One of the worst aspects of Donald Trump’s generally reprehensible tax plan is that, as currently written, it would end up raising taxes on many families with children, particularly single parents. This is because the proposal tries to streamline the tax code partly by eliminating some of the important tools, such as personal exemptions, that these households use to minimize their IRS bills. Pretty much everybody I know who thinks about taxes for a living and has looked at Trump’s published outline agrees on this. It’s not in serious dispute.

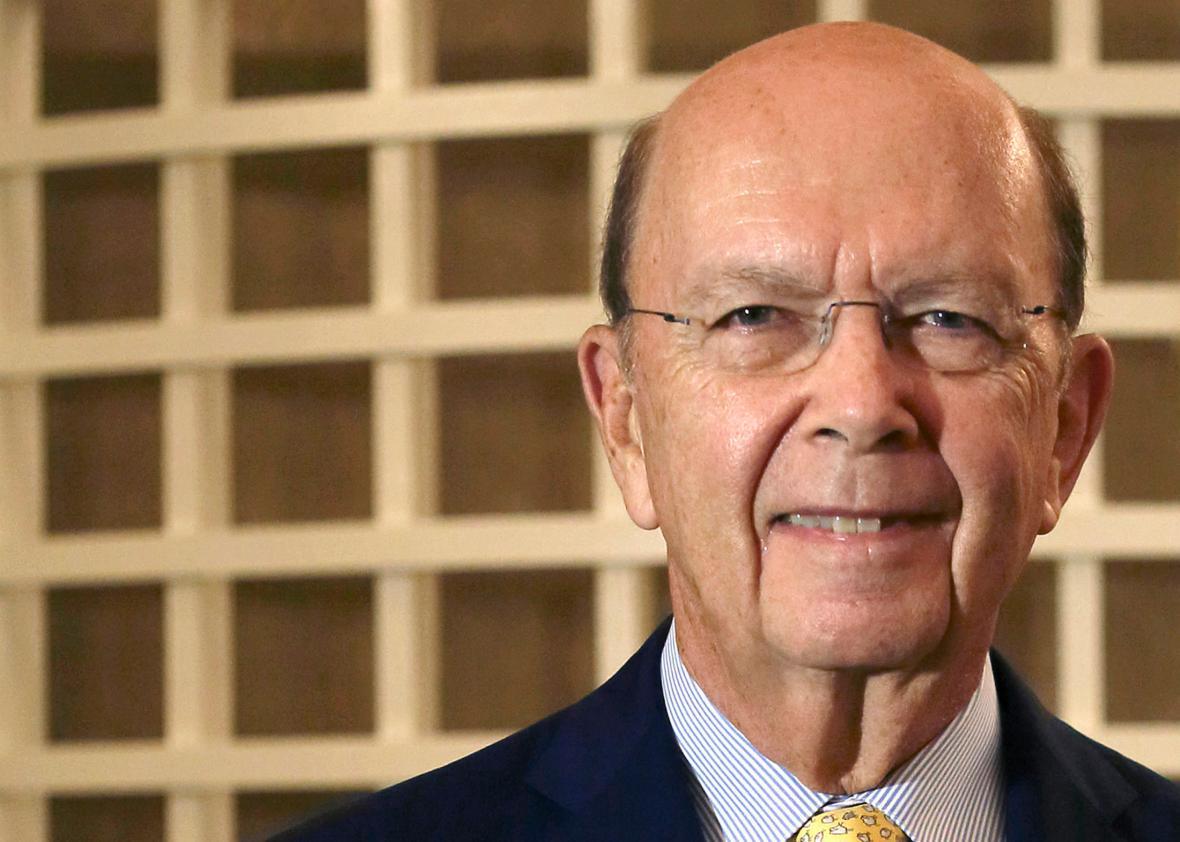

On Thursday, two of Trump’s top advisers, University of California–Irvine economist Peter Navarro and billionaire financier Wilbur Ross, appeared at Washington’s Tax Policy Center to defend the merits of Trump-onomics. Early on, Ross suggested that parts of the candidate’s tax plan had been “misunderstood,” and that the legislation would be drafted to fix “any anomalies in the proposal that could cost some taxpayers more under Trump than at present. The intent clearly is that no tax payer, other than those with carried interest, will be disadvantaged.”

