Heading into this week’s election, it seemed fairly clear that investors were dead terrified by the idea of President Donald J. Trump. When his chances of winning rose, stock prices fell. When his chances of winning fell, stock prices rose. On Tuesday night, as it became clear that the man might actually pull off an unexpected victory, markets convulsed—Dow Jones futures fell hundreds of points. It looked like panic on Wall Street.

But then things settled down, and on Wednesday the markets began to rise. The S&P 500 is actually up more than a percentage point since the vote. So why are investors seemingly learning to love—or at least make peace with—our president-elect?

A standard disclaimer: Trying to derive meaning from price movements in markets is often useless guess work. With that said, I think the pattern we’ve watched unfold reflects two basic facts. First, investors generally hate uncertainty. When you’re betting many millions or billions of dollars based on complicated projections about the future, it’s frightening when your assumptions are suddenly upended. Most people presumed Clinton would win. Moreover, Trump is a temperamentally erratic question mark who many are worried might land us in trade war or worse. Fairly or not, analysts have suggested that the man’s plans could land the U.S. (and maybe the world) in a deep recession.

I think that’s why, until Tuesday, the markets seemed to be rooting for Clinton. But now, a second reality appears to have set in: Trump’s policy agenda, insofar as he has one, is going to be a bacchanal for corporate America, particularly industries that fared poorly during the Obama administration. The president-elect wants to pass massive corporate tax cuts. That means more profits to shower on shareholders. He wants to nix Obamacare’s surtax on capital gains. That means investors get to keep more of their returns. These are wonderful developments for Americans lucky enough to have significant equities portfolios, even if it’s not for the poor and working class families who will likely see safety-net programs slashed to (partially) pay for these cuts.

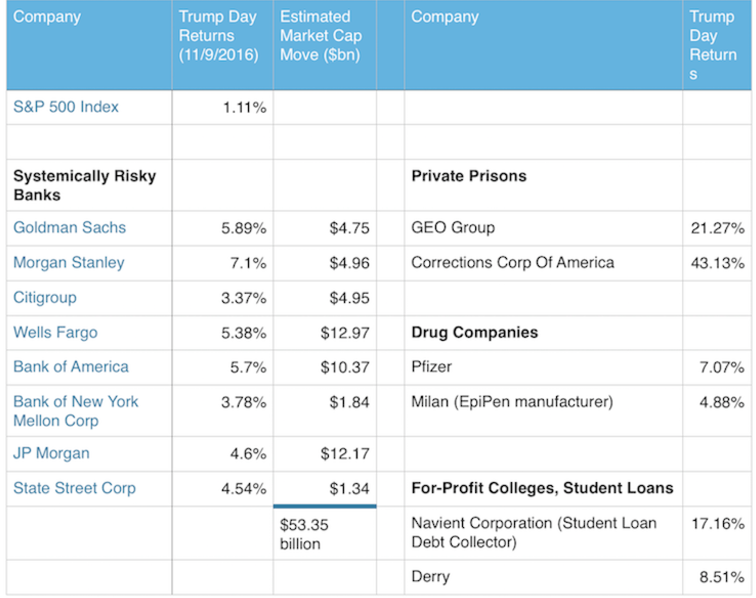

Some industries will benefit more than others, of course. Trump wants to unleash fossil fuels and finance by rolling back Obama’s clean power plan and Dodd-Frank, among other deregulatory moves. He will also in all likelihood end the Department of Education’s quiet (and just) war on for-profit colleges. And as the Roosevelt Institute’s Mike Konczal shows in this very helpful chart, companies in some of those sectors have been doing exceptionally well over the past couple days.* The biggest banks alone have added more than $53 billion to their market cap. Industries favored by liberals, like green energy, may not be doing so swimmingly. (Tesla’s stock dropped sharply Wednesday, for instance.) But it seems the profit opportunities for corporate America outweigh the perils as far as the markets are concerned.

Roosevelt Institute

So, if you want to be detailed about it, you could say markets have decided that we’re more likely to see soaring corporate earnings thanks to tax cuts and deregulation than we are an economically disastrous trade battle with China, especially given Trump’s tendency toward rhetorical bluster. The more simple version: It may be the end of the world as we know it, but investors have every reason to feel fine.

*Correction, Nov. 10, 2016: This post originally misspelled Mike Konczal’s last name.