Back in May, when the Financial Times published an attempted takedown of the data on wealth inequality underpinning Thomas Piketty’s Capital in the Twenty-First Century, the newspaper managed to prove pretty much one thing. It wasn’t that Piketty had misled readers or botched his math, as the paper claimed—by almost all accounts, his response put those criticisms to rest. Rather, it was that measuring the riches of the global elite is a complicated, inexact science that economists are only beginning to grapple with. Even Piketty says that the data set he used in Capital to illustrate the American wealth gap is probably outdated. He prefers a new set that shows an even greater disparity.

That’s why we probably need to get used to headlines like this one from Bloomberg: “The 1% May Be Richer Than You Think, Research Shows.” The piece is a roundup of some recent and provocative papers arguing that wealth inequality is probably worse than we know. But precisely how much worse is tough to say.

One of the papers comes from Philip Vermeulen of the European Central Bank. His study starts from the well-known fact that the super-rich tend not to respond to government surveys about household wealth, which distorts our picture of inequality. (When it comes to income, this is less of a problem thanks to tax records.) Government researchers in both Europe and the U.S. try to find ways to correct the data, largely by trying to oversample affluent households. But as Vermeulen shows, some attempts are far more effective than others. In Germany, for instance, the “poorest” man to make the annual Forbes billionaires list is worth an estimated €810 million. Yet the wealthiest German who shows up in Europe’s household survey is only worth about €76 million. So you can either believe that Germany has no billionaires or that European statisticians aren’t very good at finding them.

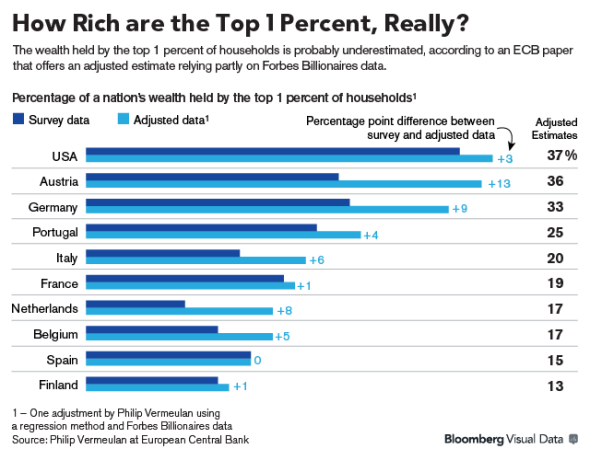

Partly by combining government data with the Forbes list, Vermeulen tries to re-estimate the share of wealth belonging to the 1 percent across European countries. Lo and behold, the rich get much richer, as Bloomberg beautifully illustrates in the graph below.

And yet, by relying on the information journalists are able to uncover about the global rich, one still suspects that Vermeulen is still lowballing the 1 percent. In May, Piketty protégé Gabriel Zucman released a draft paper in which he estimated the share of the globe’s individual financial wealth stashed in offshore tax havens; his final number was about 8 percent, or $7.6 trillion.

How does he come up with that number? It’s no easy task, given that millionaires and billionaires use Swiss bank accounts and Caribbean trusts specifically to hide their money from the tax man. Zucman’s clever approach to the problem jumps off from the fact that if you look at official international records, the world’s investors look like they have more liabilities on their books than assets, which is quite impossible in reality. The math adds up that way on paper, however, because so much wealth gets stowed in tax havens. By analyzing these statistical “anomalies,” Zucman hits on that 8 percent figure.

Because his work only captures financial assets, Zucman thinks he has probably calculated the bare minimum amount of wealth hiding offshore. The global rich can easily hide chunks of their fortune such as artwork and gold in the world’s freeports, he notes. Using shell companies, they can also anonymously plunk their money into real estate. Stocks and bonds only tell a piece of the story.

The lesson is that economists are still evolving their sense of how much wealth the world’s elite possess. Researchers have come up with smart, indirect ways of measuring money that’s carefully hidden from view. But it’s very possible that the rich are still worth more than even our wildest guesses.