It looks like the feds have some serious questions for Wells Fargo and its CEO, John Stumpf. The Wall Street Journal reports that federal prosecutors for the U.S. Attorney’s Offices in the Southern District of New York and the Northern District of California have opened an inquiry into whether the bank’s fraudulent sales practices meet the standard for a criminal or civil case.

The Wells Fargo scandal re-entered the news last week, when the Consumer Financial Protection Bureau, the Office of the Comptroller of the Currency, and the Los Angeles City Attorney levied $185 million in fines on the bank. The $100 million that will go to the CFPB is the largest fine the agency has collected in its five-year existence.

Legal authorities are now reportedly trying to determine whether bank employees were following the direction of more senior management when they opened more than 1 million bank accounts and several hundred thousand credit cards without permission of customers. They’re also attempting to determine whether high-level executives deliberately looked the other way so the fraudulent activity could continue.

From what we know, these seem like reasonable suppositions—certainly ones warranting further investigation. Wells Fargo senior executives had to know something wasn’t right at their bank long before last week. Now-retired Los Angeles Times reporter E. Scott Reckard first wrote about the strange goings-on at Wells Fargo in 2013. He reported on numerous bank employees and managers who claimed that unrealistic sales goals set by higher-ups led many of their colleagues to engage in shady behavior, signing people up for bank accounts and credit cards without their knowledge. “Anyone falling short after two months would be fired,” Reckard reported.

On the off chance that Wells Fargo executives missed out on Reckard’s investigation, they certainly found out about the misbehavior when the Los Angeles City Attorney’s Office filed a civil suit against its bank in May of 2015, saying unrealistic sales goals pressured workers into “unfair, unlawful and fraudulent conduct.” In fact, bank officials would ultimately decide to study the period between May of 2011 and July of 2015 to determine just how much fraud their employees engaged in.

Moreover, it also defies reason to believe that thousands of bank employees over a period of years, working in different regions of the United States, on their own initiative, could independently decide to engage in the same illegal behavior, without even a halfway-competent CEO wondering if this was indicative of a bigger problem at some point before the authorities began banging on his door.

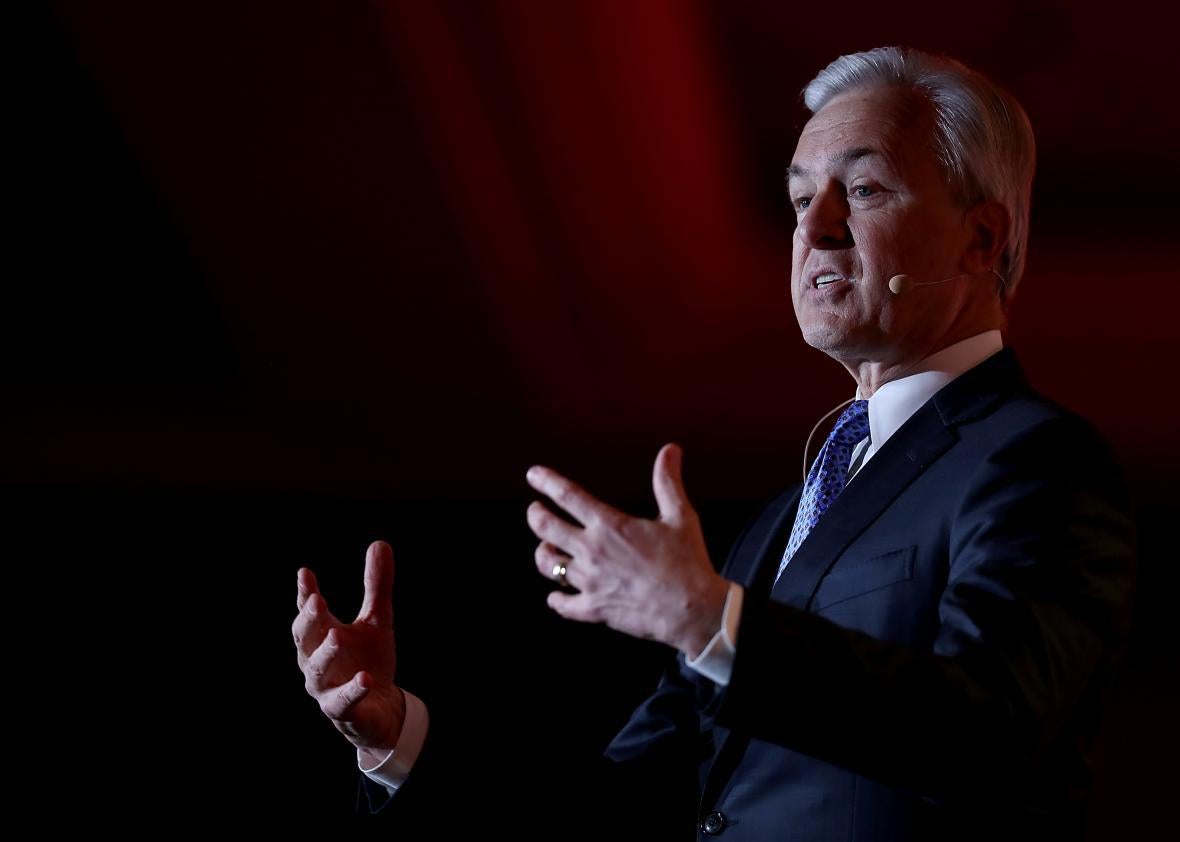

Yet, amazingly, this is what Wells Fargo executives would like the public to believe. In an interview Tuesday with the Wall Street Journal, CEO Stumpf placed the blame for the epic and widespread consumer fraud on rogue employees. The 5,300 workers the bank fired as a result of the scandal didn’t “put customers first,” or “honor our vision and values,” Stumpf hmphed.

Actually, given the extent of the fraud, it seems likely the now-axed workers understood Wells Fargo’s values all too well. Here’s hoping someone asks Stumpf about this next week. That’s when he’s scheduled to testify before the Senate Banking Committee on the matter. Among his expected interrogators? Longtime banking industry nemesis Sen. Elizabeth Warren. Get ready for fireworks.