A tectonic shift is underway Tuesday evening in America’s fashion landscape: Ralph Lauren is stepping down as chief executive of his eponymous company, and Stefan Larsson, president of Old Navy, is taking over.

With the management transition, Ralph Lauren is likely hoping to turn around its flagging financial performance, but also to broaden its appeal beyond the wealthy male shoppers who have traditionally sustained its brand. This past February, Ralph Lauren found itself facing a reckoning of sorts when it reported quarterly earnings. Traffic to stores had fallen sharply and the company had been forced to lower its sales forecast for the remainder of the fiscal year. The results sent Ralph Lauren’s stock tumbling to its biggest-ever single-day loss.

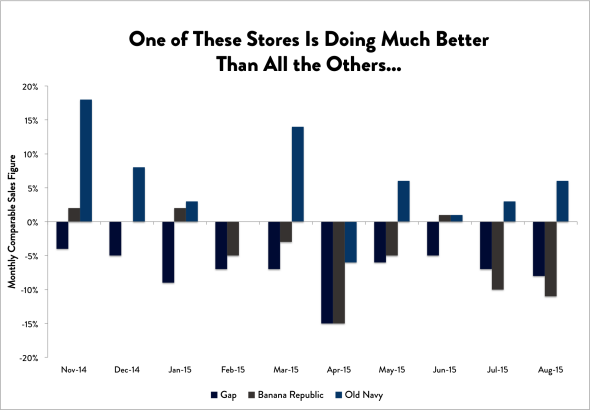

When it comes to accomplishing that turnaround, Larsson may be uniquely qualified. Since joining Gap Inc. in 2012 as president of Old Navy, Larsson has led the downmarket chain to a stunning revival. Where Gap, the corporation’s flagship label, is shuttering stores and fellow brand Banana Republic is posting monthly sales that are cool to tepid at best, Old Navy is thriving. Larsson, a champion of the “democratization of fashion,” has channeled his efforts into making Old Navy a store that’s both stylish and affordable. To see the payoff of that vision, look no further than the past several months or so of Old Navy’s comparable sales:

Data from SEC. Chart by Alison Griswold.

Ralph Lauren the designer is not abandoning his brand outright. Lauren tells the New York Times that he plans on staying involved at the company in the newly created roles of executive chairman and chief creative officer, and that though Larsson will report up to him, the relationship is intended to be a “partnership”:

“When they start designing things I can’t understand, I’ll quit,” Mr. Lauren said, sitting with Mr. Larsson at his side at his offices on Madison Avenue, adorned with the rustic paraphernalia—a tin toy robot, cowboy boots—that Ralph Lauren’s stores have come to be known for.

“But I don’t feel like I’m stepping back now,” Mr. Lauren said.

It will be interesting to see how the two mesh. Their retail philosophies are nothing if not distinct. Larsson, as previously stated, is a guru of mass marketing, and a leading proponent of the notion that high style does not have to come at a high price. Lauren, on the other hand, built his fashion empire on the promise of luxury—sharp tailoring, fine sportswear, clothes to wear on your 400-acre horse farm. If Larsson’s sole mandate is to revive revenue and foot traffic, then bringing some of that aesthetic to a wider swath of consumers might do the trick. But if Ralph Lauren isn’t ready to dilute its brand with an appeal to the masses, it will likely prove a tougher act.