The annoying thing about making sweeping predictions about the future is that sometimes it takes a while to figure out whether you were right.

A few years ago, I co-wrote an article with Derek Thompson for the Atlantic titled “The Cheapest Generation.” It argued that for a whole host of reasons—the scarring legacy of the recession, student debt, the influence of mobile tech, and a growing preference for urban living over cul-de-sac suburbs and exurbs—millennials were probably never going to buy as many houses or cars as their Baby Boomer parents or Generation X. We weren’t forecasting the death of all suburbs or the extinction of the American automobile. However, given the way financial and social forces had aligned themselves, it seemed inevitable that the young adults of 2012 would ultimately spend more modestly—and less often—on these twin pillars of U.S. living.

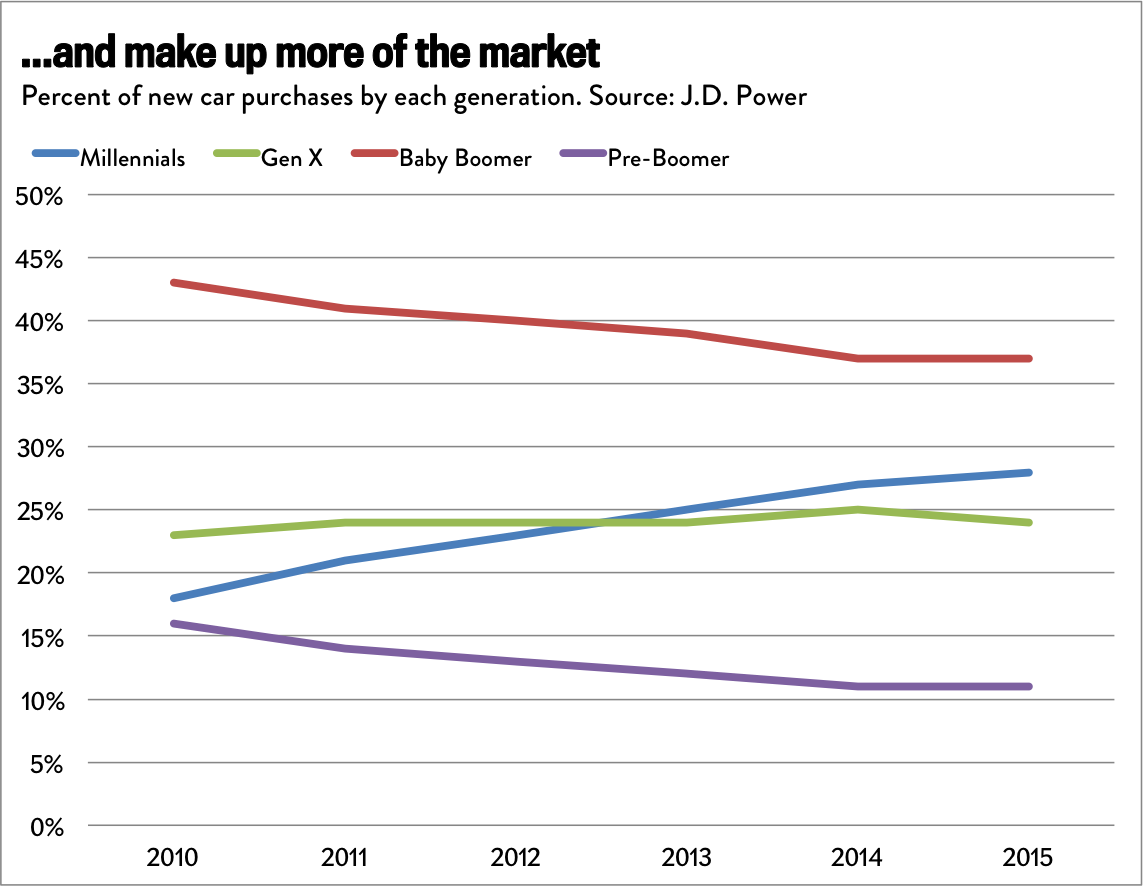

Last week, Derek decided to recant. Sort of. “Inconveniently, reality is messing with our prediction,” he wrote. The impetus was an article from Bloomberg, based on data from J.D. Power and Associates, which reported that car sales to millennials were surging as the economy improved and young adults moved to the suburbs, far away from decent public transit. Gen Y—which J.D. Power defines to include anybody born between 1977 and 19941—bought more than twice as many cars and trucks in 2014 than it did in 2010 and now makes up 28 percent of the new vehicle shoppers, up from 18 percent.

Jordan Weissmann

These stats, combined with the fact that young adults are still migrating to Sun-Belt suburbs, have led Derek to conclude that he and I “failed to anticipate the fierce undertow of the status quo” when it comes to how Americans travel and where they nest.

With all due respect to my old partner, I’m not so sure. Millennials are still pretty cheap. That might change. It might not.

Let’s start with a little car talk. In our original piece, Derek and I noted that “in 2010, adults between the ages of 21 and 34 bought just 27 percent of all new vehicles sold in America, down from the peak of 38 percent in 1985.” Unfortunately, we relied on data compiled by a company that recently closed after its founder and lead analyst passed away. Worse yet, I haven’t been able to find any comparable statistics that would let us compare today’s car market with sales 30 years, or even a decade, ago.

