President-elect Donald Trump has appointed Carl Icahn, an old-fashioned stock operator, to be his part-time regulatory scourge. According to the Wall Street Journal, Icahn, an activist investor, asset manager, and occasional stand-up comedian, won’t take a government post. But Icahn will be a “special adviser to the president on overhauling federal regulations,” the Journal reports.

This would be a great idea if Carl Icahn actually had a wise view of regulations and their impact on the American economy—and if he had a broad-minded sense of the public interest. But he doesn’t. Like pretty much all the other businessmen Trump has surrounded himself with, Icahn hasn’t spent much time articulating a sense of what public goods are. Indeed, he typically views regulations through the lens of his portfolio of stocks and companies. And his concern is less for the investing public than for himself.

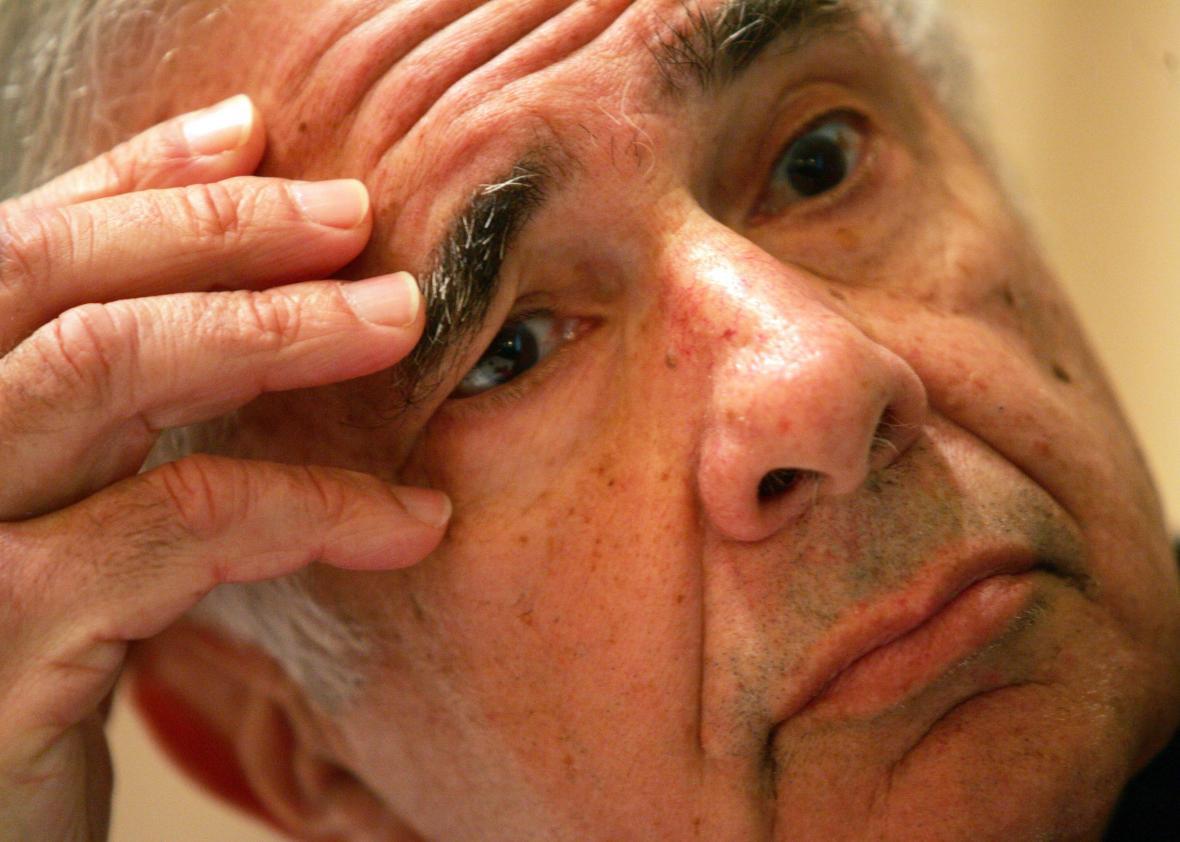

Icahn is both an extremely smart guy and an extremely shrewd one. He has learned to play the markets, the American system of corporate governance, and the financial media like so many fiddles. He has been one of the more enduring figures on Wall Street—he’s 80 and at the peak of his influence—and has shown an ability to reinvent himself. (He also endowed the cool track facility, Icahn Stadium, on New York’s Randall’s Island.)

Icahn emerged as an activist investor in the 1970s, acquiring small stakes in publicly traded investment vehicles and companies that were underperforming and then pushing the boards and chief executive officers to change personnel, give him a few seats on the board, change practices, or sell units. (Here’s a good brief history on Icahn’s early years from Investment News) And if they didn’t want to do any of that, management could simply buy back the shares he had bought at a higher price to make him go away—a practice that became known as greenmail.

In the 21st century, Icahn has transformed himself into a fund manager and a folksy, self-deprecating menace to entrenched management and boards. With the timing of a comedian, he delivers speeches at conferences in which he makes fun of the many foibles of the arrogant CEOs and clueless boards he’s encountered over the years.

Icahn relishes getting into public spats with other investors. When hypomanic hedge fund manager Bill Ackman waged a highly public short-sale campaign against nutritional supplement maker Herbalife, Icahn publicly took a long position on the company and proceeded to browbeat Ackman in a CNBC interview. (Icahn’s involvement in the imbroglio prompted hedge fund manager Dan Loeb famously to post: “New HLF product: The Herbalife Enema, administered by Uncle Carl.”)

But Uncle Carl doesn’t just talk. He does. Through his public vehicle, Icahn Enterprises, he has bought outright control of, or large positions in, several companies. These include the auto parts store Pep Boys, CVR Refining, American Railcar Leasing (which he just sold), and the gambling company Tropicana Entertainment. In 2014, Icahn Enterprises gained control of the bankrupt Trump Entertainment Resorts, which owns the ill-fated Trump Taj Mahal casino in Atlantic City. It was shut down in October.

Here’s the thing. Icahn is a very good businessman. But his interest in good governance and in regulation is purely situational. When he gets involved with a company as an activist shareholder, he typically doesn’t have deep thoughts on how they can improve their businesses for the long term. After he acquired a small stake in Apple in 2013, his big idea for how one of the most successful and innovative companies of the past century could increase shareholder returns was … to borrow money and buy back shares. And once he sells his stake, like any money manager, he loses interest in the company.

Icahn’s interest in regulations is similarly situational. He shows no evidence of having thought through the issues of how professional licensing impacts lower-income workers, or how cost-benefit analysis can or should apply to the promulgation of new regulations, or how mechanisms like cap and trade could work. Rather, he has complained about how Environmental Protection Agency regulations on the use of ethanol and biofuels are cutting profits at his refining business. Oh, and he is for keeping Dodd-Frank.

As for the public at large, Icahn has offered them the ability to benefit from his financial acumen. Individuals can buy shares of publicly traded Icahn Enterprises. Over the past three years, the stock of Icahn Enterprises has massively underperformed the S&P 500.