Don’t worry, financial advice fans. The Obama administration isn’t coming after Dave Ramsey, Suze Orman, Jim Cramer, or any other personal finance gurus.

That’s the impression you might have if you read this Forbes blog post from last Friday, which has notched nearly half a million views. In it, John Berlau argues that a Department of Labor proposal, which would tighten up rules on how financial advisers guide clients shopping for retirement plans, could also “muzzle” the financial entertainment complex, preventing TV and radio personalities from offering specific advice to callers on their popular programs. That, the post warns, could lead to a “potential chilling effect” on “free financial discussion in the media.”

No, it couldn’t. The Obama administration’s push to expand the so-called fiduciary standard to cover individual retirement accounts—I’ll explain what that means in a minute—won’t cast a pall over the cable networks and the radio dial. It won’t limit how anyone in the press talks about personal finance. “Advice needs to be compensated for it to count” under the proposed rule, says Barbara Roper, director of investor protection at the Consumer Federation of America, and a longtime advocate for expanding the fiduciary standard. “There is no way this is a real issue.” No consumer pays financial advisers on television or the radio for their specific, on-the-air advice.

The background: When we seek financial advice, surveys say that the majority of us believe the person we hire is bound to give the best, most wonderful guidance out there—something known as the fiduciary standard. This isn’t always true. Many financial advisers work to something called the suitability standard, a lower standard of care that allows the adviser to give less-than-optimal advice that will also boost his or her bottom line. It’s considered OK, as long as it’s not out-and-out malfeasant.

The White House believes this sort of conflict of interest results in the financial services sector earning up to $17 billion annually at the expense of the people it’s supposed to help. That’s why it’s changing the regulations, at least as far as retirement accounts go. A final version of the change is expected to be released this spring.

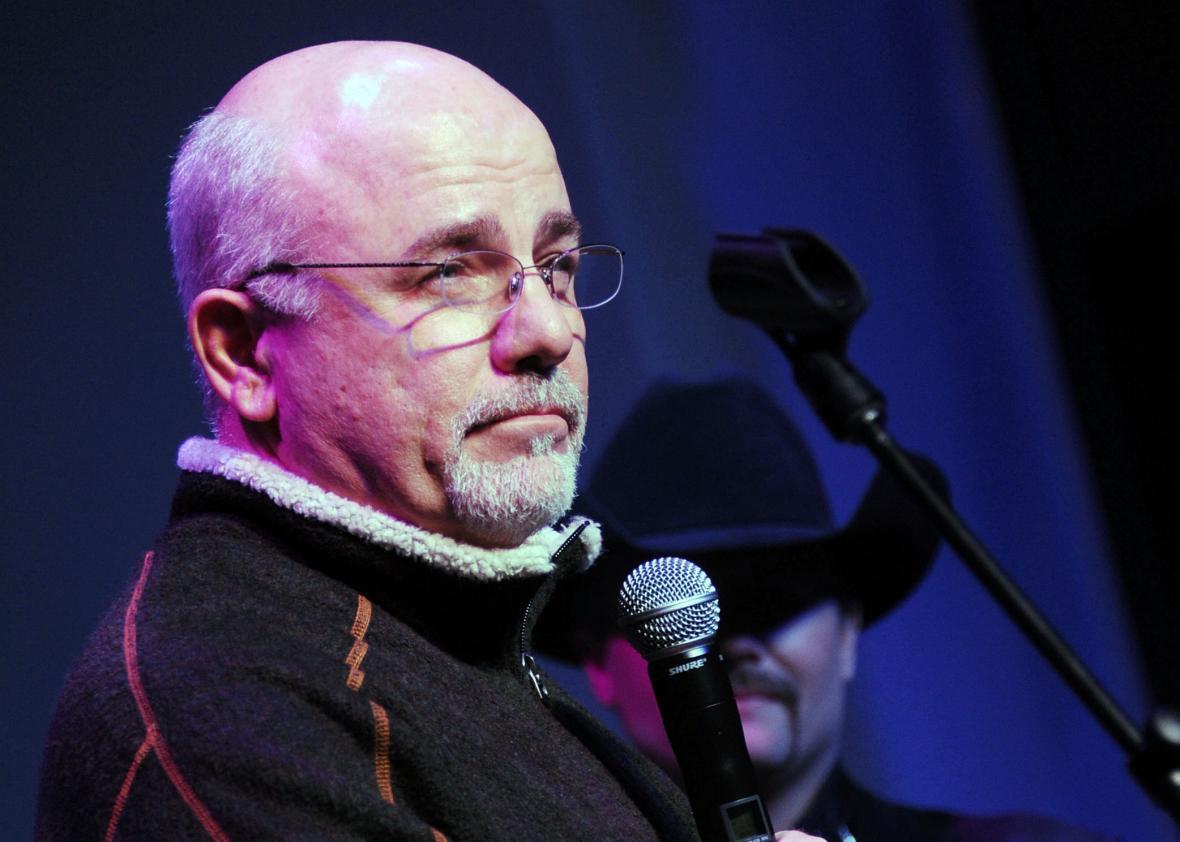

The financial services industry is pushing back furiously against the proposed change. That includes Ramsey, who runs a financial advisory network that works to the lower suitability standard—a service he talks up on his five-days-a-week radio program, which airs on more than 500 stations across the United States. Hence, Ramsey has been tweeting things like, “The Obama rule will kill the Middle Class and below ability to access personal advice.” This, as I’ve written in the past, is not true. What it will result in, according to the Center for Retirement Research at Boston College, is lower profits for companies that dole out financial advice.

Ramsey hasn’t tweeted about how expanding the fiduciary standard could affect his show, however—since it won’t. No reasonable person believes that if someone calls up a popular radio program, gives a one-minute summary of his financial woes, and then lets the host weigh in he is entering into a client-adviser relationship with the host. Those financial woes may be mundane or they may be ugly, but in this context they’re entertainment.

This should be blindingly obvious when it comes to someone like Jim Cramer, who shrieks out stock tips of dubious value night after night on CNBC. It’s true for Ramsey’s program, as well, where listeners call in with one-two punches of family and financial problems that wouldn’t sound out of place in country ballad. The advice that follows isn’t much more confidence-inspiring: Ramsey is infamous for discouraging almost anyone from declaring bankruptcy—despite the fact he declared bankruptcy himself—telling people they should live on “beans and rice” till they pay down their bills. He claims Social Security is a “debacle” that’s “ripping you off,” and he argues it’s quite reasonable to expect 12 percent average annual investment returns. As for Jim Cramer, let us all pause to remember the “Bear Stearns is fine” pronouncement he issued a week before the firm collapsed.

Now that I think about it, maybe there should be some sort of rule for television and radio financial-advice programs …