Another day, another win for the globalist cucks.

In a remarkable interview with the Wall Street Journal published Wednesday, Donald Trump said that his administration would not label China a currency manipulator, reversing a central campaign promise he repeated for months. The president also told the newspaper that he was open to leaving Janet Yellen in place as Federal Reserve chair and that he thought the dollar was already getting too strong.

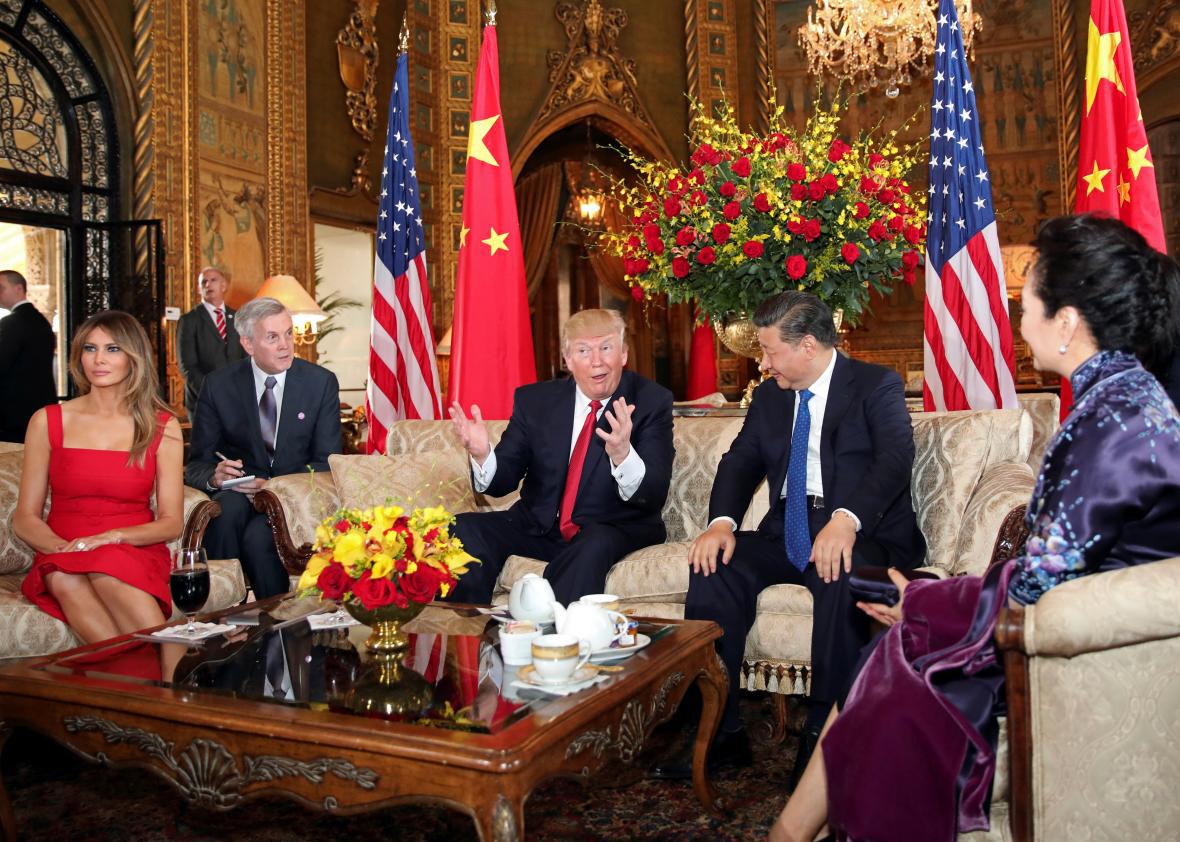

The turnabout on China appears to be a big victory for the White House’s ascendant axis of moderate Goldman Sachs alums, including National Economic Council Director Gary Cohn and Treasury Secretary Steve Mnuchin, over Steve Bannon’s band of unhinged white nationalists. But that’s not really the jaw-dropping thing about this interview. No, the real shocker here is that Trump’s comments are all coherent and more or less factually sound.

During his presidential run, Trump regularly accused the People’s Republic of artificially driving down the yuan’s value to drive exports and vowed to label the country a currency manipulator on his first day in office. While he retreated from that promise before Inauguration Day, Trump was still referring to Chinese leaders as the “grand champions” of currency manipulation as recently as February.

So, what happened? Here’s the Journal:

Mr. Trump said the reason he has changed his mind on one of his signature campaign promises is that China hasn’t been manipulating its currency for months and because taking the step now could jeopardize his talks with Beijing on confronting the threat of North Korea.

“They’re not currency manipulators,” Mr. Trump said.

It’s pretty hard to argue with that. Far from devaluing its currency, China has actually spent more than $1 trillion of its vaunted foreign reserves over the past couple of years trying to prop up the value of the yuan as investors have funneled money overseas. There are some on the left, like economist Dean Baker, who will argue that Beijing is still effectively suppressing the redback’s value by refusing to unwind its dollar reserves more quickly. But if China were really keeping its currency severely underpriced, you’d expect it to still have a big current account surplus reminiscent of 10 years ago, which it doesn’t anymore.

While the flip flop may seem sudden to some, the Trump administration has actually been evolving toward a less confrontational position on China’s currency for a while. In February, the Journal reported that the White House’s National Trade Council was considering a plan designed to deal with currency manipulation more generally while not singling out Beijing. This seems like the next logical evolution toward that goal.

That’s why, in some ways, Trump’s comments about Yellen were the most surprising part of his interview. Trump has praised her performance in the past. But last May he said he would still likely replace her because she wasn’t a Republican. He eventually accused her of keeping interest rates low to help President Obama politically, adding that she “should be ashamed of herself.”

Now, Trump’s changed his tune, apparently because he realizes the value of having a relatively dovish Fed chair who won’t hike interest rates too quickly.

“I do like a low-interest rate policy, I must be honest with you,” Mr. Trump said at the White House, when asked about Ms. Yellen.

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting—that will hurt ultimately,” he added. “Look, there’s some very good things about a strong dollar, but usually speaking the best thing about it is that it sounds good.”

He continued, “It’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency.”

Again, this is all perfectly rational and pretty much true. A strong dollar does make it hard to compete in trade. Rising interest rates do tend to make the dollar stronger, because they increase the demand for U.S. investments like Treasury bonds. And while he’s a little braggy here, the conventional wisdom is that Trump’s win did lead the dollar and interest rates to rise a bit, in part because investors expected him to go on tax cut and infrastructure binge that would lead to some inflation.

Beyond all that, it’s very much in Trump’s interest to have a Fed chair who, like Yellen, is willing to let inflation overshoot the central bank’s 2 percent target at least just a little bit. And he clearly gets that.

Asked if Ms. Yellen was “toast” when her term ends in 2018, Mr. Trump said, “No, not toast.”

“I like her, I respect her,” Mr. Trump said, noting that the two have sat and talked in the Oval Office. “It’s very early.”

Yellen has been a basically solid Fed chair thus far, and many people would be happy for Trump to keep her in place. But I think that we should all be encouraged that Trump has a clear idea of what’s in his own best interest here. It seems like calmer minds are winning out on subjects like monetary policy. (That said, Trump’s musings about the dollar being too strong did seem to spook the markets; it quickly dropped after the interview was published.)

Meanwhile, let us enjoy the grand irony that two Jewish finance guys from Goldman, and possibly Jared Kushner, are now clearly running economic policy for an administration that rose to power with the support of a white nationalist backlash movement whose mascot was an anti-Semitic frog. Hopefully, Trump doesn’t get too irritated by tweets like this.