Long term, seemingly immutable trends break. All the time. Especially in the realm of energy.

The U.S. Energy Information Administration just published a great chart that shows how oil—once pretty much the only transportation fuel we used in America—is losing its grip at a nontrivial rate.

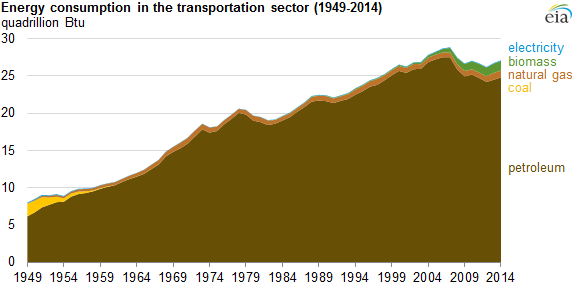

The chart shows the changing amount of BTUs (British thermal units) consumed across all modes of transportation by energy source. And for much of the past half-century, the picture was rather simple. It was pretty much all petroleum (gasoline/diesel), and it rose pretty much every year.

But several years ago, we started to see the beginnings of the slow-motion disintermediation of petroleum as a transportation fuel. No, gasoline, isn’t quite going the way of whale oil. But it has been losing market share at an alarming rate—and at the same time as the need for energy throughout the system has been declining.

U.S. Energy Information Administration, Monthly Energy Review

According to the EIA, the U.S. transport system required about 6 percent fewer BTUs of energy to function in 2014 than it did in 2007. And it used nearly 10 percent less oil than it did that year. In fact, oil consumption was lower in 2014 than it was in 2000. And as a proportion of transportation fuel, petroleum hasn’t been this low since 1954, when coal was still a significant transportation fuel. Petroleum’s market share has fallen from 96.5 percent in 2004 to 91.5 percent in 2014.

We can chalk that up to two powerful trends—the simultaneous rise of alternate fuels and the growing efficiency of America’s vehicle fleet.

First, other fuels are slowly gaining traction. Especially biofuels—chiefly ethanol, the controversial, subsidy- and mandate-aided gasoline substitute made from plants like corn. From a tiny base, 135 trillion BTUs in 2000, ethanol consumption rose eightfold to 1.092 quadrillion BTUs in 2014. Add in the small amount of biodiesel, and these renewable biomass fuels in 2014 accounted for 4.7 percent of the transport sector’s energy consumption—up from .5 percent in 2000. They have increased their market share tenfold in 14 years.

At the same time, the fracking revolution has made natural gas cheap and plentiful. As a result, it is increasingly being used as a transportation fuel, especially for buses and trucks. (The natural gas figures in this chart include gas used to operate pipelines as well as vehicles that run on natural gas.) Check out the website NGTNews.com, and you’ll see a daily flow of news stories about large numbers of fuel-intensive vehicles switching to natural gas, such as a school bus fleet in Oregon or the latest additions to the fleet of UPS, which has 2,500 vehicles that run on natural gas. Meanwhile, companies like Clean Fuel Energy are building filling stations and inking supply deals with big users—which in turn make it easier for more companies to adapt. According to the EIA, natural gas in 2014 accounted for 946 trillion BTUs, or about 3.5 percent of the transport sector’s energy consumption, up from 2.2 percent in 2004.

Combined, natural gas and biofuels account for 8.2 percent of the energy used by the sector.

And this data set doesn’t include electricity used to power cars. Every month, several thousand cars are sold that run exclusively or partially on electricity—combined sales of plug-in hybrids and all-electrics were about 9,000 in April. There are also a few buses that run entirely on electricity.

There’s another big factor that’s taming the need for all fuels—and that is particularly taking a bite out of oil use. Vehicles that use petroleum have been getting much more fuel-efficient. As Michael Sivak and Brandon Schoettle of the University of Michigan report, the typical car sold in April 2015 gets 25.2 miles per gallon, compared with 20.1 in October 2007—an increase of 25 percent. Companies are developing technologies and products that make large, gas-guzzling vehicles more efficient, whether it is XL Hybrids tricking out cargo vans to be hybrids, or Greenroad’s slightly Orwellian behavior modification software that can cut buses’ fuel consumption by a few percentage points.

That’s not to say that petroleum is out as a transport fuel. It’s still the dominant one by far. Most companies would be psyched if their product had a 91.5 percent market share. But there’s reason for concern. With each passing day, a slightly smaller proportion of America’s vehicles run on petroleum. And with each passing day, companies that profit by helping vehicle operators and owners use either less oil, or less fuel, are getting bigger.