Tom and David Kelley of the award-winning Palo Alto-based global design firm IDEO have been helping private and public sector organizations innovate, grow and bring to market new ideas for 35 years; projects include Apple’s first computer mouse and a stand-up toothpaste dispenser for Procter & Gamble. In the Kelleys’ new book, Creative Confidence: Unleashing the Creative Potential Within Us All, the brothers recount anecdotes from their work at IDEO and at Stanford’s d.school (the institute of design created by David Kelley), and offer tips to help everyone build creative muscle in an era when success depends on innovation in every field. Here at the Eye, the authors share an excerpt from the book that examines why businesses should use empathy when designing for customers.

In organizations with millions of customers, or in industries serving the broad public, there is a temptation to stereotype or depersonalize customers. They become numbers, transactions, data points on a bell curve, or parts of a composite character built on market segmentation data. That type of shortcut might seem useful for understanding the data, but we’ve found that it doesn’t work well when designing for real people.

The notion of empathy and human-centeredness is still not widely practiced in many corporations. Business people rarely navigate their own websites or watch how people use their products in a real-world setting. And if you do a word association with “business person,” the word “empathy” doesn’t come up much.

What do we mean by empathy in terms of creativity and innovation? For us, it’s the ability to see an experience through another person’s eyes, to recognize why people do what they do. It’s when you go into the field and watch people interact with products and services in real time—what we sometimes refer to as “design research.” Gaining empathy can take some time and resourcefulness. But there is nothing like observing the person you’re creating something for to spark new insights. And when you specifically set out to empathize with your end user, you get your own ego out of the way. We’ve found that figuring out what other people actually need is what leads to the most significant innovations. In other words, empathy is a gateway to better and sometimes surprising insights that can help distinguish your idea or approach.

You can use this kind of anthropological research in the field to gather inspiration at the beginning of a project, to validate concepts and prototypes generated throughout the design process, and to rekindle momentum when ideas or energy are running low. At IDEO and the d.school, we like to observe people in their homes or where they work or play. We watch them interact with products and services. Sometimes we interview them to better understand their thoughts and feelings. This kind of hands-on research can even change your understanding of who the end user is, as it did for the Embrace team when they changed their approach from designing infant baby warmers for hospitals and clinics to designing for rural mothers in their villages.

At IDEO, we hire design researchers with social science backgrounds and advanced degrees in fields like cognitive psychology, anthropology, or linguistics, people who are sophisticated at gathering and synthesizing insights from interviews and observations. But you don’t need an advanced degree to get out into the field. Usually every team member on a project at IDEO or the d.school takes part in such fieldwork, because the final concept benefits as a result. Cultural anthropologist Grant McCracken says, “Anthropology is too important to be left to the anthropologists.” Everyone can improve their empathy skills with a little practice. You may find you’ll get some of your best ideas by doing so.

Many organizations or teams use benchmarking when they want to innovate. They check out what their competitors are doing and pick what they consider “best practices.” In other words, without questioning current ways of doing things or seeking new insights, they copy and paste. In 2007, when PNC Financial Services was striving to appeal to younger customers, it could have just followed the competition, hiked up interest rates on its checking accounts by half a percent and promoted them with a marketing campaign. Instead, it created a new kind of account for young people, attracting fourteen thousand new customers in the first two months. PNC’s story starts not with benchmarking but with seeking to understand the customers it wanted to attract and then committing to improving its relationship with them.

PNC provides retail banking, corporate and institutional banking, and asset management services to more than six million people across the United States. It was looking to reach a new demographic, “Generation Y,” the first generation of digital natives, roughly ranging from college age to their mid-thirties. When the team at PNC started getting to know GenYers through interviews, it became clear that while tech savvy and adept at weaving technology seamlessly into their lives, they are far from literate when it comes to banking and managing their finances. Even people who were making more than enough to live comfortably were often overdrawn on their account because they would pay bills before their paycheck went through. And they admitted that they needed help.

The team realized that GenY would benefit from tools to better manage their money. With greater control over their assets, customers could save more and not overspend, avoiding overdraft charges. As Mark Jones, the service designer on the project, describes it, “For the person living hand to mouth, struggling with money management, the key is to let things be more visible, let them get access, let them tweak back and forth between accounts very easily.”

Bank customers love the idea of avoiding overdraft fees. But it takes courage for a bank to create such products because over-draft fees are a highly profitable part of the industry. At the time, banks were collecting over $30 billion a year in overdraft income, and young adults are especially prone to incurring those fees. But PNC decided to build better long-term customer relationships by supporting healthier financial behavior.

