Consider it a Christmas gift from Saudi Arabia: Monday morning, AAA reported that the average price of gasoline had fallen below $2 per gallon for the first time since March of 2009, when the U.S. was still smack-dab in the middle of the Great Recession. As the Wall Street Journal amusingly notes, this means fuel for your pickup truck is now cheaper than milk, a gallon of which would have set shoppers back an entire $3.30 last month.

Crashing gas prices are, of course, the result of crashing oil prices, which continued their downward slide for the year Monday as the cost of Brent crude, the global benchmark variety, dipped to an 11-year low. A barrel of oil now costs about $36. One month ago, it was more than $43. Back in January, when many well-paid analysts thought the price of crude was unlikely to drop much further—after all, it had already plummeted by more than half in 2014—Brent was selling for about $55 per barrel.

This is all largely Saudis Arabia’s doing, though Iraq, not to mention some surprisingly resilient drillers in the U.S. oil patch, are also part of the story.

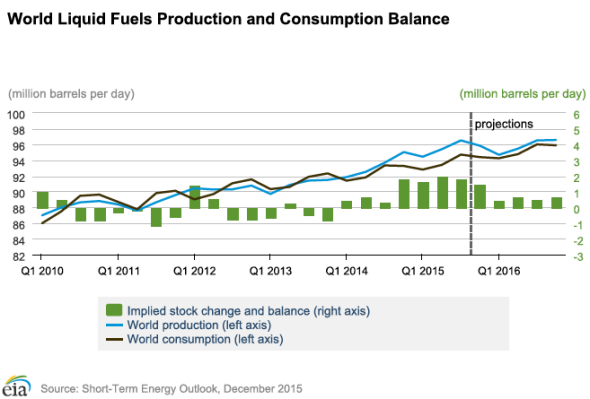

Oil prices began their descent in the summer of 2014 thanks to the combination of weak global growth and booming American oil production that left the world awash in more crude than it needed. The market then tumbled further late in the year, after Saudi Arabia surprised the world by refusing to cut back on its own drilling in order to reduce the global glut and support prices, as many had expected the country to. Instead, it launched a full-scale price war seemingly aimed at putting its competition—including U.S. frackers in Texas and North Dakota shale country—out of business.

This year, the kingdom doubled down on its strategy. Rather than keep production flat, it increased output from 9.64 million barrels per day in January to 10.34 million in August. And as the Saudis ramped up their pumping, so too did Iraq, which has been gradually rebuilding its own all-important oil industry. Its output rose by 750,000 barrels per day.

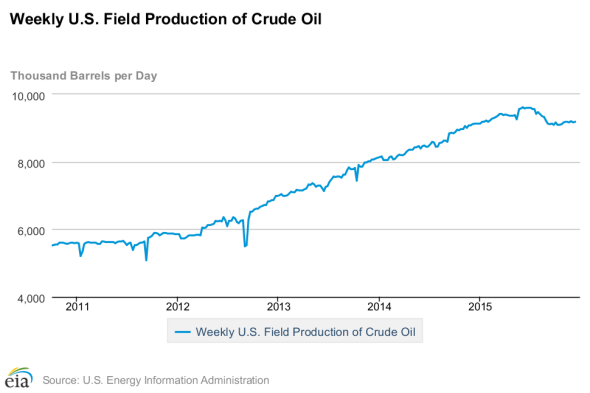

You might have expected the combination of rock-bottom prices and growing competition from the Middle East to push down U.S. production, since below a certain point pumping does become unprofitable. But, in fact, American output barely budged—after rising in the first half of the year, crude output has fallen from a peak of 9.6 million barrels per day to about 9.17 million according to the U.S. Energy Information Administration’s most recent weekly estimates, still slightly higher than at the start of the year.

In short, there’s more oil coming out of the ground now than when the Saudis began their price war. The world’s oversupply of crude is only growing. And it’s not clear when the situation might change.

Why hasn’t cheap oil broken down U.S. production? Originally, there were two main reasons to think that it might. First, fracking for oil in shale deposits was a relatively expensive process, and the conventional wisdom said that it required high prices to be profitable. Second, fracked wells had a short lifespan—they spouted geysers of crude quickly, then dried up within a year or two—which meant that companies needed to constantly drill new wells in order to maintain their output. Industry watchers figured that as companies shuttered old, used-up wells, low oil prices would keep them from drilling new ones, and the shale boom would quickly die down.

It didn’t quite happen that way. It’s true that low prices have sent plenty of small U.S. oil companies into default and bankruptcy this year. Many drillers have also pared back their operations: According to Baker Hughes, the number of U.S. rigs on land has fallen by almost two-thirds since this time last year. But that decline hasn’t been accompanied by an equivalent drop in production. Why not? It seems that companies essentially shelved their least productive, most speculative drilling projects while keeping their best wells running to pay their often sizable debts and try to make back their upfront investments. In the meantime, frackers have learned how to extend the life of their wells, so they aren’t so dependent on breaking ground on new ones.

That said, last week, the number of rigs actually jumped slightly. The news sparked another sell-off, as it became clear that many shale drillers don’t intend to disappear, price war or not. Instead, they’re adapting.

There are other reasons to suspect oil will keep on falling in 2016. The nuclear deal has freed Iran to start selling millions of additional barrels of crude, which will exacerbate the world’s oversupply. Libya is expected to sell more as well. The Federal Reserve has also begun hiking interest rates, which will likely drive up the value of the dollar—making oil, which is priced in dollars, cheaper as a result. Without a sudden, epic crash in U.S. production, or an unexpected catastrophe in the Middle East, its hard to see exactly how crude recovers.

In the meantime, if you’re a driver, you might want to consider sending Salman bin Abdulaziz Al Saud a holiday card this year. You know, just to say thanks.