It seems obvious that owing lots of student debt should make it more difficult to buy a house. After all, if you’re stuck paying interest on college loans, it’s hard to save up for a 20 percent down payment. And now that subprime lending is out of fashion, banks don’t like lending to customers with lots of debt compared with their income, which describes an awful lot of young bachelor’s degree holders.

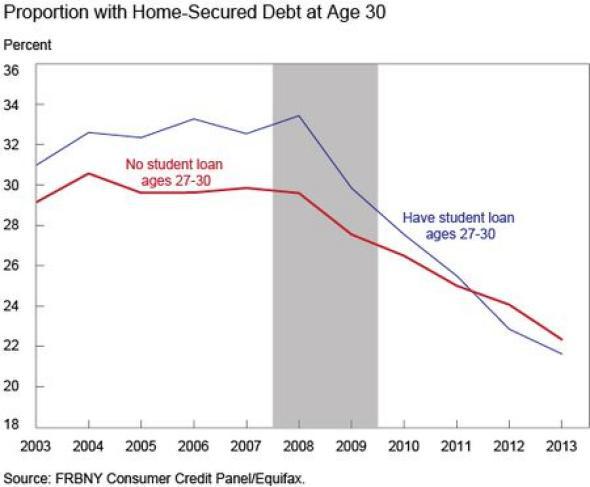

Indeed, the Federal Reserve Bank of New York reports today that in 2013, student debtors between the ages of 27 and 30 were less likely to own a home—or, specifically, to have a mortgage—than their peers who were student-debt free. Homeownership rates have fallen fast among all young adults since the recession. But, as shown below, they’ve dropped most precipitously among those who borrowed for school.

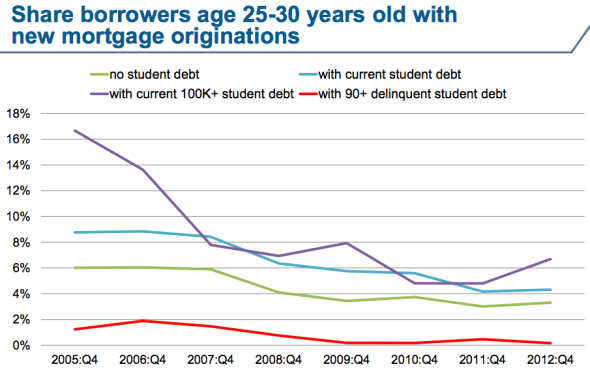

There’s one key detail this graph leaves out, however, which the Fed shared in a separate report from early last year (and which I’ve written on before). It turns out that, at the end of 2012, borrowers who were current on their student loan payments were actually more likely to take out a mortgage than other young adults. Borrowers who were delinquent on their student loans, however, took out barely any mortgages at all. In other words, young people who already couldn’t handle their debt simply weren’t in the market for houses.

That might sound like a self-evident point, but it’s an important one. If student borrowers with good credit records were noticeably absent from the mortgage market, it would suggest that either a) banks were avoiding them or b) millennials had collectively decided to pay off their college and grad school debts before moving on to big purchases. There might be some cases where that’s true, but it doesn’t seem to be the general rule. After all, the young people most likely to buy a house were those who still owed at least $100,000 on their educations.

The bad news is that student loan delinquencies and defaults exploded after the recession, which is a likely reason why the Fed finds that, on average, young adults who borrow for school have lower credit scores than those who don’t. Bad education debt has created a class of adults who will probably have trouble getting credit for quite some time. And until that changes, they’ll be renters.