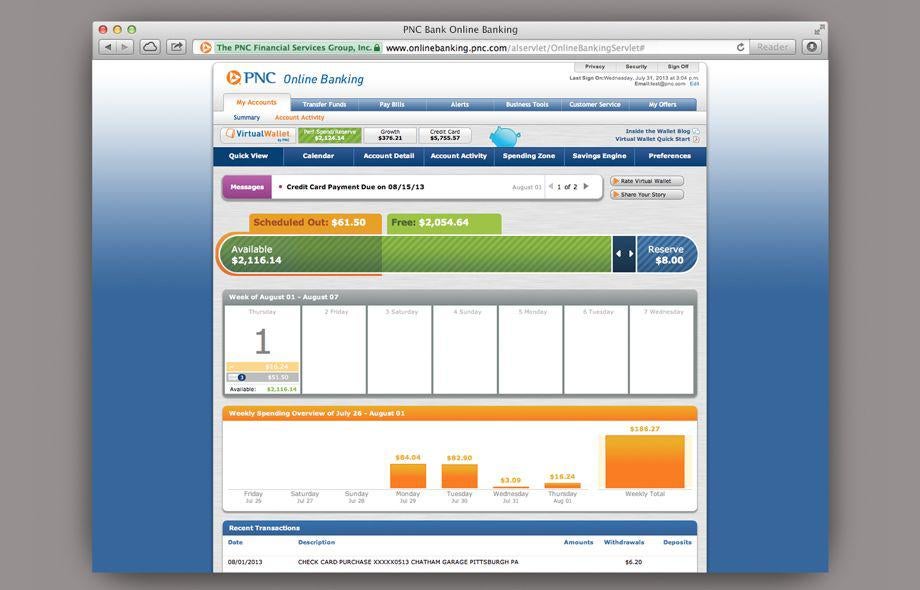

Image courtesy PNC

The PNC Virtual Wallet is a family of banking products that provides customers with digital access to their finances and enables them to have better control of their money. Instead of a ledger, a calendar view helps customers visualize their balance, with estimated future cash flow based on when they get paid and when they pay bills. The view highlights Danger Days, when customers might overdraw their account, so they can reschedule bill payments, promoting better planning. A money slide bar graphically indicates and controls fund allocation between Spend, Reserve, and Growth. With the Savings Engine, customers can set their own rules, such as automatically transferring money to savings when they receive a paycheck.

The new direction has paid off with greater deposit growth, making up for whatever revenue may have been lost from bounced check and overdraft fees. One customer described his experience, saying, “I’m just out of college and have a lot more things going in and out than I can keep track of. With Virtual Wallet, I was able to save some, pay all my bills, and know exactly where all my cash went. I have never felt more in control of my money in my life.”

Virtual Wallet was a departure from “business as usual” for PNC. But the confidence to go in this direction came from its customers. By getting to know GenY and understanding their needs, PNC gained faith in the long-term success of the product.

When we bring corporate executives to observe, meet with, and even talk to customers, the experience makes a lasting impression. “Rather than developing and then testing, we now begin projects with customers, to incorporate their thinking earlier and more effectively,” says Frederick Leichter, the chief customer experience officer at Fidelity Investments.

Does empathy research conflict with the trend toward “big data”? It’s true that there has historically been a split between quantitative market research and qualitative researchers or ethnographers. But is it necessary to disconnect the human stories from the data? Design researchers have recently begun bridging the gulf with what we call “hybrid insights.” It’s an approach that integrates quantitative research into human-centered design. Hybrid insights allow us to embed stories in the data, bringing the data to life. It brings the “why” and the “what” together. Hybrid insights can include designing a survey in a human-centered way (for example, by being more thoughtful about how we ask questions and keep people engaged). Or it can mean more rigorous concept evaluation where we test prototypes with a large number of users to see if a certain direction merits more exploration.

Coupling insights based on empathy with analytic confidence within relevant target markets may be a way to take the best of both research approaches. So while we’re sure the big data trend will continue to grow, decision makers should be careful not to forget about the underlying human element.

Reprinted from the book Creative Confidence: Unleashing the Creative Potential Within Us All by Tom Kelley and David Kelley. Copyright 2013 by David Kelley and Tom Kelley. Published by Crown Business, an imprint of the Crown Publishing Group, a division of Random House LLC, a Penguin Random House Company.

Photo by Magnolia Photo Booth Co.