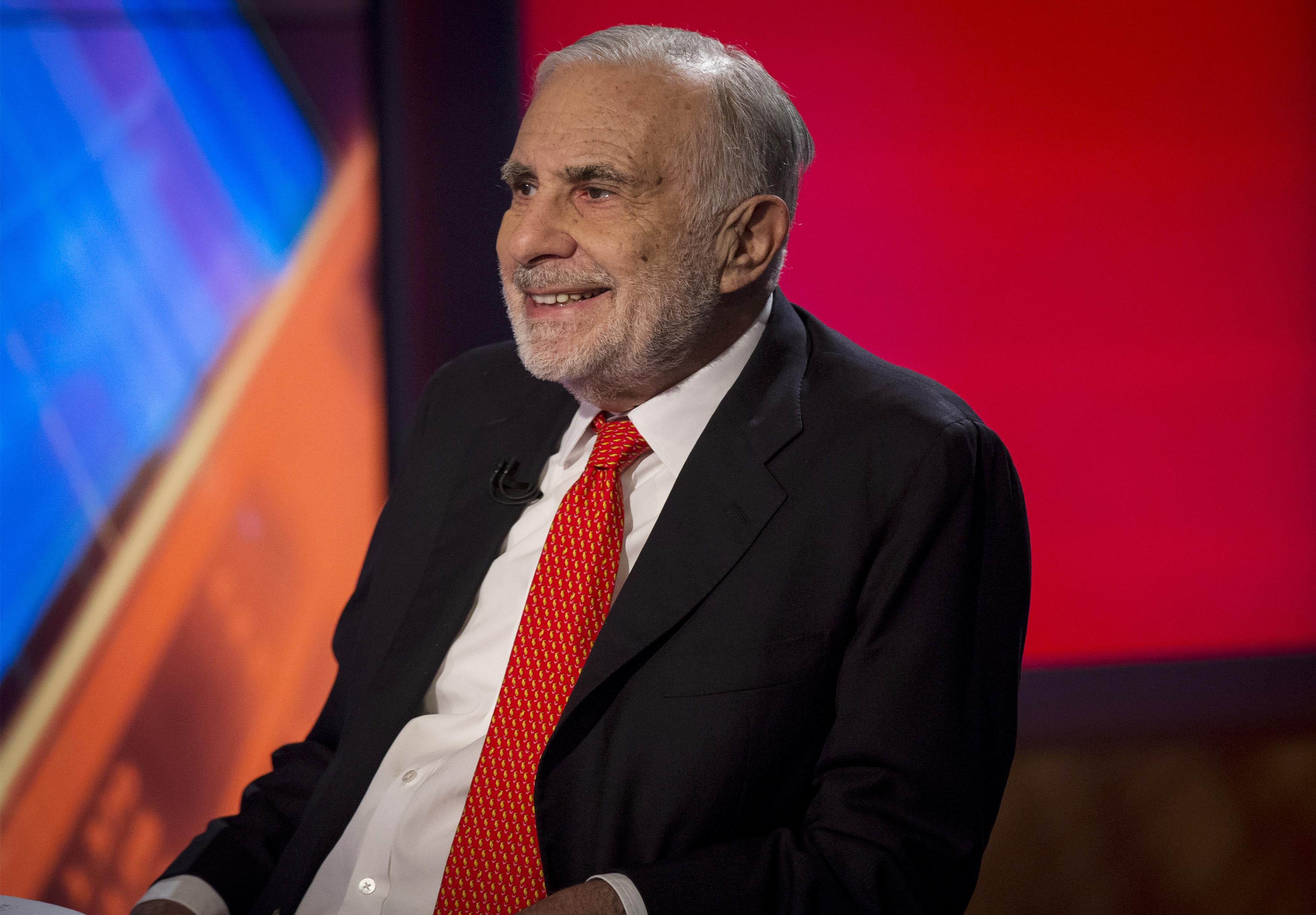

When you consider Uber’s stunning valuation ($40 billion closing in on $50 billion at last count), massive U.S. presence, and rapid international expansion, it can feel like the ride-hailing wars are already over and Uber has won. But then someone like activist investor Carl Icahn comes along and tosses $100 million at Lyft, Uber’s closest thing to a rival. Hop back in the trenches, folks.

“Lyft is a tremendous bargain,” Icahn told the Wall Street Journal on Friday. “There is room for two.” In addition to Icahn’s $100 million, Lyft also added another $50 million from shareholders to extend its $530 million funding round from March, which valued the company at $2.5 billion. John Zimmer, Lyft’s president and co-founder, said in a statement that the company intends to use the new funds to build out its presence in the United States. That echoed comments made by Logan Green, Lyft’s co-founder and chief executive, at TechCrunch’s Disrupt conference earlier this month.* Lyft’s goal, Green said at the event, was to go deep in its expansion rather than broad.

When it comes to expansion, Uber has taken precisely the opposite approach, spreading its substantial resources across 58 countries and more than 250 cities. That advance-no-matter-what philosophy has been controversial and expensive. Uber has poured funds into campaigns for “ride-sharing”–friendly legislation across the U.S., and, presumably, elsewhere around the world. Despite that, its service has faced bans in several countries, including Germany, Belgium, Spain, and France.

Perhaps in part because Lyft has grown more slowly and with greater focus, it has also managed to cultivate a friendlier image—especially against Uber’s win-at-all-costs reputation. “There’s been a bit of conversation about Lyft being the nice guy, and I think it’s true,” Green said at Disrupt. “I think it’s a fundamental part of our culture.” It will be interesting to see how Icahn—and Jonathan Christodoro, one of his managing directors who will gain a seat on Lyft’s board per the latest investment—will fit with that culture. Icahn is known as a contentious, abrasive investor who buys up stakes in public companies and then agitates for change. He’s also a market-moving tweeter. Last year, Icahn pushed hard for eBay to spin off PayPal, its payments arm; in September eBay announced plans to do just that.

*Correction, May 15, 2015: This post originally misstated when TechCrunch’s Disrupt conference was held. It was in May, not April. The post also originally misattributed a quote from Marc Andreessen to Carl Icahn. The quote has been removed and the headline has been updated to reflect that.