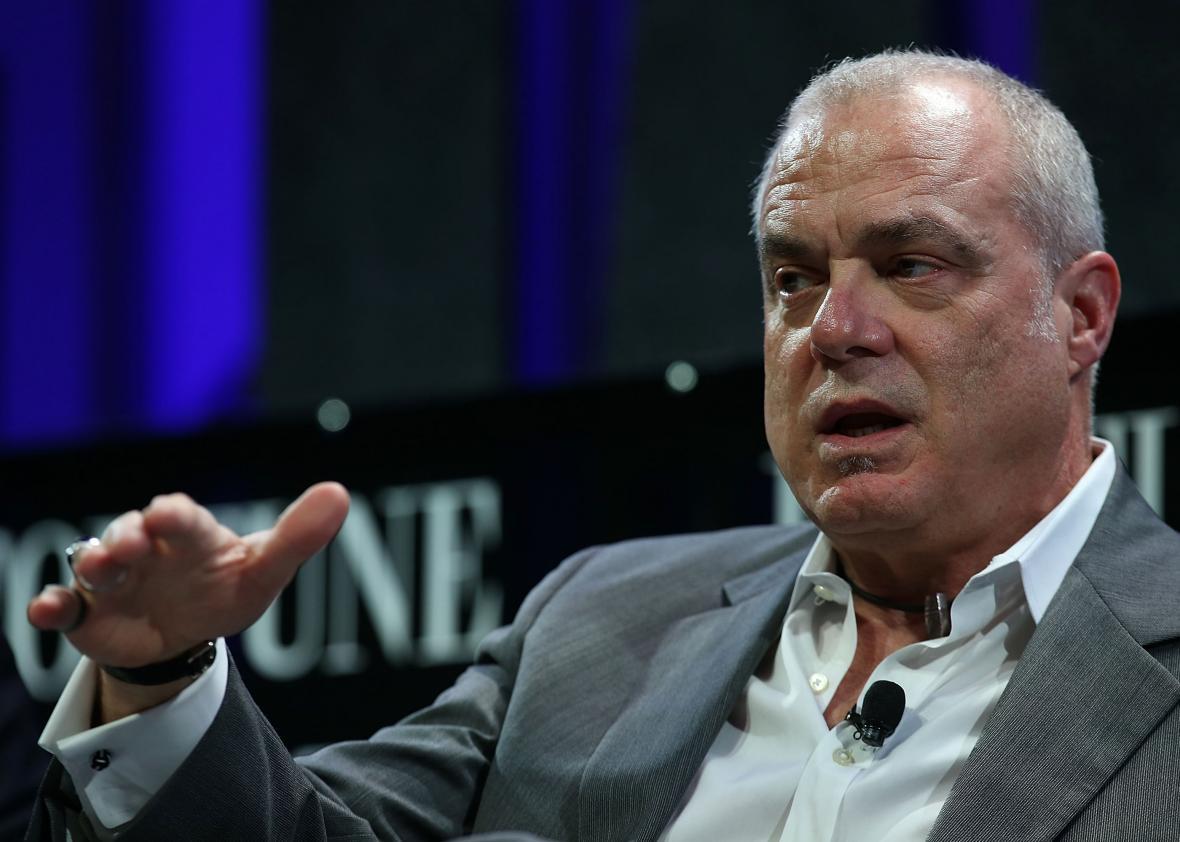

On Monday, insurance giant Aetna announced plans to pare back its health care offerings under the Affordable Care Act, reducing its participation in Obamacare exchanges from 15 states to four by next year. The reductions were spurred, company CEO Mark Bertolini said Monday, by “significant structural challenges” facing the insurance exchanges.

But according to a report by the Huffington Post on Wednesday, Bertolini wasn’t telling the whole story. Aetna is currently litigating a federal antitrust lawsuit launched last month by the Department of Justice intended to prevent the company from acquiring one of its chief industry rivals, Humana. A letter written by Bertolini and published by HuffPo makes it clear that the lawsuit triggered the Obamacare cutbacks, despite an interview in which Bertolini skirted the issue of whether the two were connected. In fact, Bertolini explicitly threatened to reduce Aetna’s ACA coverage if DOJ lawyers refused to back down.

In the letter, dated July 5 and addressed to Ryan M. Kantor, a litigation assistant chief at the DOJ’s antitrust division, Bertolini described his opposition to the suit. Insurance exchange markets “face significant uncertainty as to their economic viability over time, due to lower than initially expected enrollment, a population that is older and sicker than initially projected, an inadequate risk mechanism, and other regulatory issues and uncertainties,” he argued. “Should the deal [to acquire Humana] be blocked the challenges will be exacerbated.”

Then comes the key line, a strong-arm swathed in delightfully anesthetic corporate-ese (italics mine):

Our analysis to date makes clear that if the deal were challenged and/or blocked we would need to take immediate actions to mitigate public exchange and ACA small group losses. Specifically, if the DOJ sues to enjoin the transaction, we will immediately take action to reduce our 2017 exchange footprint.

“By contrast,” the CEO continued, “if the deal proceeds without the diverted time and energy associated with litigation, we would explore how to devote a portion of the additional synergies (which are larger than we had planned for when announcing the deal) to supporting even more public exchange coverage over the next few years.”

Bertolini went on to say that plans to expand the company’s ACA coverage from 15 states to 20 by 2017 would have to be scrapped if the DOJ continued to challenge the merger, and that coverage would actually be stripped “to no more than 10 states.” (Why Aetna apparently settled on four is a mystery.)

Bertolini’s letter did contain fig leaves in case the DOJ decided to relent. “Aetna has been a steadfast and strong supporter of the developing public exchange business and the Administration’s efforts to expand healthcare to all Americans,” he wrote, crediting the health care law with “reducing the ranks of the uninsured.” And to be fair, the thrust of his public explanation—that Aetna’s narrowing financial straits compelled it to scale back its Obamacare offerings—survives in the letter.

What should people think of the CEO’s critiques of the exchanges themselves? As my colleague Jordan Weissman detailed on Tuesday in Slate, Aetna is feeling a financial squeeze that has also beset others in the industry. But that’s as much due to an expensive, employer-provided business model that’s failed to court young customers as it is to older, sicker Obamacare enrollees. And other big insurers like Anthem and Cigna appear to be gritting their teeth and sticking with the exchanges—despite also being targeted by the DOJ for alleged antitrust violations.

Aetna’s decision to skedaddle from the exchanges “affects about 80 percent of its customers covered through insurance marketplaces,” the Washington Post’s Carolyn Johnson and Juliet Eilperin reported.