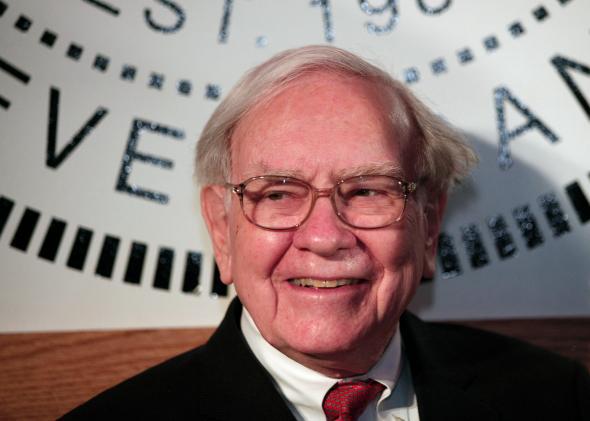

This weekend the New York Times dredged up a fact that has circulated among investors for quite some time: Warren Buffett underperformed the market for four of the past five years. The Times, in consultation with independent statistician Salil Mehta, takes this as a “sobering” reality and evidence that Buffett, 83, has finally reached the twilight of his career. Mehta, a former director of analytics at the Treasury Department, goes so far as to compare Buffett to basketball star Michael Jordan.

“There were essentially two careers,” Mehta tells the Times. “In the first, he was a superstar. And in the second, late in his career, he just wasn’t one anymore.”

Mehta made that same point a month earlier in a brief piece for TheStreet on making sense of Buffett’s underperformance. “To be clear, from a statistical performance perspective, this recent record for BRK is bad,” he wrote. “There is no argument about it, or some way to excuse it. If it weren’t known in advance that it was Warren’s performance, we would outright laugh at it.”

It’s not the first time that critics have questioned Buffett’s abilities. During the dot-com boom, Buffett was seen as missing the boat for refusing to invest in tech stocks, but Berkshire Hathaway fared better when the market tumbled. Berkshire’s declines were also less sharp than those of the broader market when the financial crisis hit in 2008. As the market rallied quickly over the past five years, Buffett’s investments had a hard time keeping up.

Mehta says that’s not a good excuse, and it’s clear he questions if Buffett still has his touch. But others have argued that the precise goal of Berkshire Hathaway is to offer long-term stability and protect against sudden downturns—and Buffett is still well outperforming the market over his decades-long career. “Berkshire Hathaway is an insurance company,” Quartz noted in March. “Its real value to shareholders emerges when market disasters strike.”