After Jeb Bush debuted his big tax plan Wednesday, those who weren’t distracted by its populist feints quickly observed that the proposal was almost certainly going to be a budget-wrecking gift to the wealthy, much like his brother’s own notorious tax cut. Today we have confirmation of that, courtesy of the conservative Tax Foundation.

To quickly review, Bush would drastically lower tax rates for both individuals and corporations, while eliminating loopholes and a number of popular deductions to make up some of the forgone revenue. The seven individual brackets we have today would be crunched down to just three, with rates of 28 percent, 25 percent, and 10 percent (currently, the top rate is 39.6 percent). Among other changes, he’d outright abolish the estate tax, which would be a boon to the Hilton family, and double the standard deduction most taxpayers take, which would help eliminate income tax liability altogether for millions of Americans. Meanwhile, he’d do away with the write-offs for state and local taxes, while capping them for things like mortgage interest and medical expenses. You get the flavor.

The Tax Foundation, which even for a right-leaning organization is unusually optimistic about the ability of tax cuts to spur growth, thinks all this would do wonders for the economy. It predicts that, long-term, gross domestic product would be 10 percent higher under Bush’s plan, wages would get a 7.4 percent boost, and that the country would tack on an extra 2.7 million jobs. Again, don’t take these numbers as gospel—as one economist memorably put it to the New York Times, some of the Tax Foundation’s recent work “would not pass muster as an undergraduate’s model at a top university.” The point is, they think that, like water from Moses’ rock, the Jeb plan would unleash a gusher of growth, which would help make up for some of the revenue lost from lowering rates.

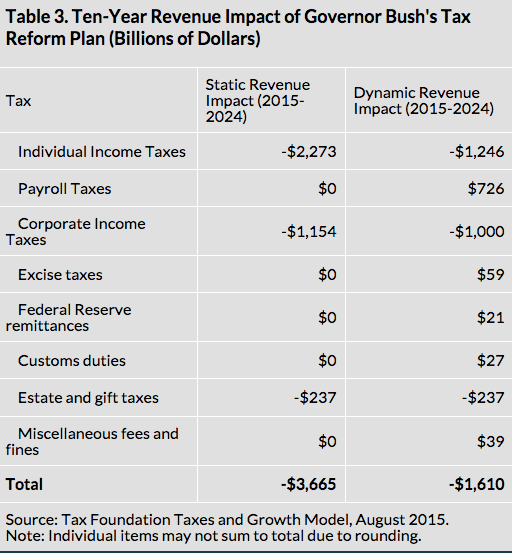

But even with those sunny assumptions, they find that the Jeb plan would still punch a massive hole in the budget. Assuming no extra growth, it would increase the deficit by $3.7 trillion over a decade. With their predictions about growth stirred in, the deficit would increase by $1.6 trillion. The problem is obvious: Wiping out deductions can’t balance out the sorts of rate cuts and the wholesale elimination of things like the estate tax that Bush envisions.

Courtesy of the Tax Foundation

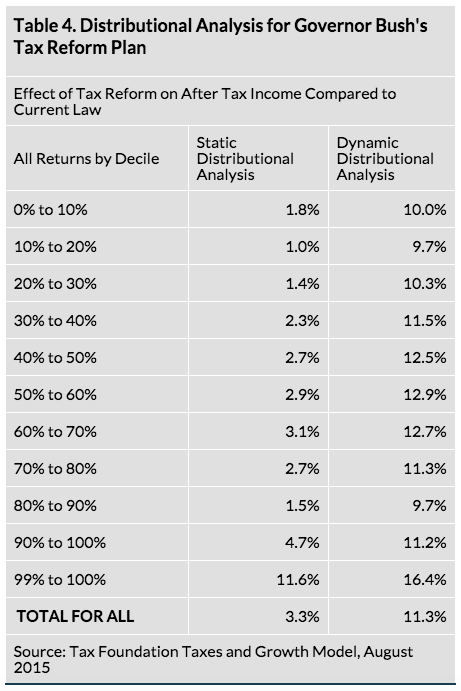

And who would benefit the most from all of this? Almost too conveniently, the top 1 percent of taxpayers, who would see their after-tax incomes rise 11.6 percent in the static model (meaning no extra growth), and by 16.4 percent in the super-juiced-up growth model.

Courtesty of the Tax Foundation

So there we go. With a friendly think tank running the numbers, it appears the Jeb! tax cut leaves a smoking crater in the federal budget while disproportionately benefiting the affluent. Meet the new Bush, same as the old Bush.