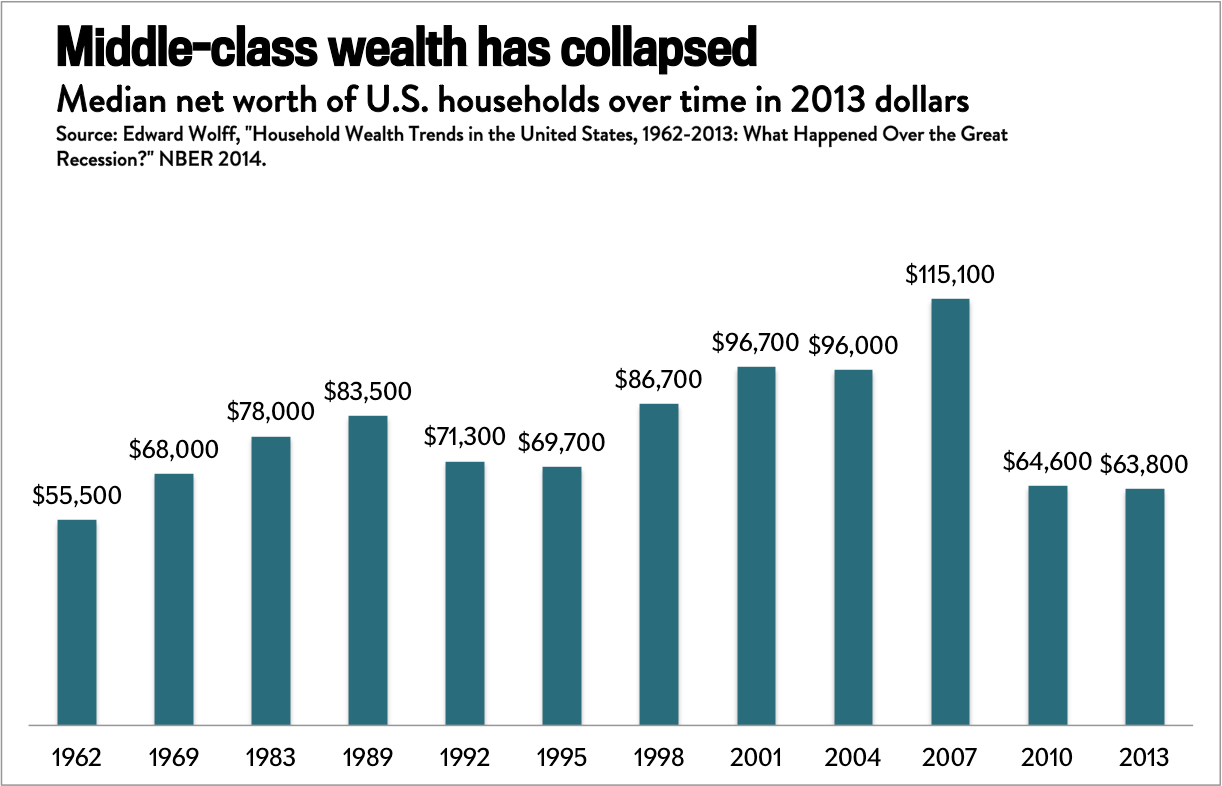

How thoroughly did the Great Recession savage middle-class America’s finances? Economist Edward Wolff will tell you. The New York University professor has updated his long-running analysis of wealth in America to include data from the Federal Reserve’s 2013 Survey of Consumer Finances. The big takeaway: Thanks to the recession, the median U.S. household is now worth less than in 1969. (Back in July I guessed this might be the case based on a slightly different data set.)

Jordan Weissmann

A little context: Net worth equals a family’s assets, such as a home or retirement account, minus its debts. Or to put it another way, it’s what you own minus what you owe. In his analysis, Wolff doesn’t count consumer goods like televisions or furniture as assets because they’re not easy to sell off, and usually aren’t worth a whole lot anyway. A tiny bit more controversially, he doesn’t count vehicles either, because most people can’t just choose to get rid of their car when they need money (you have to commute to work, after all). Meanwhile, setting aside arguments about inequality, there are lots of reasons to care about the net worth of the middle class. First, it gives families a financial cushion. Second, there’s a documented “wealth effect” on spending—households are more willing to open their wallets when their home prices are rising and stock portfolio is flush. In other words, when the middle class feels wealthy, it’s good for all of us.

The story of why middle-class wealth collapsed is familiar by now. Americans loaded up on debt—especially mortgage debt—in the lead-up to the recession. Then the housing market collapsed, and suddenly families were left with little home equity, and lots of financial obligations. Many found themselves underwater on their mortgages, meaning they owed more than their house was worth.

What’s somewhat remarkable is how weakly the middle class has bounced back, even as the percentage of underwater homes has steadily declined. People are still struggling with their debts from years back, and even if the real estate market has gotten healthier, it’s not close to where it was in the bubble days (nor should it be). And you can see the economic scars lingering in the states where the housing bust was worse.

In the end, it’s a reminder that many people don’t feel like we’re in a recovery, because for them, there hasn’t been one.