For a while, it looked like a radical lending system, one that Milton Friedman dreamed up in the 1950s, was finally inching toward the mainstream market. Over the past two years, income share agreements—contracts that allow individuals to raise money from investors by selling “stock” in themselves, i.e., a share of their future earnings—were plucked from economic obscurity by several tech companies that were rethinking how we fund education and finance young people. In April, they entered the national spotlight when Sen. Marco Rubio (R-Fla.) and Rep. Tom Petri (R-Wis.) introduced legislation that promised to broaden the use of income share agreements, or ISAs, by formally defining their terms.

But that progress backtracked this week when Upstart, a Silicon Valley financial services company and a leading proponent of ISAs, stopped offering the contracts on its funding platform. “We’re still huge fans of income share agreements, and their potential to provide a better means of paying for college and funding aspiring entrepreneurs,” Dave Girouard, Upstart’s co-founder and CEO, wrote on the company’s blog. “And while many regulatory and policy efforts are underway to facilitate the development of the market, these efforts will likely take many years—a time frame ill-suited for a startup like ours.”

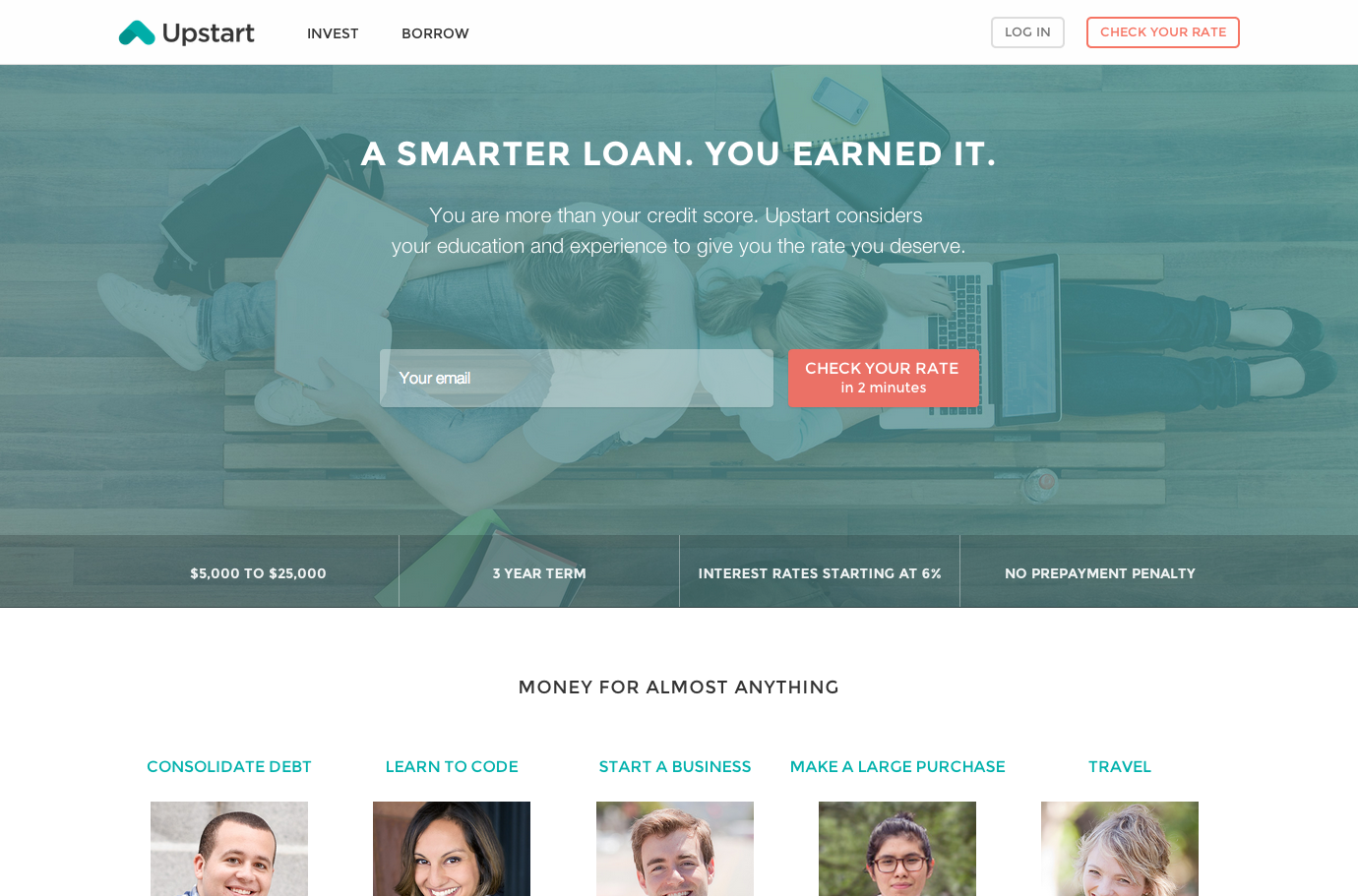

Upstart’s announcement came just two weeks after it rolled out a traditional fixed-rate loan product designed to help younger borrowers get a line of credit. Unlike income share agreements, which are often critiqued as being tantamount to indentured servitude, there’s nothing controversial or radical about this new borrowing option; the loan itself is actually quite boring. The only novelty in the new product comes from Upstart’s underwriting process, which uses a data-rich algorithm to assign borrowing rates to applicants on an individual basis by projecting their statistical likelihood of unemployment.

How badly will the about-face set back the market for ISAs? It doesn’t bode well for the industry when the company that once described its work with the contracts as “a huge and important part of our whole economy” is backing out. Pave, another funding platform that provides the contracts, said it plans to keep pushing forward with ISAs, and expected a long road ahead when it started up two years ago. Rep. Petri said in a statement that Upstart’s decision “underscores the need for action to give these plans the regulatory clarity they need to expand.” Critics, on the other hand, are sure to see the shift as one more sign that ISAs are doomed in anything other than a niche market.