There are lots of mobile payments apps out there, but none has won over teens and twentysomethings quite as fast as Venmo. In the fourth quarter of 2014, Venmo processed $906 million in payments—29 percent more than it did in the same period a year earlier. Venmo is smooth, simple, and most importantly social. You might join Venmo because you need its service, or you might sign up because all your friends already did and you’re experiencing some serious money-transfer FOMO.

So if another company with major social clout and an enormous user base decided to get into the mobile-payments business, that would be very bad news for Venmo. Especially if that company happened to be Facebook.

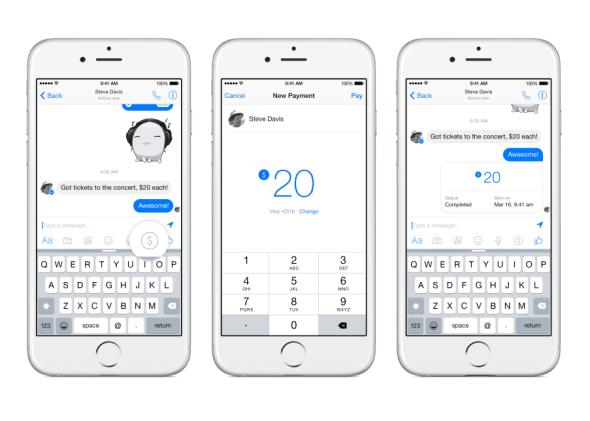

On Tuesday, that finally happened when Facebook began rolling out a long-rumored payments feature to its Messenger app. From the looks of it, Facebook is going for the same simplicity that’s made Venmo a success. To send money, users compose a message to a friend, tap a “$” icon, enter the amount they want to send, and then tap “pay” and fill in their debit-card information. To complete the transfer, the friend on the other end simply opens the message and fills in her debit card number. According to Facebook, the money moves right away, though it might take your bank one to three business days to make the funds available.

The goal of the new feature, Facebook product manager Steve Davis explained to Re/code, is to keep Facebook users in the Messenger app rather than having them go elsewhere to finish discussing a transaction. “We realized that there were all these conversations that were forced to go somewhere else in order to actually finish,” he said. “You had to go to another platform to actually pay another person.”

Notably, Facebook’s announcement emphasizes the new service’s security features. The company says it encrypts the connection between its users and Facebook, and uses “layers of software and hardware protection that meet the highest industry standards.” Anti-fraud specialists will monitor accounts for suspicious activity. Users can also add a personal identification number or multifactor authentication to their accounts for increased protection. Last month, an article in Slate documented several apparent security flaws in Venmo, including the absence of multifactor authentication and the fact that users weren’t notified of changes to their email and password credentials. Venmo has since updated its security features to address those problems.

According to Re/code, Facebook’s entire payments system was built in-house. (David Marcus, the head of Facebook Messenger, was formerly the president of PayPal, which absorbed Venmo in 2013.) In contrast Snapcash, a payments system Snapchat introduced last November, was a collaboration between the popular messaging app and payments company Square. Messenger also isn’t Facebook’s first foray into handling money—for years it has allowed users to purchase games or gifts through its platform.

That said, this is Facebook’s first attempt to truly facilitate peer-to-peer transactions, and it could be huge. Venmo doesn’t publicize its user numbers, but as of November 2014 Facebook said it had 500 million users on Messenger. To become a formidable mobile-payments competitor, Facebook needs only a fraction of those people to start sending money. Venmo, watch out.