Hillary Clinton is running for president on an extremely progressive policy platform. This fact has been drowned out somewhat by Bernie Sanders’ calls for a social democratic revolution, not to mention the Trumpian drama that’s on the verge of shredding the Republican Party to bits. But it’s true: While the message hasn’t always come across very clearly, Clinton has campaigned on things like universal pre-K, guaranteed paid family leave, a significantly higher minimum wage, debt-free college tuition, and, to fund much of it, higher taxes on the wealthy.

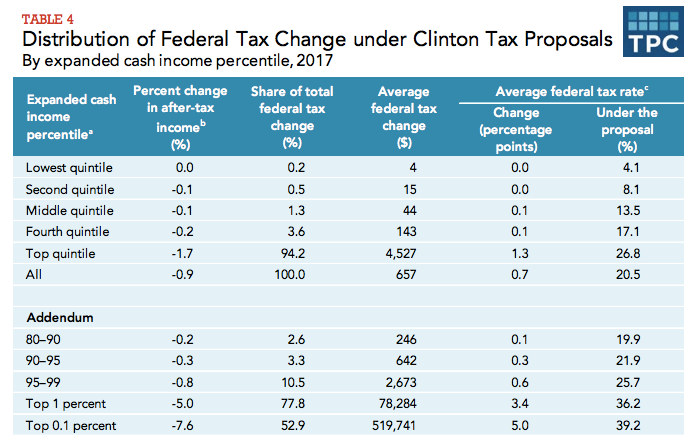

And that tax plan is very progressive. On Thursday, the nonpartisan Tax Policy Center released an analysis projecting that Clinton’s plans would haul in more than $1 trillion in extra federal taxes over their first decade. More than 77 percent of that money would come from the top 1 percent of taxpayers; more than 50 percent would come from the top 0.1 percent.1 That may not sound like soaking the rich to your typical Bernie voter, but keep this in mind: The expiration of the Bush tax cuts for top earners, which required a fierce political showdown back in 2012, was only projected to bring in about $624 billion over a decade. Hillary’s plan is far more ambitious by comparison.

Tax Policy Center

Her proposal also channels the idea that the super-rich ought to be treated differently than the merely affluent. As of now, the very top income tax bracket starts with single filers who make $415,000 a year, which, as I’ve written at length, is absurd. Clnton would slap an additional 4 percent “tax surcharge” on all incomes above $5 million, while also imposing the ever-popular Buffett Rule, which forces millionaires to pay an effective tax rate of at least 30 percent. She’d undo cuts to the estate tax, an underappreciated source of revenue that Republicans are determined to kill off, even though it only hits estates worth at least $5 million today. Clinton would apply it to estates worth more than $3 million. Less sexy to most liberals but more important from a revenue standpoint: She also wants to cap noncharitable deductions for families in higher tax brackets, which would make it much harder for them to reduce their obligations to the government.

This being a Clinton plan, there are lots of additional pieces in the puzzle—for instance, she would try to keep multinational corporations from using “earnings-stripping” to reduce their U.S. tax bills. She also has a wonky proposal to raise capital gains taxes by charging investors a higher or lower rate depending on how long they hold their stocks and bonds. It’s supposedly intended to encourage more patience among shareholders and less short-term corporate thinking. It might not be well-designed for that purpose, but it would at least raise some revenue.

And so on. Obviously, all of these proposals would be difficult to pass. The joke about Clinton branding herself as the pragmatic candidate vis-à-vis Sanders is that, as long as Republicans hold Congress, her ideas are as dead on arrival as her Democratic opponent’s, which is why I’m guessing that some will look at her plan to merely tax an extra $100 billion per year as a sign that she lacks ambition or imagination. On the other hand, should Democrats retake Capitol Hill in the next eight years, you can actually imagine these ideas (most of them, anyway) making it into law. And frankly, there was a time before a certain septuagenarian hit the scene where things like a new multimillionaire’s tax would have sounded like a Democratic dream. Now it’s just orthodoxy.

1 You may have noticed that, in the table, it looks like Clinton is raising taxes slightly on the lower-middle class. TPC explains: “These small tax increases primarily result from the business and corporate tax provisions, which we assume would translate into slightly lower wages and slightly lower returns to saving.”