Jordan Weissmann

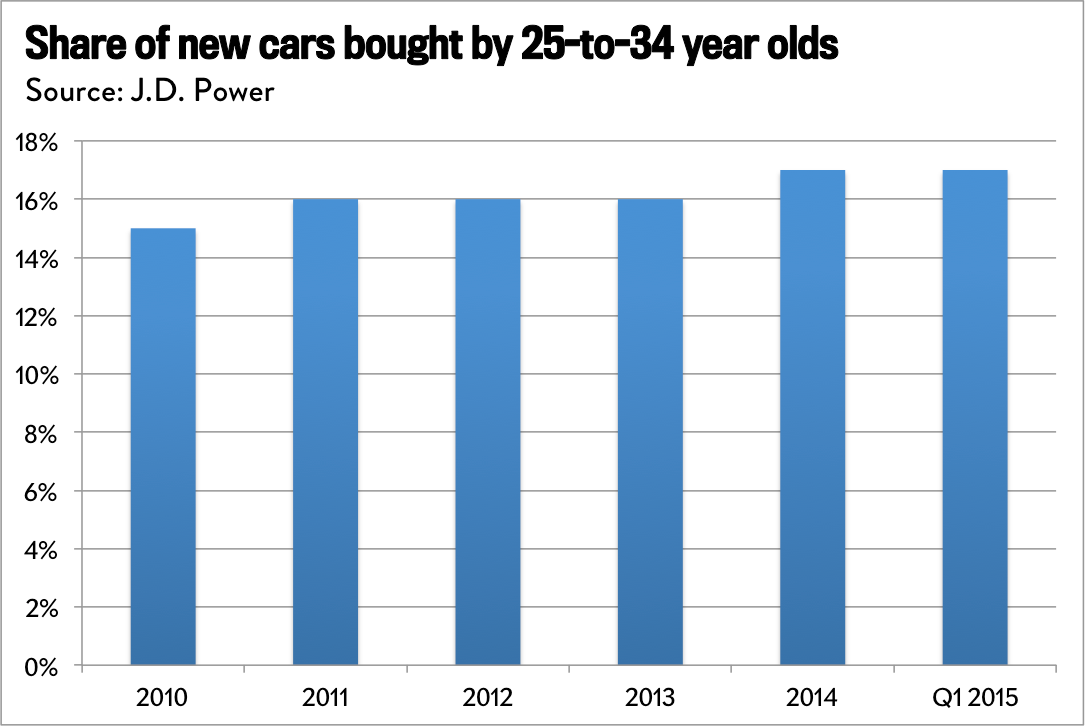

Still, the information we have does not obviously show that young adults are falling back in love with cars. Yes, millennials are purchasing more vehicles now than they did in the aftermath of the recession. Part of that is due to the improving economy. But some of it is just the result of Gen Y getting older. The 17-year-olds of 2010 are now entering their prime car-buying years. Take those former minors out of the math, and you’ll see that adult millennials don’t make up much more of the market than they did five years ago. According to J.D. Power, the share of cars bought by Americans between the ages 25 and 34 only rose from 16 percent to 18 percent.

And it might not have risen at all. According to R.L. Polk & Co., 25-to-34-year-olds purchased a smaller percentage of all new cars than in 2010.

Why the discrepancy? It may have to do with data sources—J.D. Power relies on information it gathers directly from dealers, while R.L. Polk scrapes info from new car registrations. The important thing, though, is that the market trend is kind of murky.

Here’s something that is clear, however. Once you adjust for population size, millennials were about 29 percent less likely to buy a new car or truck last year than members of Gen X or the Baby Boomers, according to City Observatory.2 It’s possible that gap will shrink with time. But until more millennials are fully employed and living under their own roofs, rather than with their parents, we simply won’t know for sure what their appetite for sedans and pickups will be. As Lacey Plache, the chief economist at Edmunds.com told me, “It’s only the last couple of years that we’ve seen the kinds of changes that would lead people to buy cars. You really just can’t tell if they want to.”

So that’s cars. What about houses? Well, the homeownership rate among Americans under 35 is at its lowest point since at least 1994, and falling (see table 19). And while it’s true that young adults are still generally moving out of cities and into suburbs (see table 15), that’s not the case everywhere, or among every segment of the under 40 population. Big cities, for instance, are booming, and young college graduates are becoming somewhat more urban, even as their less educated (and likely less wealthy) peers shift to the ‘burbs. We may not be headed for a future where everybody rents an apartment in a dense pedestrian’s paradise. But there may be more renting, and at least some cities where a growing number of families settle down in part because they can take the bus to work instead of commuting through traffic.

Again, I’m not suggesting that millennials are about to completely scramble the American way of life. But we could be getting ready to see significant changes at the margins that will still effect industries like home-builders and automakers. Back in 2012, we wrote, “If the Millennials are not quite a post-driving and post-owning generation, they’ll almost certainly be a less-driving and less-owning generation.” As of now, I’m still willing to bet that will be true. At least, I’m not ready to admit I was wrong.

1 That’s a slightly unusual definition, but whatever.

2 If you once again cut out the youngest Millennials from the picture, the gap does shrink a bit; 25-to-34-year-olds were about 19 percent less likely to buy a new car or truck compared with Gen X or the Baby Boomers.