After China’s stock market started crashing earlier this summer, its government responded, in part, by having a giant state-backed financial institution buy shares and support prices. (It also handed loads of money to large brokerages so that they could buy buy buy when everyone else wanted to sell sell sell.) But after a while, Beijing pulled back. Authorities announced that they would ease up once “volatility” declined. Then the purchases seemed to stop altogether. And prices promptly tanked again.

Eventually, things took another twist. As the Financial Times reports:

After standing on the sidelines for more than a week, the government resumed large-scale stock-buying in the last hour of trade on Thursday. This helped to lift the Shanghai benchmark index from a small loss to end the day up more than 5 per cent. The market rose by almost 5 per cent again on Friday.

All right, so China waffled. Why the sudden change of heart?

Traders and officials said the latest intervention was aimed at providing a “positive market environment” in preparation for a big military parade this week to celebrate the 70th anniversary of the “victory of the Chinese people’s war of resistance against Japanese aggression.”

So, just to repeat, China decided to intervene and boost stock prices because it had a parade coming up. Bloomberg reports the same. Suffice to say, this is not how markets are typically managed in advanced economic powers.

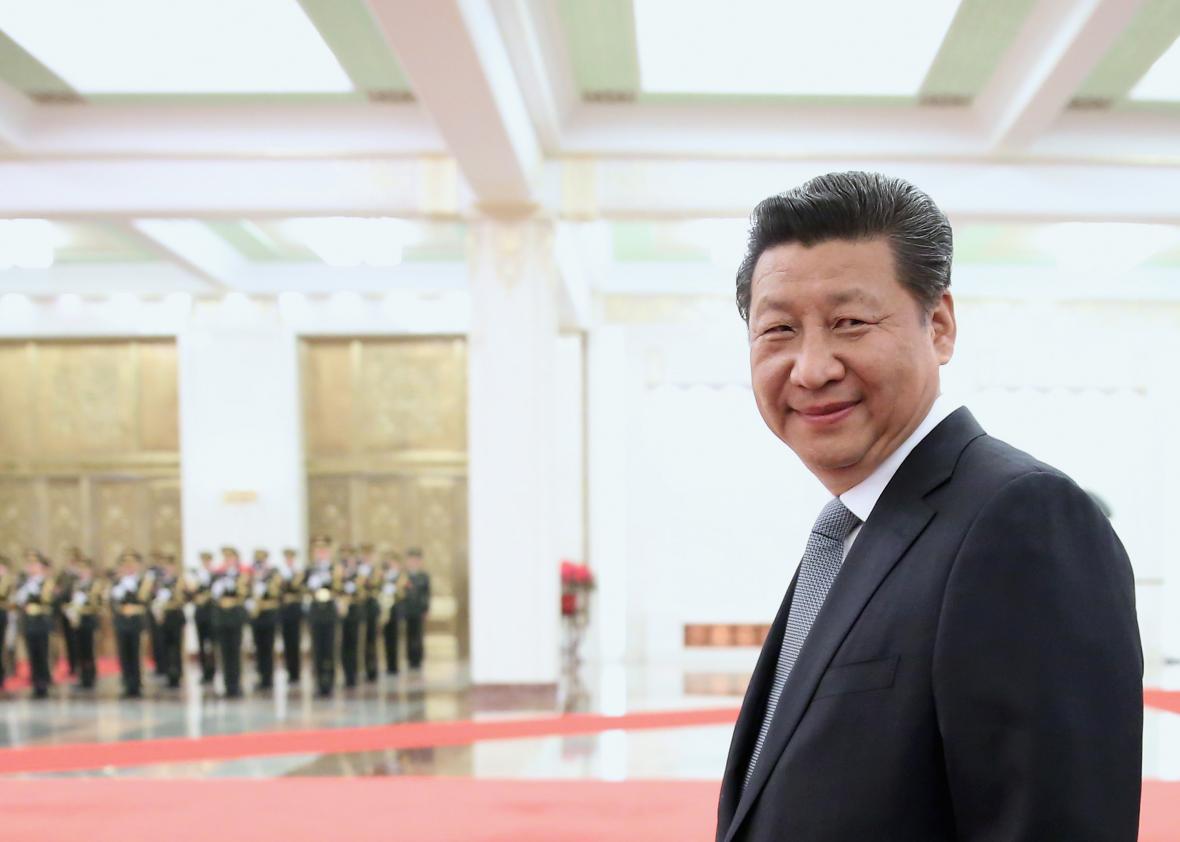

Now, to be fair, this a very important parade. I mean that sincerely. President Xi Jinping wants to use the 70th anniversary of World War II’s conclusion as an excuse to show off some of China’s military muscle with a big march through the capital. Having stocks in free-fall would sort of put a damper on those festivities. I mean, the last couple months will probably spoil things a bit anyway, and fighting to prop up equities prices for the sake of your big pageant doesn’t exactly scream “rising hegemon.” But it would be supremely embarrassing for Xi if the Shanghai Composite Index was sinking while he was trying to present China as a fearsome force on the world stage.

There’s a broader point in all of this. The old conventional wisdom about China was that its leaders were omnipotent and brilliant technocrats who were pioneering a new form of modified, state-oriented capitalism. The country’s growth slowdown and market chaos has very quickly undercut that image, and now the running theory seems to be that the government is run by a bunch of clueless incompetents who are about to crash its economy into the Great Wall. Neither characterization has ever really been true. China’s authoritarian government was well-suited for industrializing and creating an export power out of a vast and poor nation. It’s controlling impulses are less well-suited for the next stage of development, however, if it ever wants to become a truly advanced economy with thriving markets that aren’t treated as a tool for advancing political interests. Some power brokers within its fractious bureaucracy seem to understand that better than others. We’ll see who wins out in the long term. In the meantime, the parade goes on.