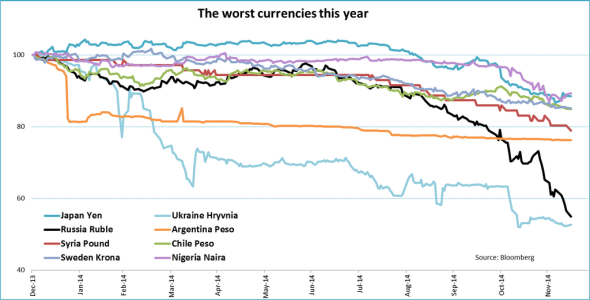

Battered by economic sanctions and low oil prices, Russia’s currency is plunging yet again today. The ruble has lost 18 percent of its value just this month, and as this chart from Jeroen Blokland tells us, if the slide continues it might just end up as the worst performing currency of the year—even worse than the Ukrainian hryvnia. Oh, the sweet, sweet irony.

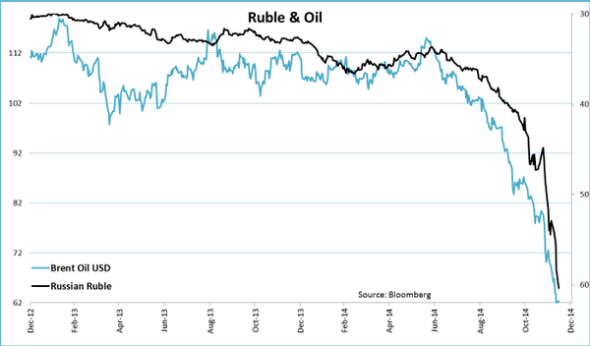

Currency prices are all about supply and demand. And just about everything that’s transpired in the past year has made the world far less interested in buying Russian money. The invasion of Ukraine drove away foreign investors who might have done business in the country, both because of the sanctions imposed by the U.S. and Europe and because it’s not particularly enticing to set up shop in a nation headed by a belligerent, authoritarian government. But over the past several months, the crashing price of oil triggered by a global oversupply has become the main story. Here’s another very telling chart from Blokland:

Last year, one-third of Russia’s exports came from crude oil. When the value of your exports collapse, so does your currency. Worse yet, the Russian government, ever dependent on oil revenue, needs about $100 per barrel to balance its budget. With Brent crude trading at near $62, and possibly headed lower, the country is looking at a deficit and potential spending cuts that could further hurt the economy. And if low oil prices last, it will likely compound the situation, because a Russia without high crude prices isn’t a country where any foreigners will want to invest for the long term.

For the most part, a weak currency is bad news for Russia, because it means more expensive imports and more inflation. However, there is a tiny silver lining. Because oil is priced in dollars, a falling ruble makes each barrel worth a little bit more money in local currency. That’s helping Russia’s budget picture a bit, though not necessarily enough to offset the overall collapse of petrol prices.

In any event, it’s looking like the most powerful economic weapon we have against Russia may turn out to be all the oil flowing out of North Dakota and Texas.