The crisis of college affordability is in the air. The agony of the 2017 college admissions cycle just came to an end; many students and families just spent a harrowing weekend figuring out how they will afford the bills. And New York State’s recently passed Excelsior Scholarship, which provides free in-state tuition at public universities to those with family incomes under $125,000, has received considerable attention and criticism. It’s an imperfect plan because it doesn’t help students with costs beyond tuition—but what would a perfect plan to reduce the cost of college even look like? Good models are out there that can help—with a little work.

I’ll start out with a simple premise—those with very low incomes should pay low amounts, those with high incomes should pay more, and those in between should pay according to their greater ability to pay. It seems reasonable to me that all pricing systems should be held to that standard. It’s called equity. Yet this simple premise isn’t always satisfied.

Let’s start with the University of Virginia. UVA is said to “meet full need” of its students. For Virginia residents, the school lists a price of $30,000 including room and board to attend, but discounts that amount based on its determination of the amount a student’s family can “afford,” which comes from a formula created by the College Board. The school’s approach is consistent with this standard (recognizing that calculating how much a family can afford is not an exact science). Other public institutions, like the University of North Carolina, the University of Michigan, and the College of William and Mary, use a similar approach.

In contrast to UVA, Ohio State University lists a price of $26,000. It does not meet full need. Instead, it has a series of ad-hoc programs that offer set dollar amounts to students based on their financial situation (and SAT Scores, in some cases). They do not abide by a determination of what a family can afford. Most public universities use similar systems; it is inconsistent with the standard I laid out.

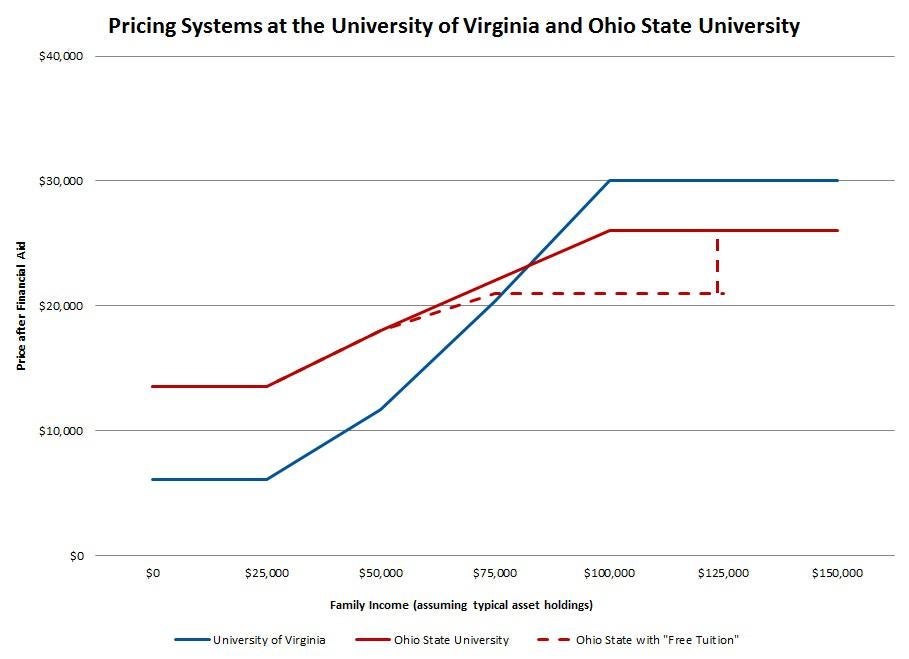

To demonstrate the difference, look at this chart showing the relationship between price and family income at the two schools. For these calculations, I used Ohio State’s net price calculator, making several plausible assumptions along the way (family of four, married parents, one child in college, federal income taxes paid equal to the average of those at that income level, SAT score of 1300, and so on.) It was not a simple process. For UVA, I used MyinTuition, a simple cost calculator I created for it and 14 other schools. MyinTuition is designed to simply estimate college costs after factoring in financial aid, based on family income, home value, mortgage balance, cash in the bank, and retirement, and nonretirement savings. It is based on the principle that greater price transparency is a virtue in and of itself—and may point the way toward a better system of communicating to students the availability of financial aid and whether they can afford college.

Phillip B. Levine

At UVA, families with incomes of $25,000 are expected to come up with around $6,100. Of this amount, the student is expected to earn $1,600 from a summer job and take out a loan of $4,500—the parents aren’t expected to pay anything. The same student at Ohio State is expected to pay more than twice this amount: $13,500. That family would need to come up with an additional $7,400, a very difficult hurdle for them.

As incomes rise, costs rise at both institutions, albeit somewhat more steeply at UVA and to a higher level. But students at UVA continue to pay less than at Ohio State until around $75,000 in family income. At both institutions, families don’t have to pay maximum tuition until they are earning $100,000. And on that score, it is useful to recognize that the maximum tuition at both institutions is far below what states spend on educating, housing, and feeding their students. That amount surpasses $50,000 at these two schools. Even at full price, students are receiving a sizable subsidy.

One critical difference between UVA’s policy of meeting full need and Ohio State’s hodge-podge of grants is the impact of tuition increases. To be extreme, suppose both states increased their list prices by $10,000. Everyone in Ohio would have to pay that increase—the entire line would simply shift up by that amount. In Virginia, only those with incomes above $125,000 would pay the full amount—the upward sloping portion of the line would simply extend to the right.

This chart also shows the impact that free tuition would have in Ohio if it adopted a policy like the Excelsior Plan. Lower-income households would not be helped at all. Mainly those between $75,000 and $125,000 would be helped. That certainly violates principles of equity.

There are downsides to Virginia’s approach, mostly associated with communicating the school’s pricing strategy. The process of applying for financial aid and of forecasting an aid award is a nightmare. If students don’t know what college is going to cost, how can they incorporate it effectively into their decision-making? The work that is left to be done should focus on addressing these problems—simplifying the financial aid system and helping students do a better job of anticipating the true cost of attendance. Clarifying college costs through simple-to-use tools is a first step in that direction, but more work needs to be done.

The free tuition movement signals that there is at least some public support for devoting greater resources towards lowering the cost of college. Those resources would be better spent on a pricing policy that adopts basic principles of equity, instead of a flawed approach that focuses only on tuition. Meeting the full demonstrated need of students needing financial aid would provide more help to those who need it the most.