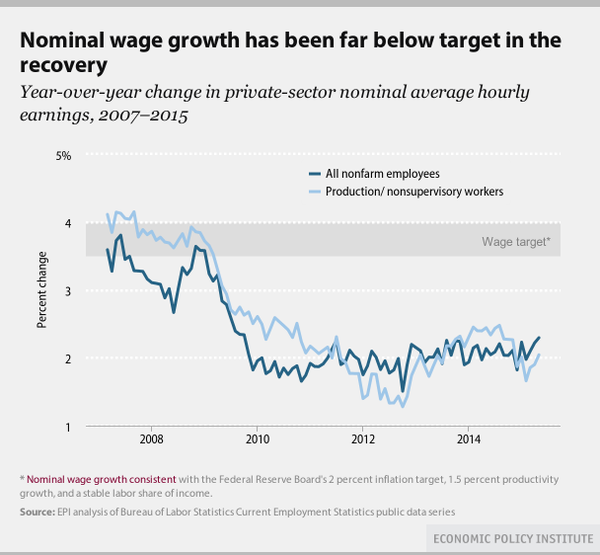

For a while now, most of the discussion about wage growth in the U.S. has focused on some variation of the same question: Why aren’t Americans getting bigger raises? You can see why thanks to graphs like this one from the Economic Policy Institute, which says wages are “stuck in the mud.” Unemployment may have dropped significantly, but even after some good news this month, hourly pay has only inched up by a bit more than 2 percent year-over-year, which typically isn’t considered great.

But here’s the thing. Thanks to cheap gasoline, prices have actually fallen over the past 12 months. And once you factor in inflation, the wage growth we’re seeing at this moment starts to look a whole lot better. By April, real hourly pay was up about 2 percent for production and nonsupervisory employees, which, while not quite dotcom-era torrid, is still respectable.

So, which matters more? If you care about living standards, you want to keep your eye on real, inflation-adjusted wage growth, since that’s what determines a family’s spending power. And on that front, this year has been a fairly happy story. If you happen to be a central banker, or CNBC-loving markets junkie, and you mostly care about whether inflation is coming in the near future, then you’re going to be watching nominal wage growth, since that signals where prices might be headed. By that measure, the economy is still looking a little cool.

And what if you just want to know if the job market is getting stronger? Well, it’s hard to say which measure tells us more. The fact that employers are handing out raises, even when inflation is dead in the water, seems like a sign that workers might have a little bit more bargaining power these days. Then again, it’s possible that employers have just become accustomed to handing out cost-of-living increases, even when the cost of living isn’t increasing. Or maybe we’re partially looking at the ripple effects of state minimum wage hikes. There are lots of potential explanations, and I don’t know that any one of them is obviously, or solely, correct.

So things are a bit murky. But within a few months, they should clear up a bit. Chances are gas prices won’t suddenly plunge again, meaning that inflation will probably come back from the dead, at least a bit. If wages rise alongside it, that would be a sign that workers really are in a position to demand raises. If they don’t, it may be a sign that employers, for whatever reason, have just been locked into upping pay by about 2 percent per year. In the meantime, though, workers should enjoy the real extra pay in their pockets.