This prompted a question from New York University law professor and former Obama adviser Lily Batchelder: If Trump’s people knew his plan would hurt some families, why were they waiting for Congress to fix it, instead of addressing the problems now? The response, from Ross, was pretty stunning. He proceeded to explain that, actually, Trump’s current plan would not raise taxes on many parents. He then explained that a married couple earning $50,000 per year who employed a nanny would shave more than a third off their taxes. By “anomolies,” he had just meant truly unusual fringe cases.

To repeat: Ross’ defense to the charge that Trump would raise taxes on single parents is that married couple who miraculously employ a nanny while earning just $50,000 per year will be held harmless.

In case you think I’m misconstruing anything, here’s the clip and full exchange. The most charming part might be where Ross—net worth $2.9 billion, according to Forbes—refers to middle-class families as “little people.” It brings to mind Leona Helmsley’s old adage: “Only the little people pay taxes.”

Batchelder: I was interested in your suggestion that Congress should fix the problems with Mr. Trump’s tax plan in terms of raising taxes on people with kids, both married couples and especially single parents.

Ross: That’s not what I said and that’s not what his tax plan does.

[Cross talk]

Batchelder: I was curious why what seemed fairly obvious—that this plan would raise taxes on a number of people with kids, why this wasn’t something you considered in advance and why you hadn’t quickly corrected that, instead of saying that Congress will correct it.

Wilbur Ross: First of all, you’re incorrect that it raises taxes on the little people. For a married couple, with two children and a nanny, earning $50,000 a year, there’s around a 36 percent decrease in their total taxes. With that same family, with a nanny, earning $75,000, there’s also a 30 plus percent decrease. For a married family, two children, and a nanny, earning $5 million a year, there’s a 3 percent decrease. There is no hardship on the people in the lower brackets. Your numbers are simply not correct. What I was referring to was undoubtedly there’s some person, at the margin, somewhere, who under some convoluted circumstance could be disadvantaged. That’s what we’ll be asking Congress to deal with.*

Is it possible that Ross has some semblance of a point? Are there millions of middle-income parents with nannies on their payroll who might benefit from Trump’s deductions? Just to make sure my snark was justified, I went and checked out the U.S. Census’ most recent data on family child care arrangements. As of 2011, there were 3.36 million American families with a working mother that earned between $3,000 and $4,499 a month, or up to about $53,000 per year. Less than one-third, or 945,000 of them, paid for any child care at all, much less a nanny. (Check out Table 5, if you’re extra curious). It’s a similar story for working mothers of all incomes who never married—about 32 percent, or 1.14 million, paid for any child care at all.

Now, if we want to be generous, it’s possible Ross thinks that Trump’s tax breaks will let working moms upgrade their child care situation to something a bit more luxe. The problem, as always, is that Trump’s tax breaks aren’t worth nearly enough to pay the entire cost of such an expense. So unless you’re an edge case for whom the deductions can make the marginal difference between being able to send your child to a day care center or not, chances are you won’t be taking much advantage of them.

The more important point here, though, is that Trump’s economic advisers are the sort of people who assume married couples making $50,000 a year are regularly in the habit of hiring nannies. This is his brain trust.

*Correction, Oct. 14, 2016: Due to a transcription error, this story misquoted Lily Batchelder as saying, “I was interested in your suggestion that Trump should fix the problems with Mr. Trump’s tax plan.” The correct quote was, “I was interested in your suggestion that Congress should fix the problems with Mr. Trump’s tax plan.”