Here’s another sign that America’s dining tastes are changing: On Monday, burger-and-fries chain Shake Shack filed for an IPO.

Shake Shack, a self-described “modern day ‘roadside’ burger stand” started by restaurateur Danny Meyer in the early 2000s, is part of the so-called better burger movement—serving up traditional American indulgences like burgers, shakes, and fries, but with higher-quality ingredients for a slightly higher price. If you haven’t waited in a never-ending line for Shake Shack’s food, think Five Guys, In-n-Out, Good Stuff Eatery, or Smashburger.

What’s happening in burgers is also occurring in other food categories as diners move from consuming fast food to paying slightly more for higher-quality fast casual. In May, restaurant industry research firm Technomic found that growth in fast-casual dining was outpacing that of every other restaurant segment. Between 2013 and 2014, sales of fast casual added 11 percent. The three biggest names in the segment—Panera, Chipotle, and Panda Express—each recorded double-digit growth. Five Guys, the biggest fast-casual burger chain, racked up sales of $1.1 billion.

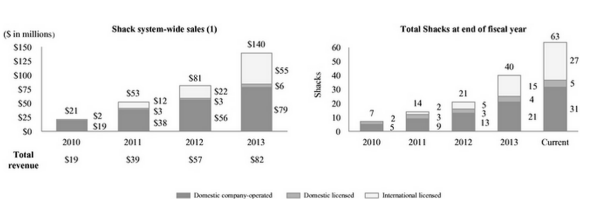

The numbers Shake Shack reports in its IPO filings echo that trend. Over the past three years, the company says it has grown from seven locations in two states to 40 outposts in six states and eight countries. During that same period, its total revenues roughly quadrupled from $19.5 million to $82.5 million, and its profit increased by a factor of 27, from $0.2 million to $5.4 million.

Shake Shack

As IPO filings go, Shake Shack’s is also pretty enjoyable to peruse, especially since the first couple of pages are covered with photos of its food. You can check out the whole prospectus here, or just scan the 10 other tasty and quirky tidbits we gleaned from the documents:

- It plans to open at least 10 new company-operated restaurants in the U.S. each year.

- Building a typical store takes 14 to 16 weeks and costs $1.5 to $2.5 million.

- All of Shake Shack’s tables are made from “reclaimed bowling lanes.”

- Its proposed ticker for the New York Stock Exchange is “SHAK.”

- Regional beef grinders are its “primary risk,” though it has locked in an emergency plan with its largest supplier “in the event of a disruption of operations.”

- Social media platforms “without filters or checks” (read: Facebook, Twitter, Yelp, etc.) are another risk.

- It was almost named “Custard’s First Stand.”

- It fancies itself the creator of a new “fine casual” dining category.

- It uses the term “Shack-onomics” to discuss financials.

- So far this year, Shake Shack has taken in $83.8 million in revenue and made $3.5 million in profit.