By all rights, the federal estate tax should be an extremely popular piece of policy. Most Americans believe that the wealthy should pay more of their money to the IRS. And while not everybody agrees on what constitutes affluence these days, the government only taxes estates worth at least $5.43 million dollars. In 2013, 2.6 million people died in this country, and only 4,700 of them had to pay any taxes as a goodbye gift to Uncle Sam. We’re talking about a levy on the 0.2 percent.

And yet the estate tax is not popular. Polls frequently show that most Americans would like to reduce or repeal it. When the House Ways and Means Committee, led by Rep. Paul Ryan, voted in favor of a bill that would scrap the tax altogether, it was, oddly, both a sop to the rich and probably good politics.

There may be a simple reason for this. And no, it’s not because Republicans started calling the estate tax the “death tax,” or because the public believes that heirs have a God-given right to inherit their parents’ second home in the Hamptons without paying a fee. Rather, Americans seem to vastly misunderstand how many families are subject to the tax. And it’s possible that simply providing them with better information might actually boost support for increasing it.

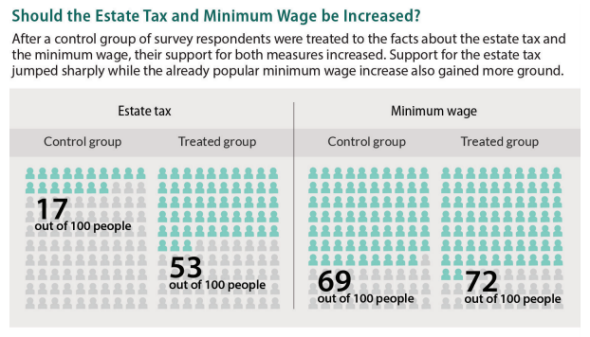

At least, that’s what one experiment by economists Ilyana Kuziemko, Michael Norton, Emmanuel Saez, and Stefanie Stantcheva suggests. In it, the team surveyed 10,000 individuals about how the government should respond to rising inequality. One group of participants was shown a presentation beforehand about the history and extent of income gap, which included information on how many households actually pay the estate tax. The other group took the survey cold. While the educational exercise did make people more concerned about inequality, it didn’t seem to change their minds much about policy. The two cohorts offered similar answers when asked, for instance, what the top income tax rate should be, or whether the government should increase funding for food stamps. However, the presentation did seem to affect opinions on two issues. It drove up enthusiasm for a higher minimum wage, but only slightly. And it more than tripled support for hiking the estate tax.

Why the huge swing? In a follow-up experiment, the researchers found that participants who saw the presentation were much, much more likely to accurately answer how many families are subject the estate tax. This suggested that many people disliked the policy because they overestimated how many households were paying it.

To be fair, the response may not have been entirely rational. The researchers found that simply presenting survey-takers with facts about the estate tax made them a little more likely to support an increase. Showing them the same facts next to a picture of a mansion, it turned out, was far more effective. Democrats, take note.