We’ve talked about Uber’s surge pricing—the mechanism by which the company increases fares for riders when demand in an area spikes—plenty of times here before. We’ve discussed how it’s not price gouging, how it doesn’t take unfair advantage of drunk people, and how people are still bound to hate it no matter how many times you explain all of that (especially on New Year’s Eve). Lately, though, outrage-fueled thinkpieces on surge pricing have been pleasantly absent from the news, which you might take as a sign that people are finally coming around to the business model, or at least aware enough of it to stop being shocked by it.

But in case you hadn’t quite gotten there yet, fear not, for Uber has just released a new study showing how surge pricing is good for its riders and its service. The short paper, which was put together by two people at Uber along with Chris Nosko, a professor at the University of Chicago’s Booth School of Business, mostly serves to confirm what Uber has been telling us all along: that the function of surge pricing is to bring supply in line with demand. The supply, of course, is measured in terms of drivers providing rides, and the demand in users requesting those rides.

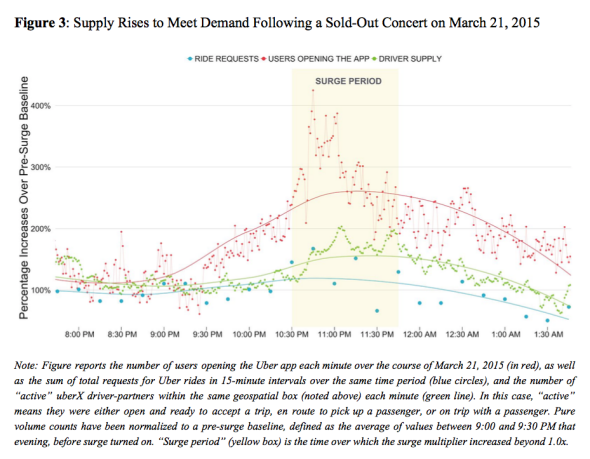

To illustrate the price-surging magic this time around, Uber and Nosko have pulled data on driver supply and ride requests from two specific events. First, a roughly five-hour window around the end of an Ariana Grande show at Madison Square Garden in late March. Second, this past New Year’s Eve in New York City, when surge broke down for 26 minutes because of a “technical glitch” in Uber’s systems. I’ll spare you most of the details, but basically they conclude that when the Ariana Grade concert ended, surge pricing did what it was supposed to—increased the supply of drivers filling requests in the area, while keeping the amount of people actually requesting rides far below the much more substantial number who had opened the app. And then they give us a pretty graph! (Click to enlarge.)

Uber

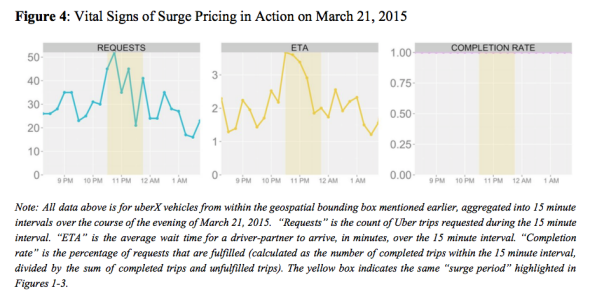

As you can see, when surge kicks in, all the things that are supposed to happen per economic theory do in fact happen. Namely, the supply of drivers stays mostly in line with the share of riders booking trips. That’s probably because those drivers are being promised more money for making pickups in the surge area, while more price-sensitive riders are being discouraged from hailing cars by the inflated fares. Uber says this is good for customers because it “allocate[s] rides to those that value them most.” That’s true, if you simply equate value with willingness to pay more. Perhaps more importantly, it’s good for Uber because it allows the company to keep its completion rate steady and estimated wait times relatively low throughout the window of increased demand, as shown here:

Uber

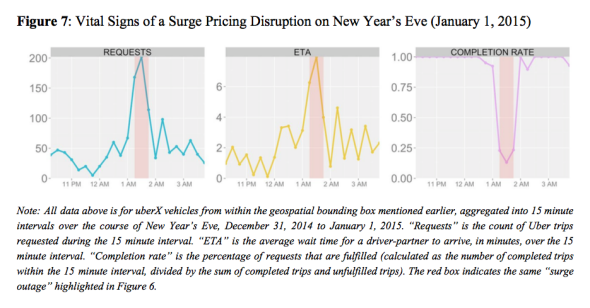

On the other hand, what happens when surge pricing doesn’t kick in as planned? Inefficiency! Chaos! Disturbance in the force! Also known as hundreds of customers requesting rides all at once, ETAs climbing above six minutes, and Uber’s completion rate plummeting to well below 25 percent.

Uber

Anyway, this is Uber’s conclusion from all of the above: “The best evidence for the effectiveness of Uber’s surge algorithm is the remarkable consistency of the expected wait time for a ride. Regardless of demand conditions, the surge algorithm filters demand and encourages supply such that a ride is almost always fewer than 5 minutes away.” To this I will say again, it sort of depends on whose consistency and reliability considerations you’re accounting for. It’s undoubtedly true that surge pricing allows Uber to consistently, quickly, and reliably provide rides to the people that are willing and able to pay the multiples in effect. Does that make it consistent and reliable for everyone who might want or need a ride? That’s a bit more of a philosophical question. The study also doesn’t address the much more interesting—and admittedly more complicated—question of whether surge pricing is more likely to align supply and demand by incentivizing drivers, by discouraging riders, or by evenly affecting both. Presumably that’s a matter for another time.

For now, though, take away these three things. Surge pricing does just what we thought it did. Surge pricing is probably good for Uber riders. And surge pricing is absolutely, definitely, unequivocally good for Uber.