Lee Siegel is an award-winning critic and an unrepentant leech. After pursuing not one, not two, but three degrees from an Ivy League university, he chose to default on his student loans at taxpayer expense, because he felt that paying them back would have hampered his ambitions of becoming a writer. “As difficult as it has been, I’ve never looked back,” he wrote this weekend in a New York Times opinion piece. “The millions of young people today, who collectively owe over $1 trillion in loans, may want to consider my example.”

For the love of God, no they should not. The Times, on the other hand, should consider apologizing for publishing this deeply irresponsible op-ed.

I can sort of imagine why the opinion section’s editors might have found Siegel’s article topical. In recent months, almost 200 former Corinthian Colleges students have made news by launching a debt strike, refusing to pay back loans they accumulated while attending the now-defunct for-profit education chain. With support from Sen. Elizabeth Warren and other Democrats, the strikers have asked the Department of Education to forgive their debts, which it has the power to do in cases where a school essentially defrauds its students. According to multiple lawsuits, Corinthian appears to have done exactly that by lying about its job placement and graduation stats.

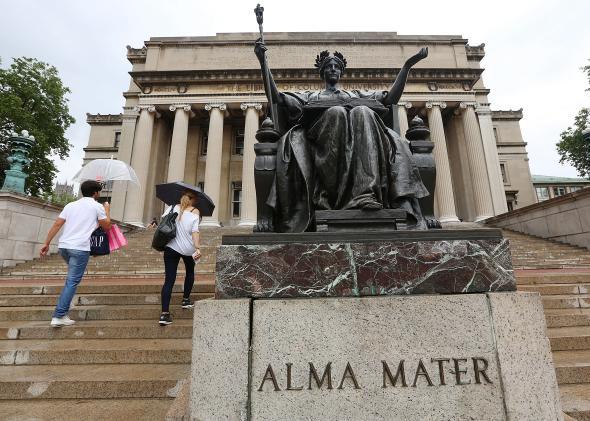

Siegel, however, was not the unwitting victim of a predatory for-profit college. He was just a feckless liberal arts major. As the man tells it, he grew up in a “lower-middle-class family” and borrowed heavily for school after his parents split following his father’s bankruptcy. At first, he tried to do the financially responsible thing by transferring from his small, private college, to a state school near home in New Jersey. However, Siegel felt he “deserved better,” and left. Though his piece never mentions his alma mater by name, his official speaker’s bio states that he eventually went on to earn a B.A., M.A., and masters of philosophy from Columbia University. All of this was financed in part with the help of scholarship money, but also seemingly with a mountain of student debt. Later, Siegel concluded that he wouldn’t be able to pay off his obligations if he wanted to keep working as a writer. So he chose to shirk them instead. Thirty years after taking out his last loan, he notes, “the Department of Education is still pursuing the unpaid balance.”

And how does he justify pickpocketing the government?

“It struck me as absurd that one could amass crippling debt as a result, not of drug addiction or reckless borrowing and spending, but of going to college,” Siegel writes. “Having opened a new life to me beyond my modest origins, the education system was now going to call in its chits and prevent me from pursuing that new life, simply because I had the misfortune of coming from modest origins.”

As we all know, “going to college” is common shorthand for “going to grad school.” Potato. Potahto.*

It’s that sort of half-baked self-righteousness that makes Siegel’s article so galling. It is, in fact, possible to be a culture writer with merely one Ivy League diploma on your wall. There are, believe it or not, successful journalists who have managed to pay off gargantuan student loan bills rather than leave the government holding the bag. Contra Siegel’s assertion that “moneyed stumbles” like tax fraud and insider trading “never seem to have much consequences” compared to student loan defaults, the federal government actually spends a great deal of time prosecuting precisely those crimes. And while it’s true that our student lending system is irrationally punitive, the people who really suffer tend to look like Corinthian’s hapless alums, not a white, male literary gadfly who decided he needed a second master’s before going on to write for the New Yorker, the Times, Harper’s, and (yes) Slate while settling down to write books in a nice suburb of New Jersey.

But tone-deafness is the least of Siegel’s sins, in this case. The much bigger problem, and the reason the Times owes the world a mea culpa in my opinion, is that he spends about a third of the column dispatching criminally negligent financial advice.

Siegel simply seems to think the world would be better off if more students followed his lead and chose to default. (At one point, he suggests with a straight face that the chaos that would ensue if everybody stopped paying their loans might force Congress to consider a “universal education tax that would make higher education affordable.”) Much of his piece is basically a guide to life after defaulting, which he argues is less awful than many would have you think. Sample wisdom: “The reported consequences of having no credit are scare talk, to some extent. The reliably predatory nature of American life guarantees that there will always be somebody to help you.”

Astoundingly, Siegel never mentions, nor demonstrates that he understands, the fact that in most cases of default the government can simply start garnishing up to 15 percent of borrowers’ disposable wages directly from their paychecks. That’s more than the 10 percent they would owe if they simply signed up for the newest income-based repayment plan that the Department of Education offers. In other words, unless you’re making a political statement like the debt strikers, there is virtually no rational reason to default. And telling anybody that they should consider doing so is gross journalistic malpractice, even in an opinion piece. If anybody actually takes Siegel’s advice for a road test, the Times will have succeeded at making the world a slightly crappier place, and nothing more.

I’m not sure why Siegel doesn’t seem to recognize these issues—the word “garnish” appears nowhere in his piece—but I assume it may be because, since he’s a freelance writer, the government may have a harder time tracking down his employers and taking his pay. If so, lucky him. He found a loophole.

Anyway, according to the Times, Siegel is “writing a memoir about money.” Presumably, it will include an even lengthier rationalization of why he’s entitled to yours.

Correction, June 8, 2015: I originally joked in this post that “going to college” was a well known shorthand for “acquiring a pair of master’s degrees from one of the world’s most expensive universities.” After publication, Siegel told Yahoo! News, “I had my full tuition paid all my years at Columbia,” and implied that he was borrowing for living expenses while at the school. “If I had worked full-time, I never would have finished,” he said. So, while it seems accurate to say that he took out loans in order to attend grad school, it’s not fair to suggest that he paid out for one of the world’s most expensive universities. The article has been revised elsewhere to reflect that he received scholarship money.