It’s here! Thomas Piketty’s eagerly awaited technical appendix update to Capital in the Twenty-First Century! And it really does deserve the exclamation points. Ever since the Financial Times published a story last week arguing that everybody’s new favorite French intellectual had made a host of data errors in his book and spun some numbers “out of thin air,” the econ world has been waiting for his detailed response. He delivered it today, and it seems like a pretty authoritative retort. In short, he says the FT itself committed a form of analytical malpractice by smushing together numbers that didn’t belong together.

To quickly review, the FT had accused Piketty of inserting errors and distorting data in such a way that exaggerated the historical rise of wealth inequality in Europe and the United States. However, their disagreements about two countries, France and Sweden, were fairly minor. And while the paper did raise some fair questions about the quality of data that were actually available for the U.S. when Piketty wrote his book, a key study has come out since that confirms that wealth gap really is rising dramatically stateside.

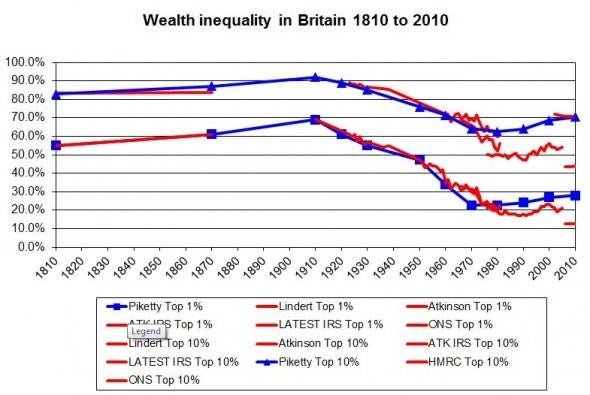

That left one important point of contention: Great Britain. According to the FT, the U.K.’s official figures actually showed that wealth inequality had fallen slightly since the 1970s, whereas Capital suggested it had risen. They illustrated the difference in the graph below, with Piketty’s data series in blue, and official figures in red. Piketty estimates the top 10 percent of households in Britain controlled 70 percent of the country’s wealth, while the FT pegs it somewhere between 40 or 50 percent. That was a huge difference, one that, according to the newspaper, suggested Piketty had mishandled his numbers. (It should be said that the FT also questioned the way Piketty averaged data across European countries, but that issue isn’t particularly important if he got Britain’s trend right).

According to Piketty, the FT made its own blunder by combining two incompatible data sources. His own analysis of Great Britain’s wealth distribution was based on estate tax statistics. The FT, on the other hand, arrived at its conclusions using a giant mashup. Its figures from the 1920s through the 1980s came from the same study of estate taxes that Piketty used, but its wealth data from 1990 onward came from a British household survey.

The problem with that approach is that while tax records tend to be very comprehensive, household surveys are known to systematically underestimate the share of wealth belonging to the rich. That might especially be the case in the U.K., Piketty notes, where response rates are very low. So the FT uses one data source that captures much of the wealth belonging to Britain’s 1 percent, then follows it with a second source that largely misses those riches. That’s what makes it look like inequality is falling. Or, as Piketty puts it, “such a methodological choice is bound to bias the results in the direction of declining inequality.”

After making that point, he unloads with a bit of econ snark:

Also note that a 44% wealth share for the top 10% (and a 12.5% wealth share for the top 1%, according to the FT) would mean that Britain is currently one the most egalitarian countries in history in terms of wealth distribution; in particular this would mean that Britain is a lot more equal that Sweden, and in fact a lot more equal than what Sweden as ever been (including in the 1980s). This does not look particularly plausible.

True. Britain’s post-1990 estate tax data doesn’t cover many years. But it seems like the onus is on the FT to explain why combining two extraordinarily different data sources, without any adjustments to normalize the differences, makes sense.

There are two bigger points to take away about this controversy, however. One is that, as Mike Konczal and others have pointed out, the issue of whether or not wealth inequality has already risen is not an essential part of Piketty’s bigger theory, even if it is a likely outcome of it. The second is that, as Piketty himself notes—and as the FT’s ability even to raise these questions makes clear—our data on wealth are still very imperfect (far moreso than our understanding of income). This is a subject we’re only beginning to fully understand. In that sense, Capital isn’t the end of a debate. It’s the beginning of one.