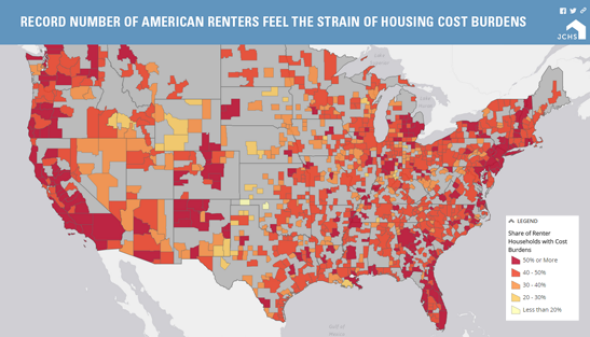

Do you rent your home? Do you get that woozy, “Wow, so this is what it’s like to give blood” feeling every time you cut a check to your landlord? Well, you’ve got plenty of company. Harvard’s Joint Center for Housing Studies reports today that the number of “cost-burdened” renters, who spend at least 30 percent of their income on housing, reached 20.8 million in the U.S. during 2013, a new peak. Overall, about 49 percent of Americans who rent were in that unfortunate category, down just slightly from 2012. And while a handful of major metro areas fared significantly better—fewer than 40 percent of renters in Des Moines were cost-burdened, so hurray for Iowa—for the most part, renting is pretty rough in and around any large city.

And it’s probably getting rougher. “Rental markets tightened again in 2014 as the national vacancy rate fell by nearly a full percentage point to 7.6 percent—its lowest point in two decades,” Harvard’s researchers tell us. Meanwhile, rents rose at twice the rate of inflation, and faster than wages. However bad 2013 was when it comes to the country’s collective rent burden, it seems likely last year will look worse when the final numbers are in.

Rents are rising for the simple reason that, thanks to the never-ending hangover of the housing bust, a larger share of Americans are renting their living places now than they have in 20 years. And while developers have responded by building apartment buildings like mad—last year, there were the most multifamily housing starts for rent since 1987—it hasn’t quite been enough to keep up with demand. (Moreover, new construction is largely catering to wealthier buyers, while the families most burdened by rent tend to be lower-income.) Old, unwanted single-family homes from the boom days of the 1990s and early 2000s are relieving some of the pressure on the market, but not quite enough to keep prices from jumping.

Meanwhile, demand for rentals is probably going to keep rising. First, the Federal Reserve would really, really like to raise interest rates in the near future, which will make mortgages less affordable. But more importantly, millennials are getting older. Thus far, most of the growth in renting has been driven by middle-aged and older Americans. But even if young adults continue living with their parents at the same rate as today, there are simply so many twenty- and thirtysomethings that the rate of new household formation is bound to jump in the coming years, which is going to create much more appetite for rentals.

Here are two ways all of this could play out. The optimistic possibility is that developers will see dollar signs thanks to all these young people looking for new homes and race to build new apartments, eventually leading to massive overconstruction that will finally cool off rents (even though most of the new properties will be aimed at relatively well-off customers). The more dour possibility is that all those millennials leaving the nest will simply overwhelm the rate at which companies can break ground on new real estate. In which case, paying rent will only make us feel even woozier.