Paying for college is obviously expensive for middle-class families, just like it is for everyone who doesn’t have thousands of free dollars to throw around each year. But every once in a while, you’ll hear someone argue that the middle class is especially out of luck when it comes the cost of higher ed, because they’re stuck saving for school while poor kids get financial aid. Glenn Reynolds makes a version of that point this week while arguing against President Barack Obama’s proposal to tax 529 college savings plans. “This doesn’t hurt the very rich—who just pay for college out of pocket—or the poor, who get financial aid, but it’s pretty rough on the middle– and upper–middle class,” he writes.

Let’s leave aside the issue of 529 plans for a moment (I say tax ‘em, for what it’s worth). Is it really true that the middle class gets left out in the cold these days when it comes to financial aid?

Not really. Thanks in part to a shift toward awarding grants based on academic “merit” instead of need (“merit” can be a pretty loose term), colleges today are fairly generous toward families in the middle of the income pack.

Jordan Weissmann

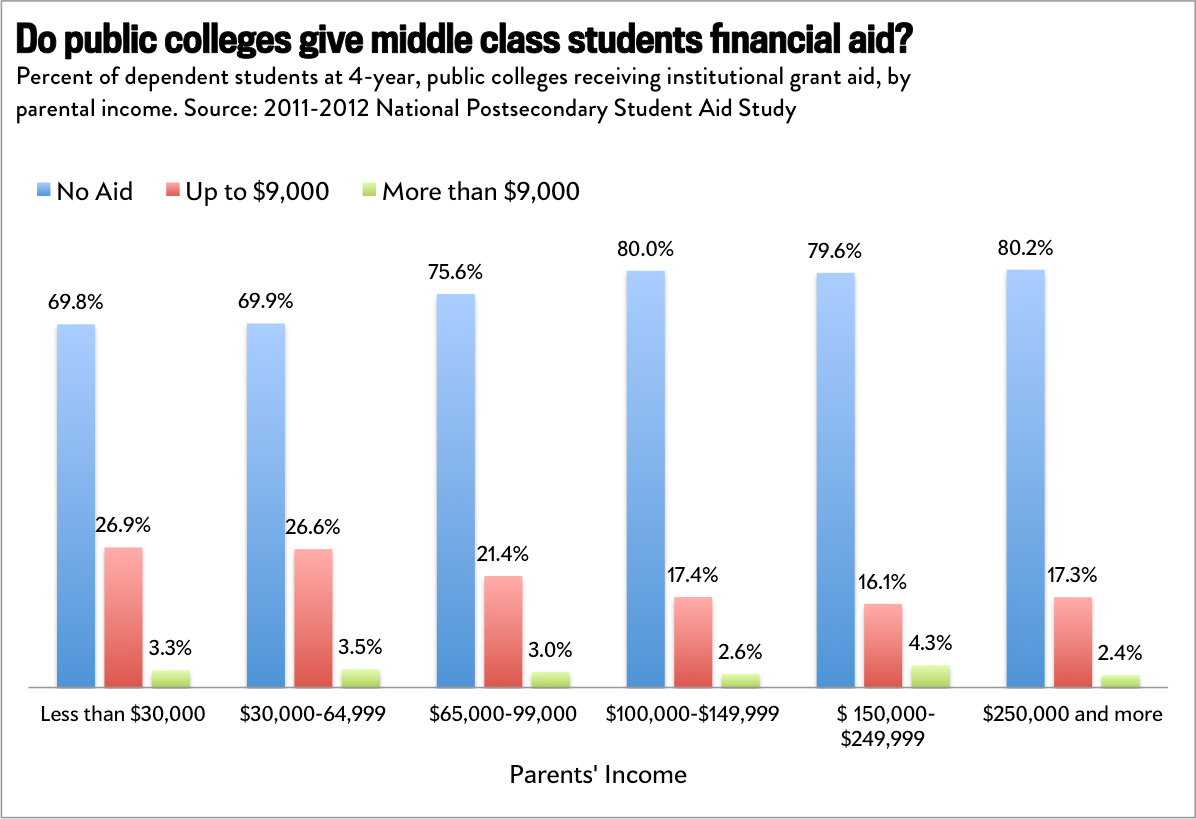

Defining the “middle class” is more art than science—I generally tend to set the bar below $100,000—but let’s be generous and go with the Obama administration’s de facto line of families that earn less than a quarter million dollars a year. At public four-year colleges, about 20 percent of students from families that earn between $150,000 and $250,000 get institutional aid. That’s compared to roughly 30 percent of students whose parents make up to $65,000 per year. No matter how wealthy they are, most students who receive aid get somewhere under $9,000.

