Rand Paul is quickly turning his absurd crusade to audit the Federal Reserve into a mainstream conservative cause célèbre—enough so that today, during her testimony before the Senate, Janet Yellen herself weighed in. (Like just about every other Fed official who has addressed the issue, the central bank’s chair trashed the idea, saying it would “politicize monetary policy.”) Given the White House’s opposition to Paul’s legislation, it shouldn’t become law any time soon. But let’s say it did. What would happen?

Ironically, it might just lead to higher inflation—which is supposedly the last thing the senator from Kentucky wants.

Like his father, Paul is a monetary-policy paranoiac, the sort of person who goes on about the debasement of the dollar and flirts with the idea of linking our currency to a commodity. (Though not necessarily gold. Because, you know, the man’s not that crazy.) He has referred to the Fed as an “an enormous creature, a creature that creates its own money,” as if he were describing Cthulhu with a printing press. He has fretted about Weimar-like hyperinflation just around the corner, even though prices are rising at less than 2 percent per year. He has delivered a factually challenged rant suggesting the Fed would be considered insolvent if we judged it like a normal bank (it wouldn’t be).*

While Paul acknowledges that the Fed is, in fact, already audited—its books are verified by Deloitte & Touche, and Congress can and does request separate audits by the Government Accountability Office—he says that the scrutiny isn’t enough, that those are “a bunch of fake audits.” Sure, you can go online and see every asset on the Fed’s balance sheet, including its serial tracking number. But, Paul says, that doesn’t tell readers “who they bought them from or whether they were bought at fair market price or whether they were bought at a haircut and whether or not there were any conflicts of interests in the buying and selling.”

That argument might be more convincing if Paul’s bill were focused just on conflicts of interest. But it’s not. In large part, it’s geared toward letting the Government Accountability Office “audit” the Fed’s monetary policy decision-making, one of the few areas of the central bank’s business it’s not allowed to assess. In plainer language, it gives the GAO the power to produce a lengthy report criticizing the central bank’s handling of interest rates, which might theoretically put political pressure on it to change its policy direction. In a small but meaningful way, it would chip away at the central bank’s independence.

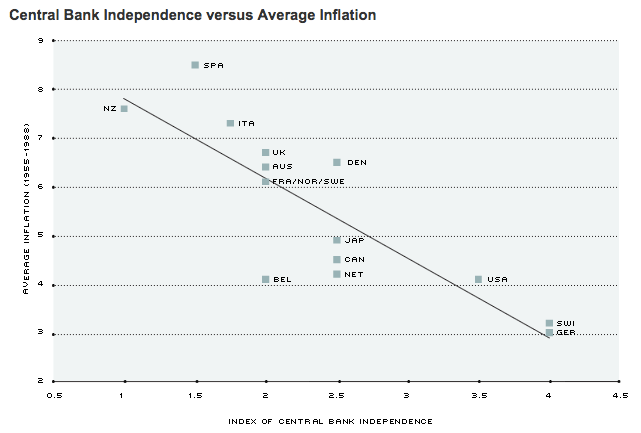

This is where the humor comes into play. Politically independent central banks are better at fighting inflation. That has been the consensus ever since Larry Summers and Alberto Alesina published a famous paper on the subject in 1993.

There are some very obvious reasons why this should be the case. Politicians have a habit of pushing central banks to print money when they shouldn’t. And unless they happen to live in Germany, officials in power generally don’t like it when central bankers hike interest rates to tamp down on inflation, because it leads to slower growth and can trigger a recession. Even if a Republican president ends up in office after a long campaign promising hard money, it is very unlikely that he or she would follow through if it meant jeopardizing re-election, nor would a Republican Congress undermine its own White House. During her speech today, Yellen made exactly that point, recalling Paul Volcker’s assault on inflation in the 1980s, which drove the economy into a sharp, double-dip downturn. “I really wonder whether or not the Volcker-led Fed would have had the courage to take the hard decisions necessary to bring down inflation and get that finally under control,” she said. “I wonder if that would have happened with GAO reviews in real time of monetary policy decision-making.”

This is why inflation hawks like Dallas Fed President Richard Fisher oppose Paul’s audit bill as well. An extra GAO report here or there wouldn’t necessarily have a devastating impact on the Fed’s ability to function. But the audits would contribute to a slow chipping away of its independence. And that could set the stage for Paul’s worst, Weimar-themed nightmares to finally come true.

*Update, Feb. 24, 2015: I originally referred to Paul as a “Cassandra” in this post. Turns out, I have been using that reference incorrectly up until now. According to Greek myth, Cassandra was given the gift of prophecy, but cursed so that nobody would believe her predictions, leaving her unable to change the events she could foresee. Rand Paul is in precisely the opposite position: Influential, but not very prophetic.