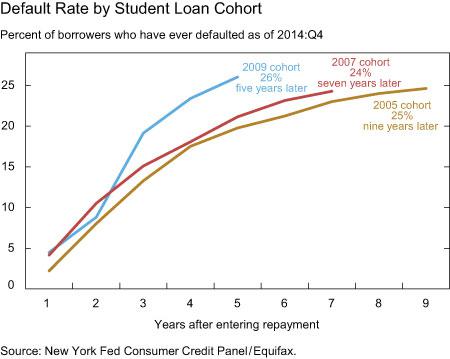

How dysfunctional is our student loan system? Consider this: Of borrowers who began repaying their debts in 2009, 26 percent have already defaulted—meaning they fell at least 270 days late on their debt—according to new data from the Federal Reserve Bank of New York. Of those who went into repayment in 2005, when the economy was somewhat decent, 25 percent have defaulted.

How bad are those numbers compared with other sorts of lending? Let’s take mortgages during the housing bust as a comparison point. After almost five years, only 18 percent of home loans that were issued in 2006 had fallen into a serious delinquency (meaning the owner was at least 90 days late with a payment), according to CoreLogic.* That should give you a sense of scale for the problem. Student borrowers are getting financially slaughtered.

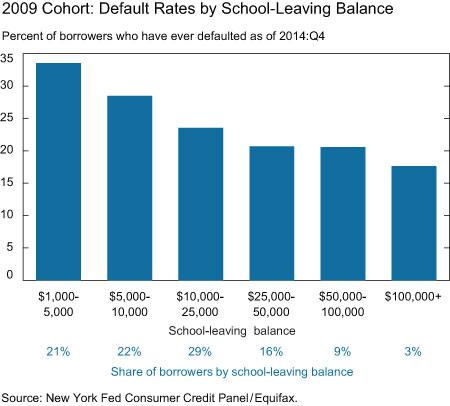

And it’s not just those who are furthest in debt. As the Fed illustrates, students who borrow small amounts for school are far more likely to default than those who borrow six-figures.

Federal Reserve Bank of New York

Two takeaway points here. First, whenever you read about how young adults with student loans are more likely to live with their parents and less likely to buy a home, remember these default numbers. It’s far harder to get a mortgage when your credit rating has been cratered by bad education debt.

Second, this is why Washington needs to focus on both decreasing the amount of debt students take on, and on changing the way it’s repaid. As a group, students are inherently risky borrowers.The federal government will lend money to anybody who goes to school, no matter how poor their chances of completing their degree and finding a job that will position them to repay their debt. And when the economy nose-dives, leaving jobs scarce, it exacerbates those issues. But at the same time, there are lots and lots of options for federal loans that should, theoretically, keep just about any borrower from outright defaulting, for instance by hooking monthly payments to income. The problem is that those programs are vastly underused, because people either don’t know about them or don’t realize how they could help. So we see hordes of young adults with small, potentially manageable debts going into default. That costs them, and costs the government. (Even though you can’t discharge student loans in bankruptcy, Washington still has to pay debt collectors to harass troubled borrowers.)

There are lots of good ideas for how to make student lending safer. For instance, as I’ve written, we could automatically enroll borrowers in income-based plans. We need to make those changes soon.

*Correction, Feb. 19, 2015: This post originally misstated that 18 percent of mortgages originated in 2006 ended in foreclosure. The data on serious delinquencies encompassed foreclosed homes.