Jordan Weissmann

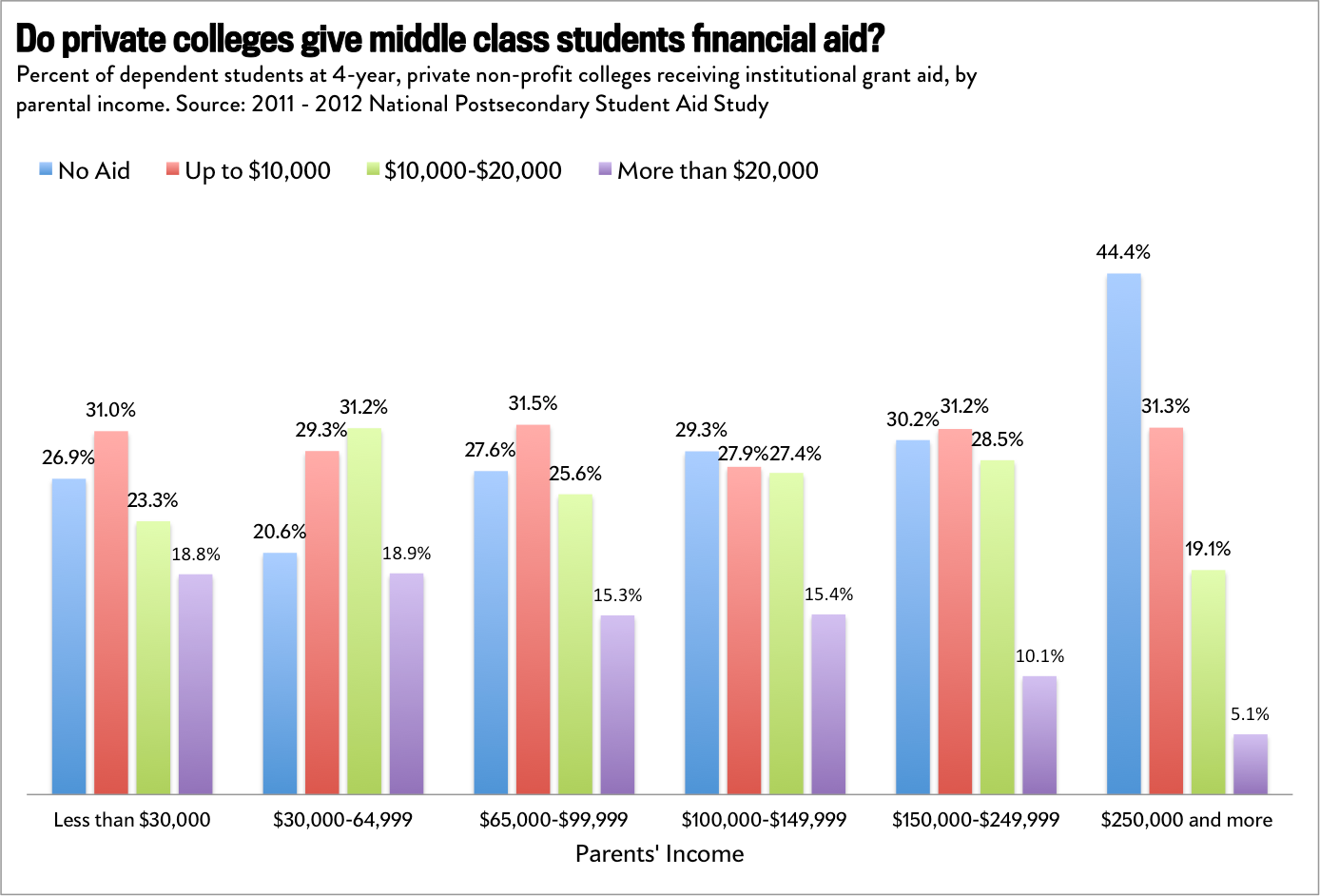

Private schools are even more willing to lend a hand. Again, low-income students are indeed more likely to get institutional aid. But about 70 percent of students from families earning $150,000 to $250,000 get some amount of help. Roughly 39 percent of them get more than $20,000 a year. Some might try to say that those aid dollars simply don’t stretch that far, because upper-middle-class students are often paying to attend incredibly expensive, highly selective schools. But to some degree, that’s a personal consumption choice, and in the end, they’re still getting help.

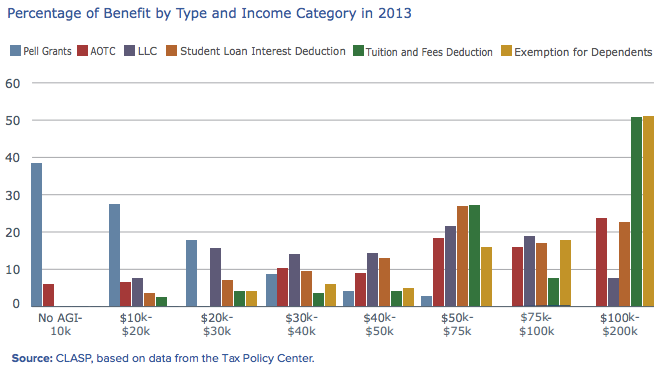

That’s the schools. What about the government? Contrary to popular belief, federal aid dollars are spread across different income groups pretty well. Pell grants target lower-income families. But tax breaks, which make somewhere around half the federal aid budget if you don’t count loans, tend to reach higher up the income scale. (Note: The American Opportunity Tax Credit is in red, while the Lifetime Learning Credit is in purple.)

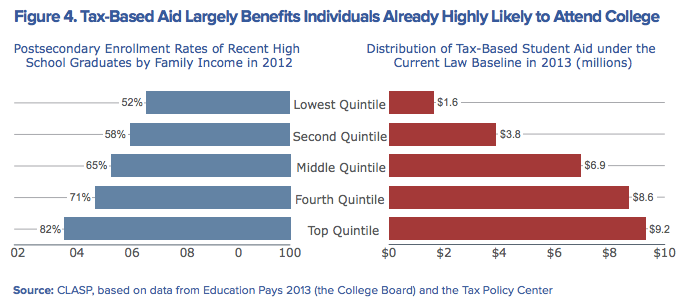

Here’s another way of looking at how tax aid gets distributed, in dollar amounts. In general, richer families reap the biggest rewards. Now, there are some higher-ed experts who don’t really consider tax breaks “financial aid,” strictly speaking, because it becomes available after students have already paid their bills. In my book, that just makes it poorly designed aid that has the political advantage of being hidden in the tax code. (For those wondering, these numbers do include tax breaks on 529 accounts, but if you subtracted out that $1.98 billion, it probably wouldn’t change the basic pattern too greatly).

So middle- and upper-middle-class students get plenty of help from schools and from the feds. One area where they might get the short end of the stick is in state scholarships, which are frequently need-based. But with that said, large states like Florida and Georgia run large merit-based scholarships programs, and a number of other states have begun targeting scholarship dollars at families with low six-figure incomes.

To recap, then: College is expensive for everybody. But the middle class also gets plenty of help, whether it feels that way or not.