This year, America’s richest households are expected to pay their highest federal tax rates since the Clinton administration. For that, we can thank the partial expiration of the Bush tax cuts, and the new taxes that were tucked into Obamacare.

One could call this a minor victory for the notion of progressive government. Alternatively, one could take it as an opportunity to fret over the plight of the country’s top earners, which is the route the Wall Street Journal seems to have taken in an extraordinarily misleading article titled “Top Earners Feel the Bite of Tax Increases.” Wealthy taxpayers are feeling “sticker shock,” it declares. “That, in turn, is rekindling a debate over a question likely to smolder for a long time: How much more could—or should—taxes go up on the well-to-do?”

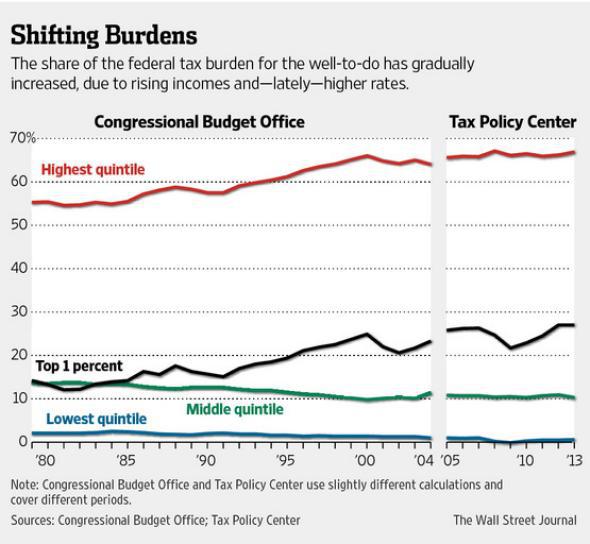

There is nothing wrong with having that debate—most liberals, I think, welcome it. There is something very wrong, however, with how the Journal presents America’s shifting tax burden, which it traces in the graph below. The chart is supposed to tell us that the entire top 20 percent of households—the group shown in red, which includes “couples with two children making more than $150,000,” as writer John McKinnon puts it—is now responsible for paying a vastly larger share of all federal taxes than it was at the start of the Reagan era. It’s not just the ultra-rich who are doing the heavy lifting. It’s the upper-middle class, too.

That is only true if you lump together the top 1 percent with the next 19 percent of taxpayers. Break them apart (as I’ve done below, using the same data sets as the Journal), and it’s clear that the only cohort responsible for a notably larger share of the country’s tax bill is the top 1 percent. (The graph includes a break where it shifts from Congressional Budget Office data, which ends in 2010, to figures from the nonpartisan Tax Policy Center).

If you only look at federal income tax liability—so no payroll taxes or corporate taxes—then the entire top 10 percent has seen its share of the burden grow quite a bit. But that brings us to the bigger point: Income inequality is rising. And as long as we have progressive taxation, that means the rich will naturally pay a larger share of the tax tab. The Journal, to its credit, acknowledges this. What it fails to point out is that, according to both the Congressional Budget Office and Tax Policy Center, only one group is paying a higher average tax rate than it did during the Bush era. Again, that’s the top 1 percent.

If you’re going to mourn for the rich, don’t pretend as if you’re mourning for anyone else.