Did the economics profession just resoundingly reject Thomas Piketty’s most famous theory? You might have thought so if you were hanging around Twitter yesterday afternoon.

Every so often, the University of Chicago’s Initiative on Global Markets asks a panel of top economists to weigh in on hot public policy issues, such as the effect of stimulus spending, whether Uber and Lyft are good for consumers, or if the minimum wage kills jobs. It’s a way of gauging mainstream opinion in the field. On Tuesday, it released a poll on Piketty’s trademark argument that inequality will increase when the return on capital exceeds the rate of economic growth, shorthanded as r>g.

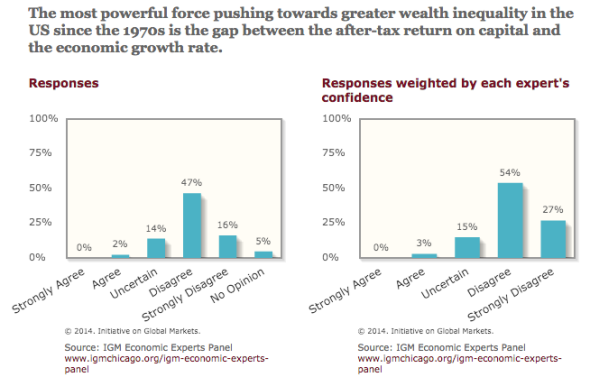

Specifically, it asked economists whether they agreed or disagreed with the following statement: “The most powerful force pushing towards greater wealth inequality in the US since the 1970s is the gap between the after-tax return on capital and the economic growth rate.”

Or to simplify: Does Piketty’s theory explain why the wealth gap has been rising for the past 40 years? Overwhelmingly, the panel’s answer was no, with only one out 36 panelists agreeing with the statement.

Afterwards, a number of journalists, economists, and other wags took to Twitter and blogs to talk about how Piketty had just gotten a black eye. Sample headline courtesy of the American Enterprise Institute’s James Pethokoukis: “Survey: 81% of top economists disagree with the Piketty inequality argument.”

Except they didn’t really. Piketty’s Capital in the Twenty-First Century never suggests r>g is the main reason behind the recent rise of inequality. Rather, it theorizes that, in the absence of government intervention, r>g ensures the future concentration of income and wealth. Tellingly, Berkeley professor Emmanuel Saez, one of Piketty’s longtime collaborators, disagreed with IGM’s statement, noting: “Income and savings inequality increases are now fueling US wealth inequality. Down the road [r>g] will be central as predicted by Piketty.”

As Justin Wolfers wrote in the New York Times yesterday, some of the panelists did explicitly reject Piketty’s real argument. For instance, MIT’s Daron Acemoglu wrote in a comment, “Theoretically and empirically the case that [r>g] is a major determinant of inequality or even top inequality is weak.” Acemoglu has co-authored an entire paper making the point. Ultimately, though, IGM was asking economists to opine on an argument that nobody was making in the first place.

I found myself wondering: How would Piketty himself weigh in?

“Well,” he told me in an email this morning, “I think the book makes pretty clear that the powerful force behind rising income and wealth inequality in the US since the 1970s is the rise of the inequality of labor earnings, itself due to a mixture of rising inequality in access to skills and higher education, and of exploding top managerial compensation (itself probably stimulated by large cuts in top tax rates), So this indeed has little to do with r>g.”

In short, you can add Piketty to the “Disagree” column, too.